As central banks began raising interest rates, 2022 rapidly became one of the worst years for fixed income in more than a decade. Inflation concerns remained a key driver. The Fed's response and its tightening monetary policy remained a focal point for market participants who adjusted their expectations accordingly. But as the economic setting continues to evolve, investors need to look ahead to what might be the next “main event” for their portfolios.

The Mackenzie Fixed Income Team is carefully considering three broad narratives regarding what lies ahead:

Soft landing: Growth slows just enough to bring inflation to an acceptable level. This scenario would likely avoid an over-correction, without undue harm or turbulence.

No landing: A relentlessly strong US economy results in inflation stabilizing or rising at inflated levels. Central banks take their eyes off the prize (inflation) to avoid recession.

Hard landing: A significant economic crisis, possibly related to a bank-induced collapse of confidence, with potential consequences being deflation and a recession.

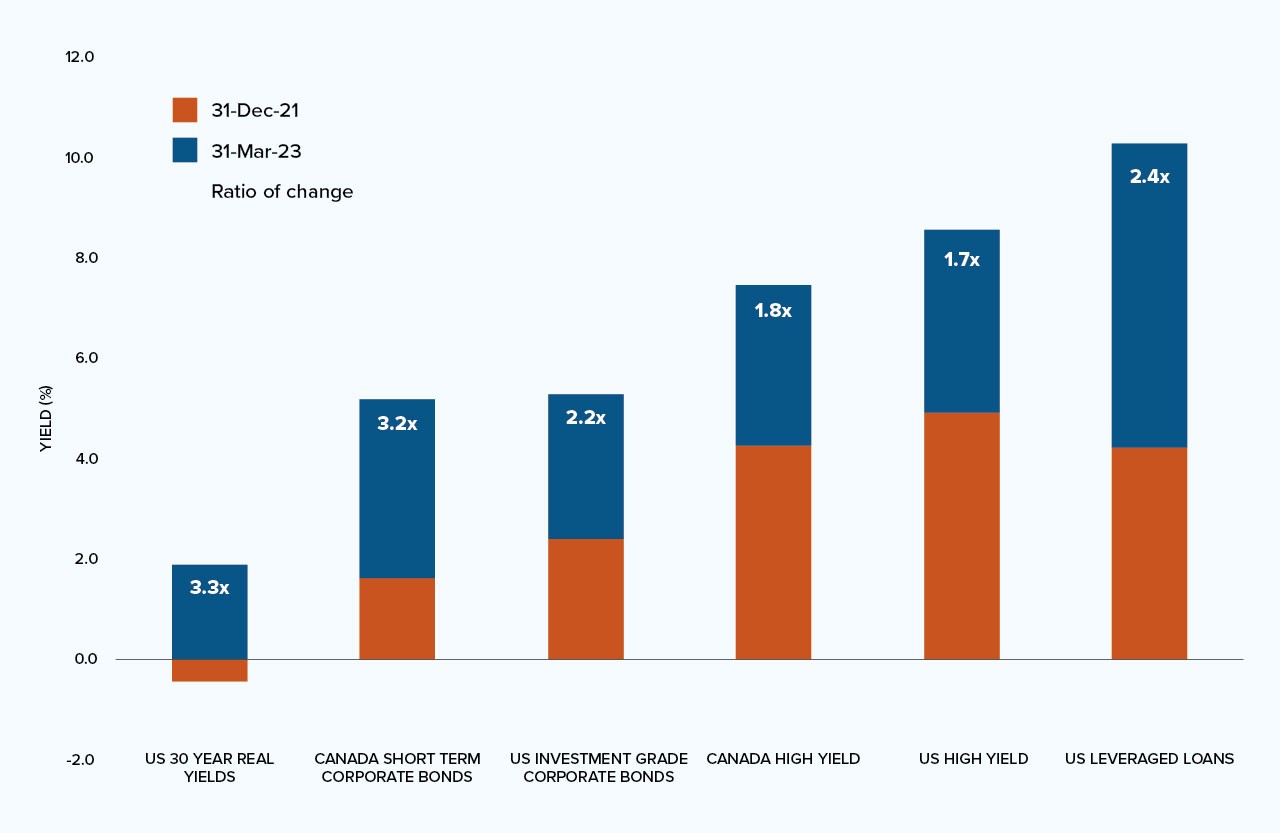

With three very divergent possible paths, it’s important to maintain a flexible approach to fixed income. Consider the extreme volatility and emerging opportunities that have emerged in a little over a year in this space.

As central banks raised policy rates through 2022, the fixed income market sold off across the board. The result was a dramatic increase in yield by the end of February 2023, with two-year US Treasuries yielding upwards of 5%, and 10-year Treasuries above 4%.

More recently, the market has recognized that these relatively risk-free assets were “on sale”. Buyers swooped in on the opportunity created by an extreme risk-off sentiment, driving the yields sharply lower within three trading sessions and restoring their status as defensive assets.

Source: Mackenzie Investments, Bloomberg as of March 31, 2023

The Mackenzie Fixed Income Team believes that the Bank of Canada is likely at the end of its tightening cycle, having led the charge ahead of most G10 countries. They believe the market may be getting a little bit ahead of itself and expect the Fed will remain focused on inflation for the near term.

The team has been positioning their funds to ensure they can adapt to any scenario.

They’ve added duration to some mandates, particularly focusing on the middle of the US Treasury curve. At the same time, they have reduced loan exposure across all mandates and have lowered credit exposure in the unconstrained mandates to the lowest since Q1 2020.

Conversely, they have increased investment-grade exposure, which is now the highest since Q1 2020. Additionally, they have reduced non-investment grade holdings in core plus mandates to the low end of their historical range, while maintaining near-neutral duration.

Overall, these changes demonstrate a shift towards a more conservative investment strategy with a focus on investment-grade holdings and reduced exposure to loans and non-investment grade securities.

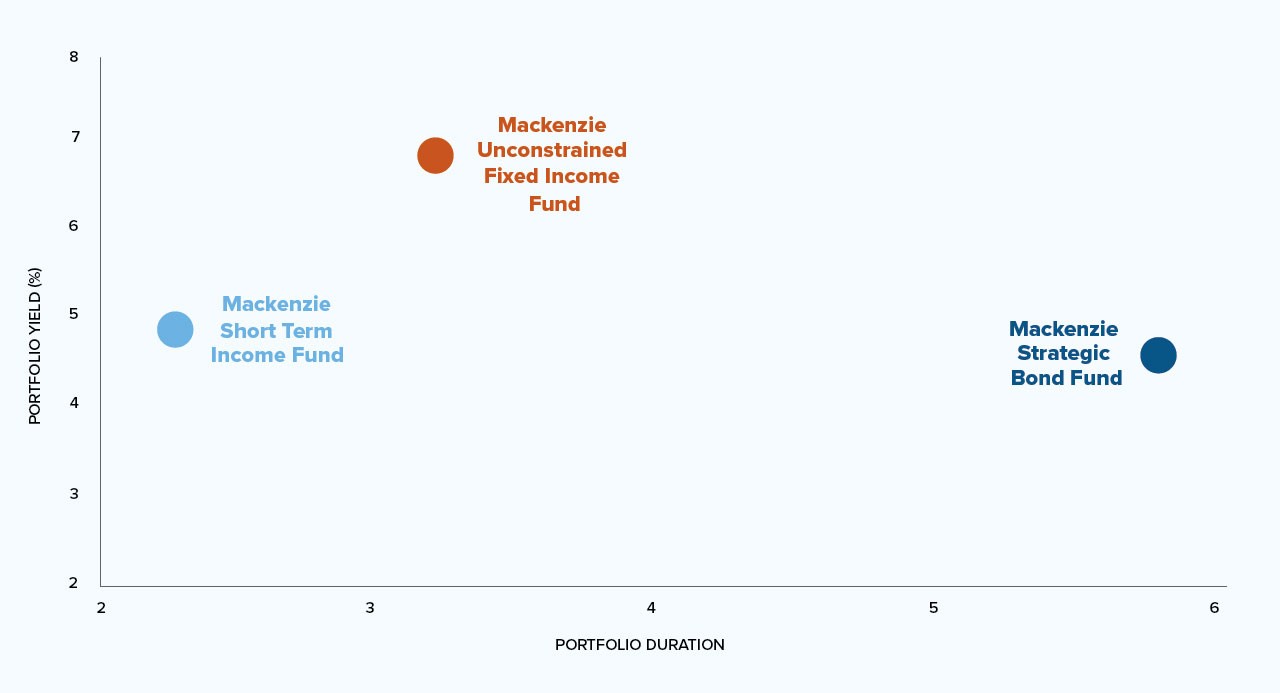

In today’s evolving markets, we believe flexibility can offer advantages over traditional fixed income investing. With our comprehensive range of fixed income funds, we bring forward-thinking solutions to address your clients’ needs.

Fund |

Portfolio Duration |

Portfolio Yield (%) |

Investment Grade Bonds (%) |

Canada (%) |

Mackenzie Short Term Income Fund |

2.2 |

4.6 |

99.7 |

91.9 |

Mackenzie Unconstrained Fixed Income Fund |

3.5 |

6.7 |

61.5 |

39.1 |

Mackenzie Strategic Bond Fund |

6.0 |

4.5 |

93.1 |

86.7 |

Source: Mackenzie Investments, as of March 31, 2023

Mackenzie Fixed Income Team

In today’s evolving markets, we believe the approach to fixed income investing shouldn’t be fixed - flexibility can offer advantages over traditional fixed income investing.

Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns as of March 31, 2023 including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any securityholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. For Advisor Use Only. No portion of this communication may be reproduced or distributed to the public as it does not comply with investor sales communication rules. Mackenzie disclaims any responsibility for any advisor sharing this with investors. The content of this communication (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.