James A. Morrison, MBA, CFA

Vice President, Portfolio Manager

Lead Manager: Mackenzie Ivy Canadian and Ivy Canadian Balanced Fund

Marlena Zabielska, CFA

Associate Vice President, Portfolio Manager

Ivy Canadian: Key Takeaways

- Fluctuating market sentiment is providing opportunities for long-term investors.

- Ivy Canadian and Ivy Canadian Balanced have performed well through recent volatility.

- The funds remain well positioned to offer short-term protection and long-term capital appreciation.

We Don’t Bet on Scenarios, We Invest in Businesses

Markets are complex and it seems that there is almost always an oversimplified narrative driving short-term performance. Over the course of 2023, we've seen market sentiment fluctuate in response to liquidity concerns, AI enthusiasm, optimism for a soft landing, and fear of higher-for-longer rates. The only constant is change and without a framework to navigate frequent and volatile changes, one risks getting whipsawed around to the detriment of achieving long-term financial success. This is why we take a long-term approach. It frees our capacity to focus on what really matters and what we can more reliably predict: businesses that will succeed over time.

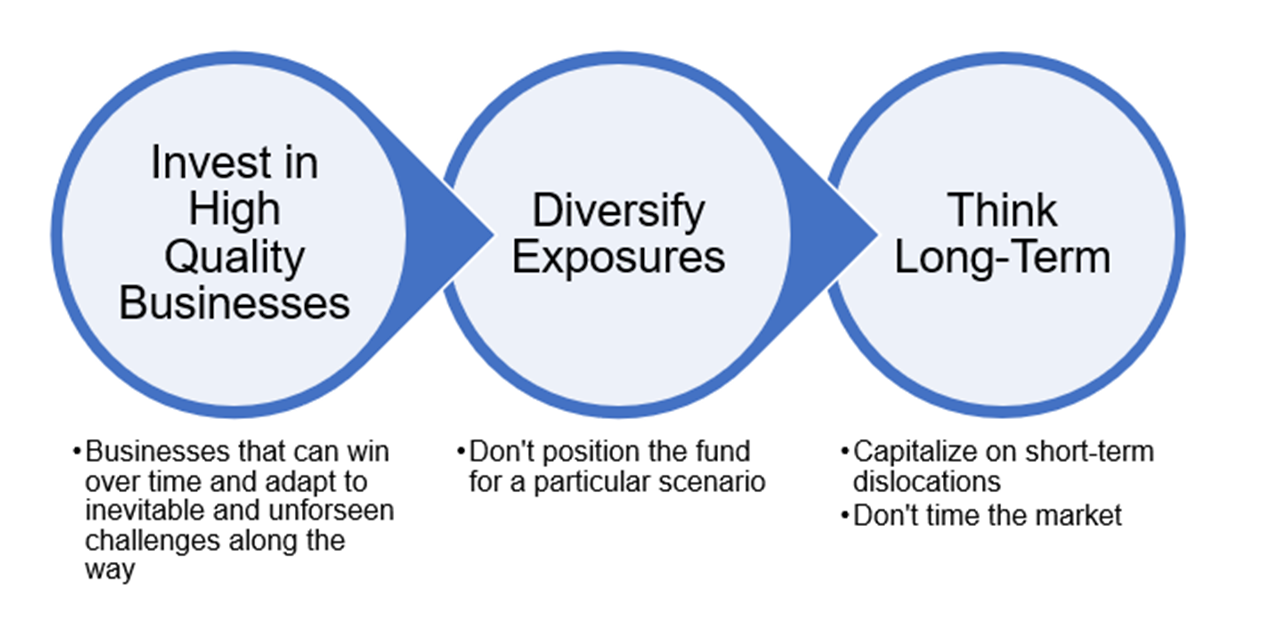

Our Framework is Simple

Although We Don’t Bet on Scenarios, We Do React to Them

Rising bond yields have dominated market sentiment of late. The historic rise over a short period has introduced a heightened level of uncertainty into the markets. Therefore, it's important that we take great care to ensure the businesses that we're investing in are resilient, while at the same time looking for opportunities where market sentiment is out of sync with the long-term prospects for a business.

Take Fortis, for instance. It operates transmission and distribution assets across North America. Its stable earnings and yield are often considered bond-like, and therefore rising bond yields have weighed on valuation. Despite the rate inspired migration of funds out of the sector, the fundamentals for the business remain strong. In the short-term, rising interest expenses are expected to be a modest headwind to earnings, however, regulators are beginning to incorporate higher rates into allowed ROEs, providing a slight benefit to the earnings power of the business. Looking ahead, we expect sustained growth to be supported by the essential role of transmission in the electrification and decarbonization of the economy. While we didn’t position the fund for a higher rate environment, it has presented us with an opportunity to increase our exposure to a business with a compelling combination of sustainable growth, stable income, and downside protection.

Brookfield Corp has also faced valuation pressure in the current interest rate environment, partly due to its capital-intensive nature and use of leverage. Brookfield is one of the world's largest investors in alternative assets. While it's no surprise that the value of long-duration assets would be pressured by rising interest rates, Brookfield is a disciplined acquirer, leveraging its global scale, access to capital, and operational capabilities to seize opportunities during periods of market disruption. Although the risks associated with its use of leverage are by no means immaterial, they are far outweighed by the many positive attributes of the business and effectively managed through non-recourse structures, diversified sources of capital and stable and growing underlying cash flows. In the fullness of time, we believe that Brookfield’s ability to extract value from assets should override the negative impact of higher interest rates on earnings and the discount rate. While the company's exposure to real-estate features prominently in headlines, the business is also positioned at the nexus of several secular tailwinds, including the energy transition, aging infrastructure and cash strapped governments that net out to provide a long and attractive growth runway.

Long-term Returns, Built on Superior Downside Protection and Predictable Growth

Our objective is to help Canadians achieve their long-term financial goals. While returns are an important element of this objective, the path of returns play an integral role in helping our clients stay invested so that they can achieve the returns of our funds. By investing in a relatively concentrated portfolio of high-quality businesses and taking a long-term approach, we can build conviction and capitalize on periods of dislocation in order grow our client’s capital with considerably less volatility.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

The contents of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) are not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of October 17, 2023. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.