Q&A on performance and distributions 2020-2022

As inflation accelerated pace and jumped to a 40 year high, Treasury Inflation-Protected Securities (TIPS) ETFs have become a popular investment option to help investors protect their portfolios against higher prices. But understanding how TIPS work is not always simple. They have some unique characteristics that can sometimes make the investing experience confusing. Here are answers to some of the most frequently asked questions about TIPS.

1. What are Treasury Inflation-Protected Securities (TIPS) and how do they work?

Treasury Inflation-Protected Securities (TIPS) are bonds issued by the US government that are designed to protect investors from the risk of higher-than expected inflation. They do this by adjusting the principal of the bonds relative to changes in the Consumer Price Index (CPI). For more specific details on how TIPS work please refer to What are TIPS piece.

Like other treasury bonds (nominal bonds) that are issued by the US government, TIPS have an original face value of $100 and pay out a fixed percentage of the principal as coupon semi-annually until maturity. Different from nominal bonds, TIPS help protect investors’ purchasing power by adjusting their principal based on changes in the US Consumer Price Index (CPI). Since TIPS are indexed to changes in the CPI, their principal value is adjusted upwards when inflation increases and downwards when CPI decreases. This adjustment is based on two months prior CPI being applied to the fund’s underlying securities. When the bonds mature, investors receive the greater amount of either the adjusted principal or the original principal (investors never receive less than their originally invested principal). TIPS pay out a fixed coupon rate, which is calculated based on the new principal amounts, so, like the principal, interest payments rise with inflation and fall with deflation.

2. What factors drive TIPS performance?

The performance of TIPS is largely driven by changes in inflation expectations and interest rates, in particular changes to real rates; measured as the difference between nominal yield and expected inflation. The sensitivity to changes in interest rates is measured by Duration. As an example, Mackenzie US TIPS Index ETF (CAD-Hedged) (QTIP) has a duration of approximately 7.5 years1, which means that if real yields increased by 1%, the price of QTIP may fall by 7.5%.

TIPS are designed to preserve purchasing power by protecting investors from the risk of higher-than-expected inflation over the long run. They are more sensitive to changes in inflation expectations rather than actual inflation. Current inflation expectations are often already priced by the market and may not have a significant impact on the performance of TIPS. Inflation expectations are typically measured by break-even inflation rate, which is the inflation level required for investors to be indifferent between holding a nominal bond or an inflation-linked bond. It is calculated as the difference between the yield of a nominal bond and an inflation-linked bond of the same maturity.

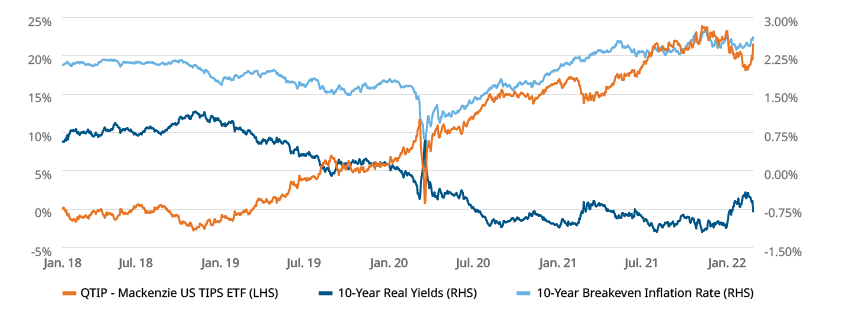

Using QTIP as an example, as the chart below illustrates, since its inception on January 24, 2018, QTIP has generated a total return of 21.5% (4.9%) annualized against the backdrop of decline in 10-year real yields and increasing inflation expectations, measured by 10-year breakeven rates.

Source: Blomberg, based on daily data. 10-year real yields represented by Generic Inflation Indexed United States 10-year government bonds. 10-year break even inflation rate represented by: US Breakeven 10 Year index

Source: Blomberg, based on daily data. 10-year real yields represented by Generic Inflation Indexed United States 10-year government bonds. 10-year break even inflation rate represented by: US Breakeven 10 Year index

3. Do high CPI numbers always lead to positive performance for TIPS/QTIP?

Inflation (measured by CPI) impacts TIPS performance when there is a deviation of actual CPI data relative to what the markets had predicted. The main purpose of TIPS is to protect against unexpected rise of inflation and a high absolute CPI value may not have a positive impact on performance if the amount is on par or below market expectations. Given that TIPS are government issued bonds, they are also sensitive to interest rate risks (as interest rates increase prices for existing bonds decline and vice versa).

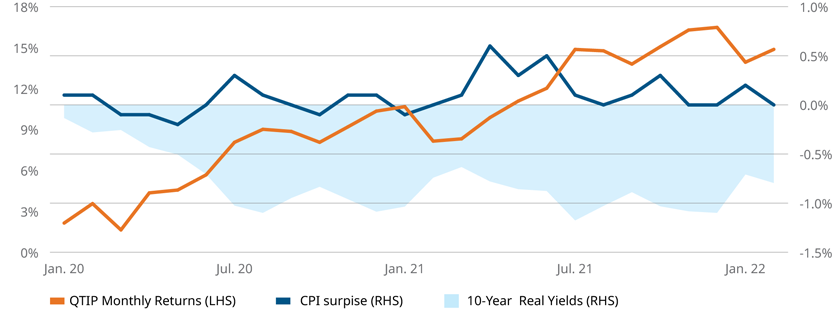

Looking back to the example of QTIP again, since QTIP has a duration of approximately 7.5 years it will be very sensitive to changes in real yields. When yields rise, QTIP’s price may decline enough to offset the inflation adjustment and lead to negative total returns. Similarly, when yields decline and consumer prices rise, total returns would benefit from both price appreciation and the inflation adjustment. An environment where CPI exceeds expectations and real yields decline would be the most favorable for the performance of TIPS or an ETF such as QTIP. The chart below highlights the impact of inflation surprises and real yields changes in QTIP performance since the Covid-19 pandemic started in 2020.

January 2020 to June 2020 – QTIP generated a positive performance despite the negative inflation surprises as the price gains from the decline in 10 real yields outweighed the negative impact from the inflation adjustments.

March 2021 to July 2021 – QTIP gained 7% and benefited from both inflation adjustments (CPI exceeded expectations) and price appreciation as real yields declined by 54 basis points.

July 2021 to February 2022 – QTIP’s performance was flat but volatile. The positive impact of inflation adjustment was offset by price decreases due to the increase in real yields.

Source: Blomberg based on monthly data. CPI surprise is calculated as Actual CPI – Median Surveyed CPI. CPI is represented by US CPI urban YoY NSA index

Source: Blomberg based on monthly data. CPI surprise is calculated as Actual CPI – Median Surveyed CPI. CPI is represented by US CPI urban YoY NSA index

4. How are TIPS distributions calculated?

TIPS ETFs distributions consist of accrued coupon income and the principal inflation adjustment. Increases in TIPS’ principal amounts due to upward inflation adjustments are considered taxable income in the year they occur, even though such increases are not realized until the bonds are sold or mature. This differs from a TIPS ETF or mutual fund, which pay out both coupon income and the income from principal adjustments to investors to match the cashflow with the appropriate tax consequences. The inflation adjustment is based on two months’ prior CPI applied to the fund’s underlying securities. ETF distribution yields may fluctuate due to short-term fluctuations in CPI; lag in CPI data; as well as due to differences in calculation conventions and distribution schedules among different ETF sponsors.

Current Distribution annualizes the most recent cash distribution amount to show what the percentage yield would be if the most recent distribution persisted for 12 months. This can overstate or understate the actual yield if a very high/low monthly CPI reading was short lived.

Trailing 12-month yield is calculated by adding the last 12 monthly distribution payments. While this accurately reflects the yield over the past year, it is backward looking-and might not be a strong indicator of what to expect in the future, especially if the inflationary environment changes.

5. Can monthly cash distributions decline when CPI readings are high?

Inflation adjustment is mainly driven by month-to-month changes in CPI rather than absolute CPI prints. A high inflation number is a relative term and may still lead to a decline in monthly distribution if a given month’s change is less than the previous month’s change. In addition, there are delays between the time CPI is released and when it is considered as part of the calculation for a distribution. For example, the CPI reading for the month of January will not be released until mid-February. That inflation adjustment may not be reflected in the fund distribution until a month or two later, when the calculation methodology takes this adjustment into account.

6. Where do TIPS fit on your portfolio?

Our view is that TIPS/QTIP should be considered as a long-term strategic allocation due to diversification, inflation protection and equity risk offset benefits the asset class may provide. Given the similar characteristics and interest rate sensitivity to other US government bonds with similar duration and maturity, we believe an allocation to QTIP should be within the government and aggregate bond sleeve of client portfolios. How much to allocate will vary based on individual investors unique risk return profiles and time horizons. A higher allocation to TIPS may make sense for retirees or other older demographics nearing retirement since they are designed to protect investors purchasing power from increases in consumer prices. According to a recent Wall Street Journal article, eight out of then largest 2020 target-date mutual funds (proxy for recent retirees) have allocated between 5% to 10% in TIPS.

1 Bloomberg as of February 28, 2022

Commissions, management fees, brokerage fees and expenses all may be associated with Exchange Traded Funds. Please read the prospectus before investing. Exchange Traded Funds are not guaranteed, their values change frequently and past performance may not be repeated. The Mackenzie ETFs are not sponsored, promoted, sold or supported in any other manner by Solactive nor does Solactive offer any express or implicit guarantee or assurance either with regard to the results of using the Indices, trade marks and/or the price of an Index at any time or in any other respect. The Solactive Indices are calculated and published by Solactive. Solactive uses its best efforts to ensure that the Indices are calculated correctly. Irrespective of its obligations towards the Mackenzie ETFs, Solactive has no obligation to point out errors in the Indices to third parties including but not limited to investors and/or financial intermediaries of the Mackenzie ETFs. Neither publication of the Solactive Indices by Solactive nor the licensing of the Indices or related trade mark(s) for the purpose of use in connection with the Mackenzie ETFs constitutes a recommendation by Solactive to invest capital in said Mackenzie ETFs nor does it in any way represent an assurance or opinion of Solactive with regard to any investment in these Mackenzie ETFs. This should not be construed to be legal or tax advice, as each client’s situation is different. Please consult your own legal and tax advisor.