The Globe and Mail article | September 2022

For decades, most individual investors were well-served by a balanced portfolio built with the familiar asset classes of stocks, bonds and a little cash. But with the return of stock market volatility, rising interest rates and higher inflation, many investors have seen their stocks, bonds and cash lose value simultaneously.

In response, Canadians may need to expand their investment universe. Michael Schnitman, head of alternative investments at Mackenzie Investments, believes a truly diversified modern portfolio should include alternative assets that can help provide steady returns when traditional markets face challenges.

Alternatives, especially private markets, provide valuable diversification as they tend not to move in tandem with traditional markets,” Mr. Schnitman says.

Private assets (for instance, private equity, private credit and private infrastructure) have been among the fastest-growing alternatives in recent years, in part owing to the declining number of publicly traded companies, a result of corporate mergers and a slowing pace of initial public offerings.

“In fact, only about 2 per cent of companies in North America are public. You’re missing out on 98 per cent of companies if you don’t include private assets in your portfolio,” Mr. Schnitman says.

Historically, this vast area of opportunity has typically been limited to institutional investors.

“We’re on a mission at Mackenzie to make alternatives more accessible to the retail investor,” Schnitman says. “We believe every investor should have at least 10 to 20 per cent of their overall portfolio allocated to alternatives, depending on their investment objectives.”

What is Private credit?

Private credit consists of non-bank lending to predominantly private companies. Borrowers seek private credit as a preferred alternative to bank loans due to the availability of customized structures and faster loan processing.

Private loans are commonly used to support buyout transactions by private equity funds. Private loans are unlisted, non-quoted and may not be rated. Private lenders add value in this relatively inefficient market by sourcing attractive opportunities and deep due diligence, which helps to account for the attractive yield premium, relative to other fixed income assets.

The advantages of private credit

Private credit is well-suited to help investors navigate challenging fixed-income markets. Its appeal includes a yield advantage over most types of traditional bonds, a floating rate that insulates against rising interest rates, and customized legal protection for lenders in case of default.

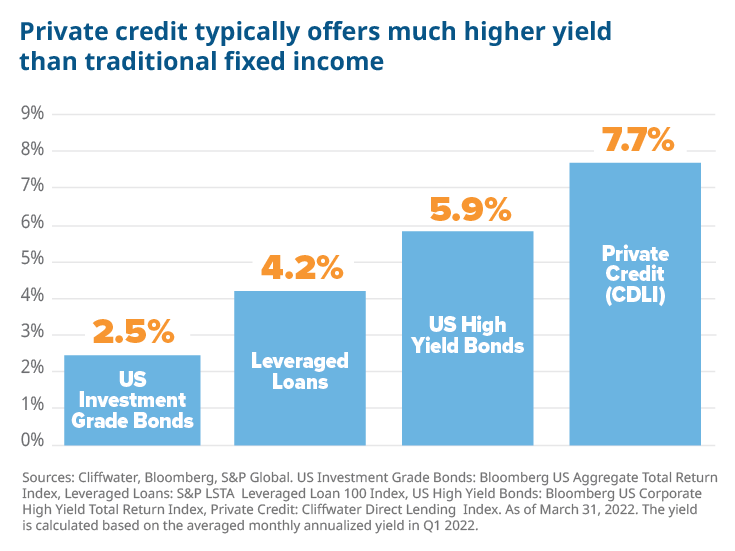

Higher yields: Private loans typically offer yields that can be two to three times higher than broad bond indexes and can also exceed that of high-yield debt. Private companies accept these higher borrowing costs in exchange for greater speed, flexibility and customization than traditional lenders may be willing to offer.

Floating rate: Private loans are priced with an interest rate spread on top of a reference rate such as the secured overnight financing rate (SOFR), which moves in tandem with the U.S. Federal Reserve’s overnight lending rate target. While traditional fixed-rate bonds typically fall in value when interest rates rise, yields on private loans rise in step with rates, mitigating potential capital losses.

Credit quality: Private credit investments have shown lower default and loss rates than similarly rated public credit, owing in part to better lender protections. Private credit loans feature financial covenants and other lender protections that prevent borrowers from taking actions that may damage the chances of the loan being serviced and repaid in full.

First in Canada to unlock private credit for all investors

Mackenzie has been aggressively building its capabilities since launching Canada’s first accessible alternatives strategies mutual fund in 2018. In 2020, the firm entered a strategic partnership with Northleaf Capital Partners, a global leader in private markets investing. With more than a 20-year history, Northleaf is a highly experienced and respected private markets investment partner, successfully investing on behalf of Canada’s largest institutions.

The Mackenzie Northleaf Private Credit Fund was launched in February 2021, via offering memorandum. A year later, Mackenzie launched the prospectus-based Mackenzie Northleaf Private Credit Interval Fund, the first of its kind in Canada, allowing non- accredited investors access to private credit.

Both funds provide exposure to a diversified portfolio of loans to global mid-market private companies, with an allocation to fixed-income exchange-traded funds (ETFs) to aid quarterly redemptions. The interval fund features monthly purchases, limited quarterly redemptions and an accessible $5,000 investment minimum.

Portfolio reconstruction with a trusted partner

Private markets represent a highly promising space for most Canadian individual investors. Schnitman believes Canada is on the cusp of rapid growth in investor adoption of private market investments, with the potential for $100-billion to flow into the sector over the next five years.

“Investors must ensure that they are working with partners, like Northleaf, that specialize in private markets, and have demonstrated the highest level of integrity and investment success for many years,” says Schnitman.

Together, Mackenzie and Northleaf are breaking down barriers for all Canadian investors and encouraging advisors and investors to reconstruct their portfolios with new, innovative solutions in a changing world.

Commissions, trailing commissions, management fees, and expenses all may be associated with investment fund investments. Please read the offering memorandum before investing. Investment fund securities are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. There can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.The Mackenzie Northleaf Private Credit Fund is offered to accredited investors (as defined in National Instrument 45-106- Prospectus Exemptions) by way of Offering Memorandum. The Mackenzie Northleaf Private Credit Interval Fund is offered to retail investors by way of prospectus, annual information and fund facts. The Mackenzie Northleaf Private Credit Interval Fund is a non-redeemable investment fund in continuous distribution that is structured as an `interval fund’. Interval funds differ from mutual funds in that investors do not have the right to redeem their units on a regular, frequent basis. The Mackenzie Northleaf Private Credit Interval Fund is only available through IIROC licensed dealers/advisors. An investor should carefully consider whether their financial condition and investment goals are aligned with an investment in the Mackenzie Northleaf Private Credit Fund. The Mackenzie Northleaf Private Credit Fund and Mackenzie Northleaf Private Credit Interval Fund will invest primarily in (i) illiquid private credit instruments on an indirect basis through investments in one or more Northleaf Private Credit Funds and (ii) public securities and other debt instruments on an indirect basis through investments in exchange traded funds. The legal offering documents contain additional information about the investment objectives and terms and conditions of an investment in the Funds (including fees) and will also contain tax information and risk disclosures that are important to any investment decision regarding the Funds. An investment in the Funds are suitable only for long-term investors who can bear the risks associated with the limited liquidity of the units. An investment in the Funds are not intended as a complete investment program. Investors should consult with their financial advisor to determine the suitability, and appropriate allocation, of the Funds for their portfolio.