As EM central banks end the rate hike cycle, outlook is strong

A darkening outlook for the global economy last month prompted the International Monetary Fund to pare back its forecast for global growth next year, down to 2.7% from 2.9% in July. As leery investors seek to tighten up their portfolios in preparation for more bad news ahead, some large investors have put emerging markets equities on the chopping block, including Australia’s CDN$232 billion Future Fund. The sovereign wealth fund recently announced it has cut its exposure to emerging markets equities due to worries over China’s economic slowdown and the perceived inability of these economies to grow in this kind of macroeconomic environment.

On one level, the move makes sense - a strong U.S. dollar, China’s zero-COVID strategy and surging energy costs will most certainly weigh on emerging markets growth in the short term. But long-term investors should think twice before making this kind of tactical decision based on these factors. In fact, a closer look at the data shows that, beyond today’s macroeconomic conditions, the long-term case for emerging markets equities remains strong. If anything, this is the best time for investors to stay the course. There are many reasons to remain optimistic about emerging markets, including:

1 - Risk-free rates are heading up - Risk-free rates have increased sharply in the last year globally – that has raised the expected return of most asset classes, including emerging markets equities. Moreover, emerging markets are much further ahead of developed markets when it comes to the global rate hike cycle currently underway. Central banks in emerging markets have raised interest rates by a 6,340 basis points already year-to-date – moving forward, signs point to the end of rising rates in these economies.

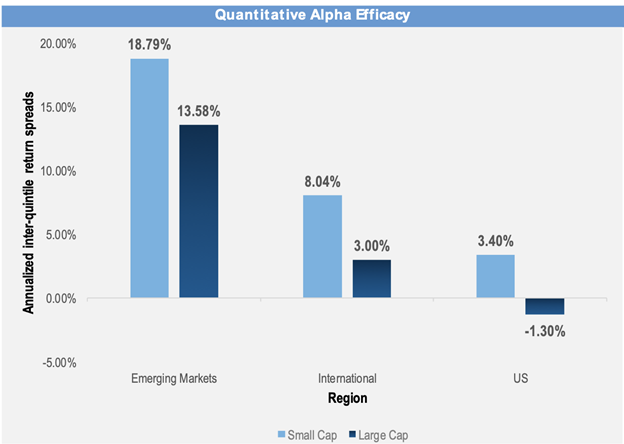

2 - The long-term risk premium - The long-term risk premium for emerging markets stocks remains higher than that of developed market equities. Moreover, current valuations for emerging markets stocks relative to their long-term fundamentals remain attractive, especially compared to developed market equities and U.S. stocks in particular (Figure 1). Even with today’s tough economic conditions, longer-term valuations still look attractive. Bottom line: emerging markets still offer a higher risk premium, both short- and long-term.

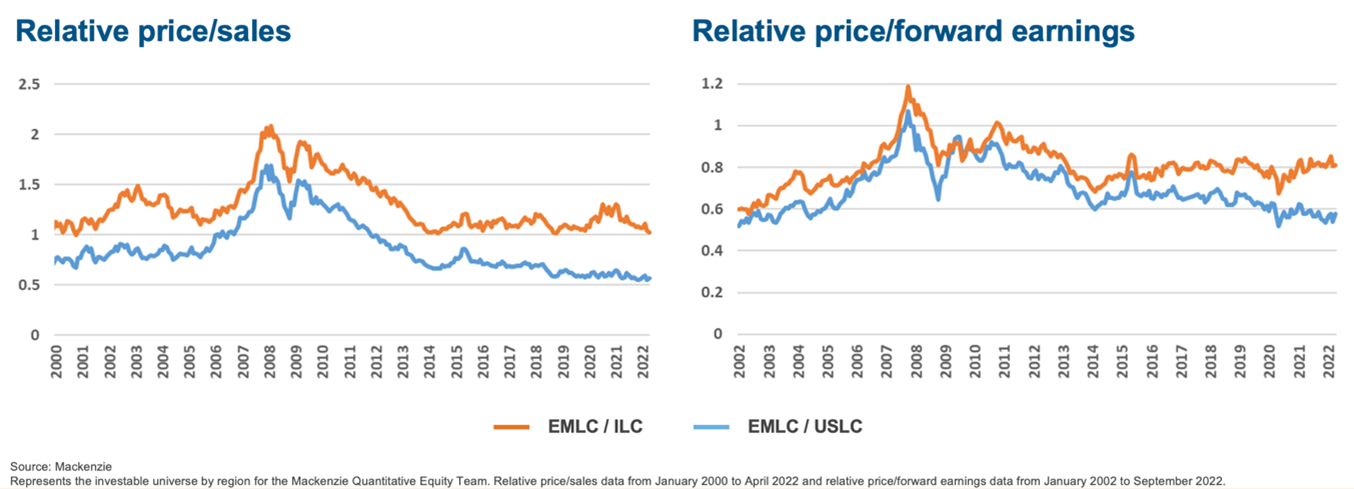

3 - The long-term returns are still there – especially with active management - We all know that selling assets based on a short-term tactical view is costly. Beyond the cost however, the expected returns from emerging markets equities remain attractive over a five- to 10-year time horizon, especially relative to developed market equities. Figure 2 shows our own 10-year return expectations for emerging markets at 8.9% versus 6.5% for U.S. equities and 7.3% for EAFE equities. Contributing to the outperformance is a large share of Chinese equities in the emerging markets index which provides investors with access to a rapidly growing economy that is fast becoming a greater share of the global capital market.

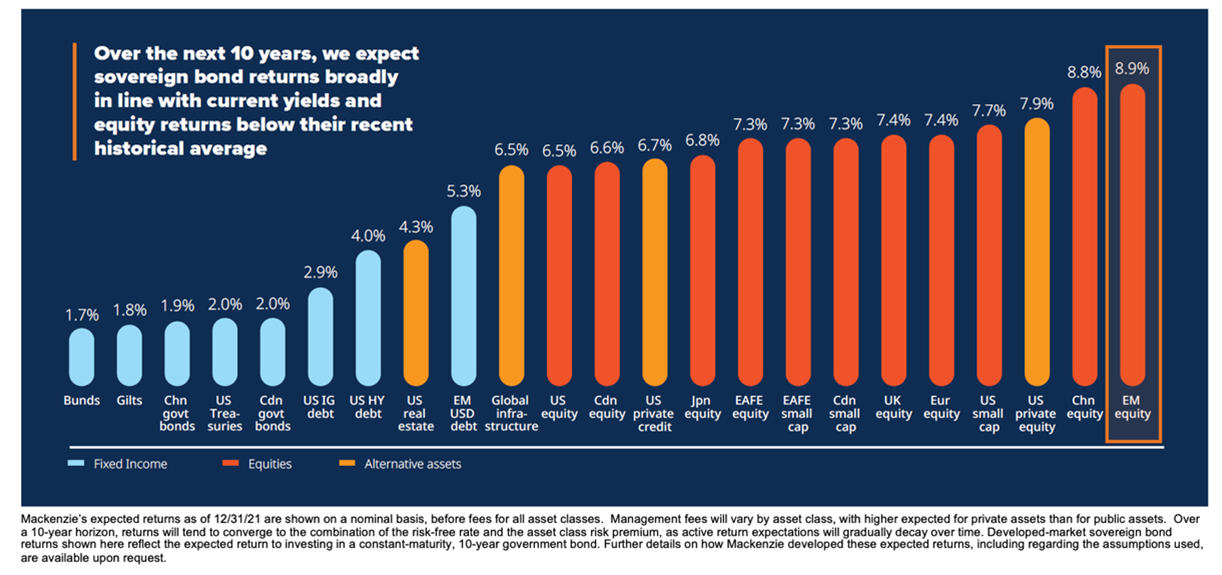

4 - It’s about the alpha - Finding alpha in developed markets equities is going to be challenging in the years ahead. Not so for emerging markets, where expected alpha from equities will remain attractive relative to other markets – in particular quantitative alpha efficiency is very strong (Figure 3).

While it’s true we are facing dark times ahead, it’s important not to lose sight of the long-term picture. The main downside risks of emerging markets remain today’s challenging macroeconomic conditions and the geopolitical landscape. Looking beyond that and into the longer-term, however, emerging markets are still on a path to outsized growth well beyond their developed markets counterparts. Investors should remain focused on the long-term.

Figure 1

Figure 2

Figure 3