Asset allocation is essential for investors looking to maximize their growth potential, while managing risk. It can account for up to 92% of the variation in a portfolio’s returns.1

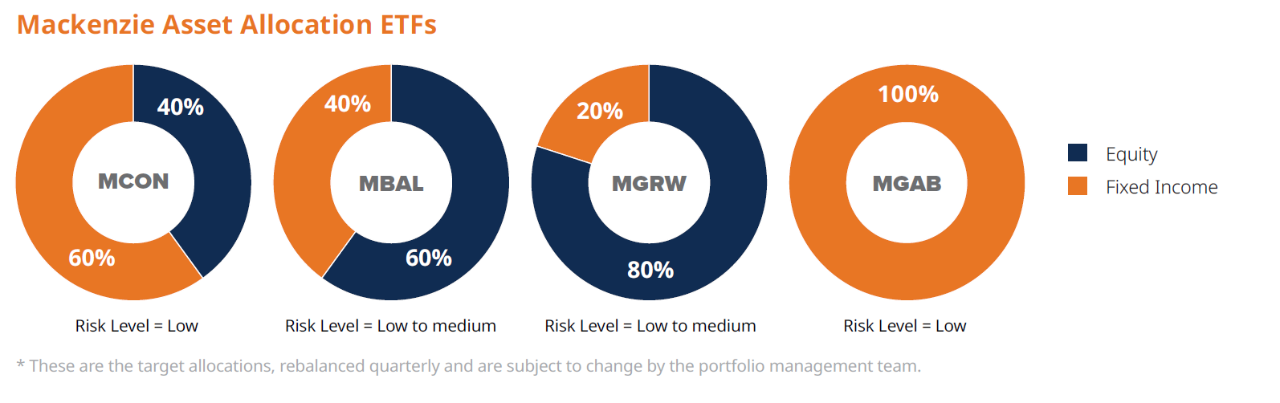

ETFs are increasingly being used as part of effective asset allocation strategies. Mackenzie’s suite of Asset Allocation ETFs is designed to provide a variety of allocations, suited to different investors’ risk preferences. They offer the options for conservative, balanced or growth allocations. The Global Fixed Income Allocation ETF brings exposure to diversified fixed income with a strategic asset allocation mix that includes investment grade government bonds.

Mackenzie’s suite of asset allocation ETFs is designed to provide Canadian investors with:

• Low cost management fees (between 0.17 – 0.25%)

• A simple, single-ticket solution to deliver effective asset allocation

• Risk-based strategic asset allocation to match various risk profiles

• Help in mitigating the impact of market volatility

• Rebalanced allocation every quarter to maintain the preferred asset mix

How they work:

Each of Mackenzie’s Conservative, Balanced and Growth Allocation ETFs holds underlying Mackenzie ETFs, which offer broad global diversification across both asset classes and geographies. Mackenzie’s Global Fixed Income Allocation ETF also holds underlying Mackenzie ETFs, with a diversification of fixed income asset classes designed to reduce risk.