Why you need international dividends in your portfolio

Dividends can be an important component of investment returns over the long term. They are often more stable than stock price performance and can help buoy a portfolio in years when market returns are negative. When a company can consistently increase its dividend over a longer period of time, it is often a signal the business is able to profit through different market environments.

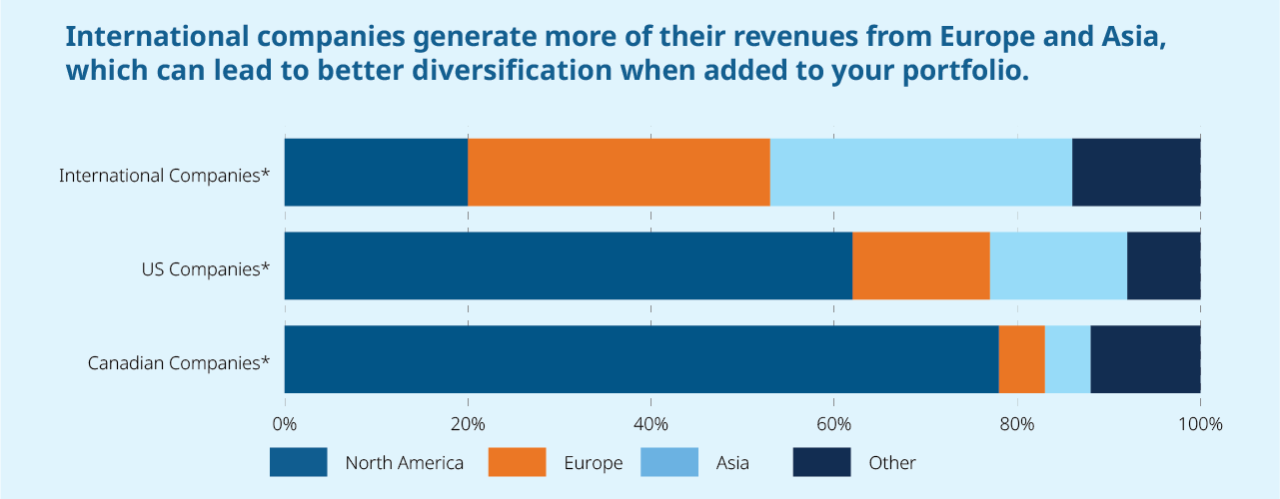

There are many excellent dividend-paying companies located in North America, but Canadian investors tend to already have high allocations to Canada and the US. By expanding to international markets, investors gain exposure to the fast growing regions of Asia and the refined markets of Europe. These companies offer a broader opportunity set and their inclusion can help build a more diversified portfolio with the potential for better returns in the long run.

Why Mackenzie International Dividend Fund?

The fund seeks to achieve solid long-term growth and a steady flow of dividends.

Durable growth through time:

The fund is constructed with high-quality companies in stable industries that have a lower risk of disruption from outside forces. These companies will generally have a competitive advantage over their industry peers that makes their operations and profit margins more durable through time. Owning stable companies could lead to less volatility as you accumulate wealth.

Dividend diversity:

Traditional dividend portfolios consist of high allocations to dividend paying financial services, utilities and energy companies. While consistent in their dividend payouts, they may not offer alternative growth avenues. This fund gives investors access to the best of both worlds – dividend paying equities and growth potential through a broader mix of dividend paying companies, including sectors such as technology, health care and consumer discretionary.

How it works

Identifies industry leaders:

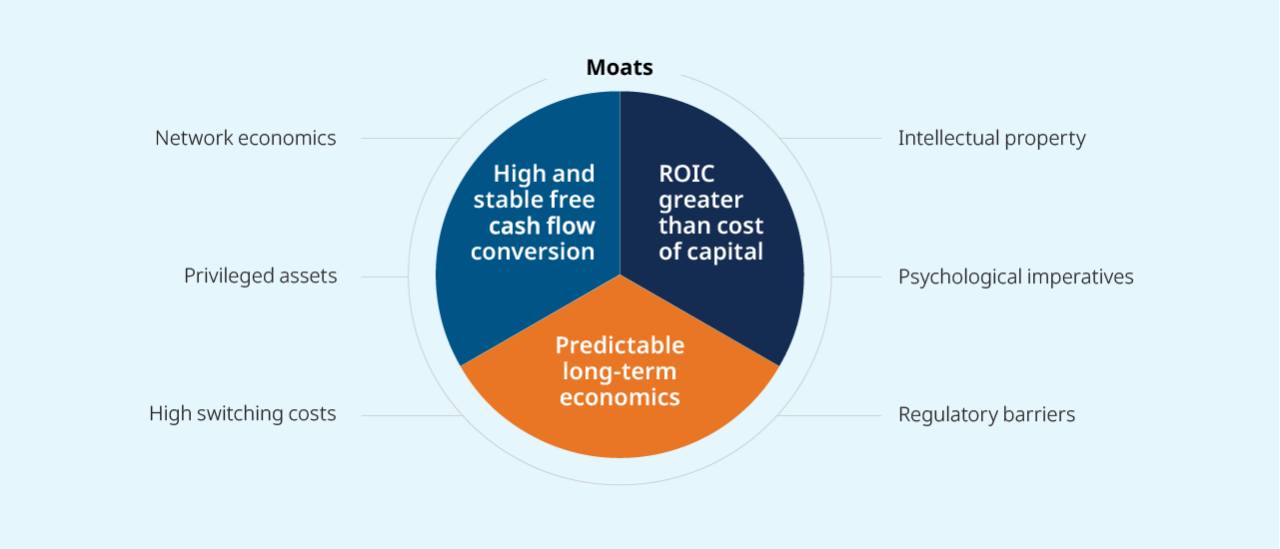

The team searches international markets to find industry leading companies that have a competitive advantage, or protective “moat”, that make the economics of their business operations more predictable and durable. Moats come in many forms, each providing the company with a distinct edge over their peers.

Nimble when opportunities arise:

A strong sense of curiosity combined with decades of diligent and detailed research has led to a defined watch list of high-quality dividend-paying companies. By maintaining a focused list of industry-leading businesses outside of North America, the team is able to act quickly when the market environment changes, and the share price of these industry leaders falls below what the team believes they are worth.

Why invest with Mackenzie

As a Canadian-owned global asset management provider, we’ve been helping advisors deliver the best possible advice and investment solutions for more than 50 years. With over $147 billion* in assets under management and a comprehensive line of investment solutions, we are one of Canada’s leading asset management companies. Our journey began with one client and one advisor working together, and though we’ve grown, we remain committed to the same belief, advice matters. When we work together with advisors and investors, we can achieve better financial outcomes.

Source: Morningstar, as of January 31, 2021. *International companies represented by MSCI EAFE Index. US companies represented by S&P 500 Index, Canadian companies represented by S&P/TSX Composite Index.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The content of this collateral (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.