In the current challenging macroeconomic environment, investors are looking for opportunities that help meet their investment goals. For years, pension funds have thrived in challenging conditions by investing in private markets assets that boosted performance and enhanced stability. Canadians contributing to the Canada Pension Plan (CPP) and the defined-benefit plans offered by some large corporations and the public service have been contributing indirectly toward private markets without even knowing it.

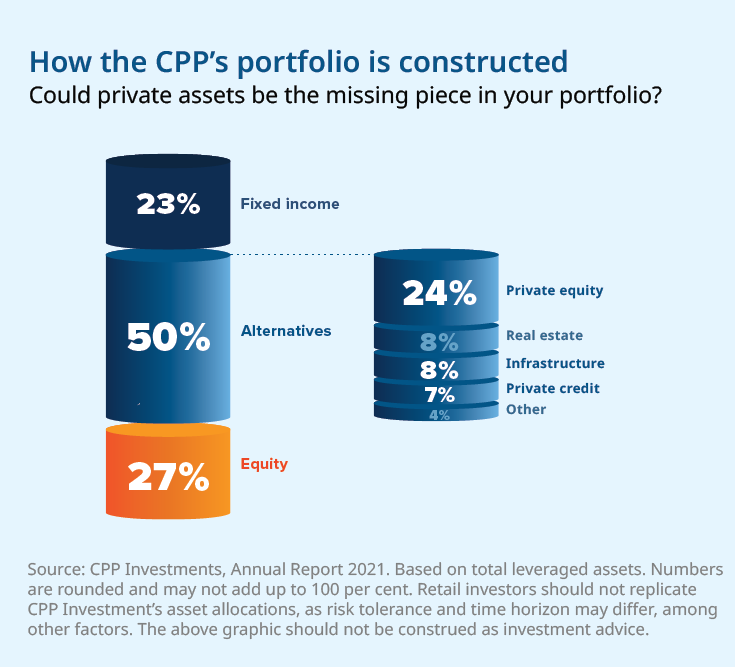

In the past, pension plan allocations to private markets were relatively small, nestled between the much larger allocations to traditional fixed income and equity made through public markets. More recently, allocations to private assets have grown substantially — so much so that nearly half of the Canada Pension Plan today is invested in private markets.

Over the years, many defined-benefit plans, which provide set payment for life within certain limits, have been replaced with defined-contribution or group registered retirement savings plans (RRSPs) that are limited to investing in public markets. Investing in private assets now represents the “missing middle” for most individual investors’ portfolios.

The potential advantages of private markets — greater diversification, enhanced total return and less volatility — that underpin institutional allocations to the asset class demonstrate why now may be the time to reconstruct individual portfolios to address that missing middle.

“Alternatives, especially private markets, provide valuable diversification as they tend not to move in tandem with traditional markets,” says Michael Schnitman, head of alternative investments at Mackenzie Investments. He says a truly diversified modern portfolio should include alternative assets that can help provide steady returns when traditional markets face challenges.

Fast-growing asset class

Private assets as a broad category include private equity, private credit, private infrastructure and real estate.

This asset class is rapidly expanding, driven by a number of different trends. Among these is the declining number of publicly traded companies over the past 20 years, owing to mergers, and an overall slowing of initial public offerings. The number of private companies, meanwhile, has grown to account for about 98 per cent of businesses in North America.

Banks have also reduced their exposure to private lending, following the global financial crisis.1 Private credit specialty firms have stepped into their place, fuelled by demand from institutional investors.

The building of infrastructure, including projects needed to support society’s transition to clean energy, is also contributing to the growth of this asset class.

Why private markets now?

Private markets offer many benefits versus public markets. Private equity investors typically take controlling interests in businesses, make capital and expertise available to support growth strategies and can drive real business improvements that translate into superior financial performance. This active value-creation model has led to private equity returns that have exceeded the relative performance of public equity over the past 20 years.2

In our experience, private investors provide “patient” long-term capital that is less concerned about near-term liquidity and quarterly earnings, making private markets less susceptible to fickle investor behaviour often found in public markets. Private assets are typically valued using longer-term cash-flow models, resulting in muted volatility relative to public markets

Portfolio reconstruction with a trusted partner

Michael Schnitman says Canada is on the cusp of rapid growth in investor adoption of private markets investments, with the potential for $100 billion in flows over the next five years.

In 2020, Mackenzie entered a strategic partnership with Northleaf Capital Partners, a global private markets investment firm with top-tier capabilities across private credit, private equity and private infrastructure. The firm has been actively investing capital on behalf of investors in the private markets since 2001 and has raised more than US$20 billion3, including from some of the world’s most sophisticated institutional investors.

“Investors must ensure that they are working with partners like Northleaf that specialize in private markets and have demonstrated the highest level of integrity and investment success,” says Schnitman.

Together, Mackenzie and Northleaf are breaking down barriers for all Canadian investors and encouraging advisors and investors to reconstruct their portfolios with new, innovative solutions in a changing world.

Key private assets

Private equity funds acquire companies that they help grow into larger and/or more profitable businesses before seeking to sell them at higher valuations. Historically, these have generated returns in the mid-to-high teens and are ideal for investors seeking long-term capital appreciation.

Private credit funds lend capital to businesses to help them operate and grow. These loans can earn yields in the mid-to-high single digits and are typically floating rate, making these funds ideal for investors seeking greater income and shelter from rising interest rates.

Real asset funds emphasize the ownership of productive, tangible assets and may include direct investments in real estate and infrastructure. These can be effective for investors seeking a stable mix of growth and income and are often sought for their resilience in the face of inflation.

1 https://www.callan.com/blog-archive/private-credit-dislocation/

2 Sources: Preqin and Morningstar. Private markets (as represented by the Preqin Private Equity Index, Preqin Private Debt Index, and Preqin Private Infrastructure Index), public markets (as represented by the MSCI World NR, ICE BofA Global Broad Market TR Hedged to CAD, and S&P Global Infrastructure TR). MSCI World NR, 1 year – 20.8%, 3 year – 18.6%, 5 year – 13.7%, 10 year – 15.2%, 20 year – 6.8%. Preqin Private Equity Index, 1 year – 35.2%, 3 year – 22.2%, 5 year – 19.7%, 10 year – 19.6%, 20 year – 11.5%. ICE BofA Global Broad Market TR Hedged CAD, 1 year – (-1.6%), 3 year – 3.8%, 5 year – 3.0%, 10 year – 3.6%, 20 year – 4.4%. Preqin Private Debt Index, 1 year – 19.1%, 3 year – 8.2%, 5 year – 8.3%, 10 year – 12.1%, 20 year – 8.5%. S&P Global Infrastructure TR, 1 year – 10.9%, 3 year – 7.4%, 5 year – 6.5%, 10 year – 10.1%, 20 year – 8.1%. Preqin Private Infrastructure Index, 1 year – 25.3%, 3 year – 10.6%, 5 year – 10.8%, 10 year – 13.6%, 20 year – NA.

3 As of June 30, 2022

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward- looking information contained herein is current only as of September 8, 2022. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise