The Mackenzie Corporate Knights Global 100 Index ETF

For over two decades, Canadian-based Corporate Knights has championed the most sustainable companies in the world. The Corporate Knights magazine has consistently promoted the ideas, actions and innovations that companies can adopt to help create a sustainable economy.

Since 2005, Corporate Knights has produced its annual Global 100 Index, a ranking of the world’s 100 most sustainable corporations.

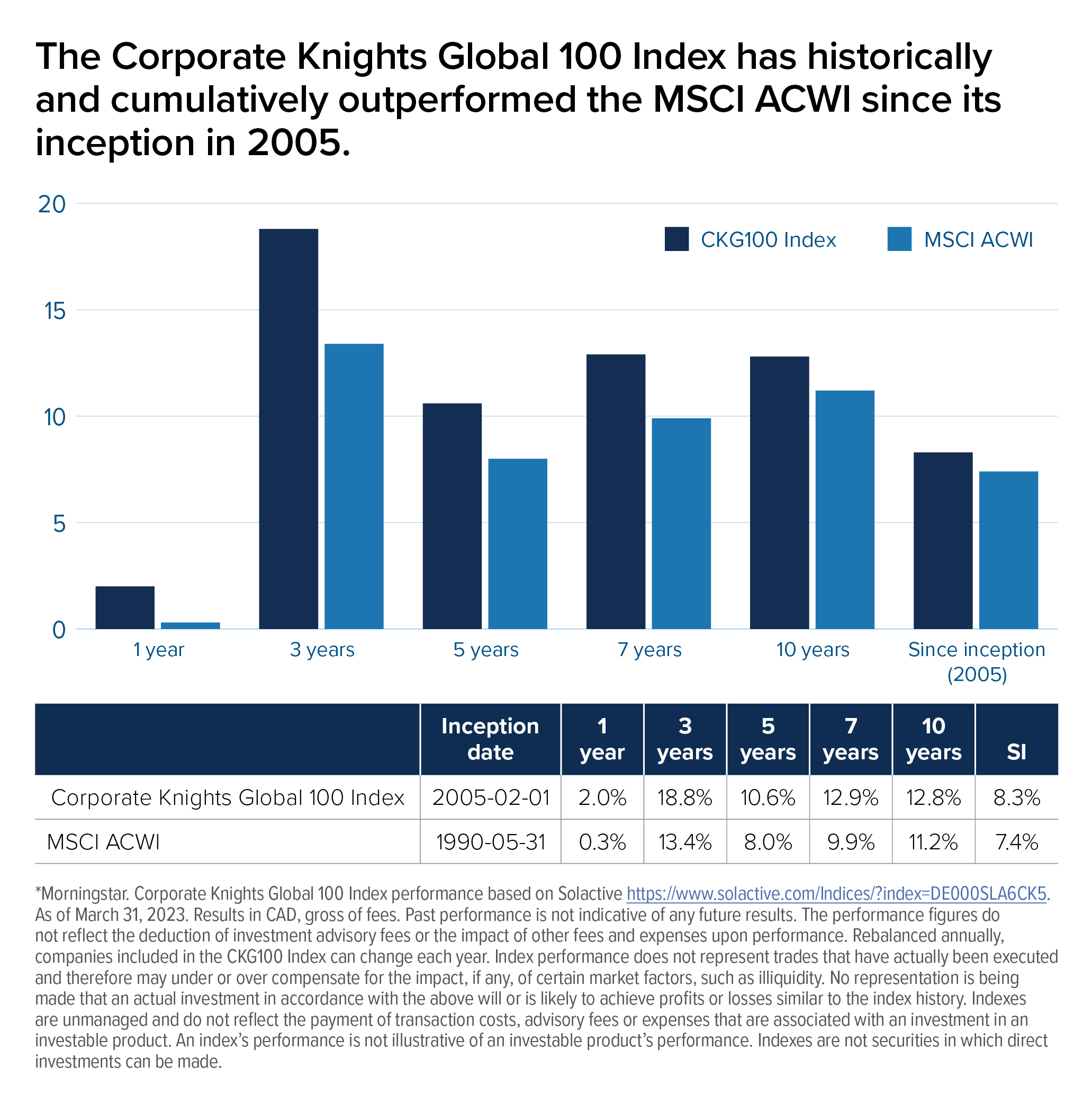

Toby Heaps, Corporate Knights CEO and co-founder, says, “Global 100 companies have been at the forefront of the sustainability transition, and the Corporate Knights Global 100 Index has historically outperformed its benchmark, the MSCI ACWI.”

Previously, investing in the index was practically impossible for individual investors, but that has now changed. In April 2023, Mackenzie launched the Mackenzie Corporate Knights Global 100 Index ETF (ticker MCKG). Let’s take a look at how the index is put together and why Mackenzie launched a new ETF to track it.

What is Corporate Knights?

Corporate Knights is a media and research company, based in Toronto, which focuses on promoting ways to create an economic system where people and the planet can thrive. It publishes its self-titled magazine four times a year, distributed in the Globe and Mail, Washington Post and Wall Street Journal.

The company’s research team produces a number of sustainability rankings, including the most responsible funds, the fastest growing sustainable companies and the cleanest companies. Its flagship ranking is the Global 100, which is a list of the most sustainable corporations in the world.

The Corporate Knights Global 100 selection methodology

The research begins with a list of 6,720 publicly traded companies; these are global corporations with revenue above $1 billion (according to purchasing power parity). Any companies that take part in “red flag” activities are disqualified (these activities include thermal coal, blocking climate policy and deforestation).

The remaining companies are then analyzed and receive a score based on 25 key performance indicators (KPIs). Data used includes annual reports, sustainability reports, company websites and third-party providers.

Half of the weighting is assigned to sustainable revenue and sustainable investment. Sustainable revenue includes income from activities such as clean technology, energy efficiency, recycling and renewable energy. Sustainable investment includes initiatives like investing in research and development for sustainable buildings, more efficient equipment, acquiring sustainable companies, etc.

For the other 50% of the weighting, Corporate Knights studies 23 KPIs that are broken down into four segments:

- Environmental KPIs: For example, water efficiency (a company’s profit per unit of water used).

- Social KPIs: Such as employee turnover. When it’s high, compared to the company’s total number of employees, this will impact productivity and share price.

- Governance KPIs: This includes senior executives’ pay being linked to sustainability targets, or diversity on the board and among top executives.

- Economic KPIs: For example, the pay gap between the CEO and the average employee — the smaller the better.

Each company is compared against its peer group (for example, banks versus banks, restaurants versus restaurants, etc.) when it’s scored. The top 100 companies are then placed in the index, with sector breakdown aligned to the broad MSCI ACWI index. For the purpose of supporting the energy transition, the weights of the utilities and energy sectors are combined.

Why Mackenzie has launched its Corporate Knights Global Index ETF (MCKG)

One of the key reasons is that Corporate Knights is a leader in research into sustainable businesses. Mackenzie wanted to bring a broader, core sustainable investment option to the market, harnessing Corporate Knights’ research to do this.

While the index has been publicly available to view since 2005, investing in the index has been almost impossible until now. Mackenzie’s new ETF makes it easy to add the companies within the index to any investor’s portfolio.

Another key reason is the thesis that underlines the new ETF; responsibly run companies create shareholder value. Mackenzie has always believed that you don’t have to sacrifice returns when you invest sustainably. The Corporate Knights Global 100 Index has consistently performed well compared to its benchmark, the MSCI ACWI (All Country World Index, which consists of almost 3,000 companies in 48 developed and emerging market countries).

As you can see in the chart below, since the Corporate Knights Global 100 Index began in 2005, it has consistently outperformed the MSCI ACWI. Between 2005 and 2022, the Corporate Knights Global 100 Index generated a total investment return of 270.7% compared to 222.1% for MSCI ACWI.

Mackenzie’s methodology for its Corporate Knights Global 100 Index ETF (MCKG)

MCKG is constructed to mimic the Corporate Knights Global 100 Index; each company in the index has a 1% weighting in the ETF. Companies are not represented by their size or overall ranking; this ensures that the ETF gives proper representation across all of the various industry sectors. It also allows smaller companies to be highlighted and showcased.

As with the index, MCKG will be updated every year. Companies that appear on the list can’t rest on their laurels; competition for spots in the index is fierce, and there is a turnover of between 20% to 30% of companies every year. This way, investors know that the ETF always contains the current top 100 sustainable companies, as per Corporate Knights.

What type of investor is the new ETF designed for?

MCKG is designed to be a core part of the portfolio for any investor who is looking for a global solution, that gives broad market exposure with a sustainability tilt. Also, given that the index has a lower concentration of North American companies and a higher concentration in Europe, it’s well suited to investors who are looking for additional diversification (and who could use this as an alternative to US-heavy ETFs).

This fund is filling a big gap in the sustainable investing market. The Corporate Knights Global 100 Index has an 18-year track record, containing companies that have scored highly on sustainability metrics to be among the top 100 of over 6,000 corporations. Yet this elite group of companies, whose sustainability and financial performance have to be consistently excellent, has not been available to investors in a single package before now. The Mackenzie Corporate Knights Global 100 Index ETF makes it easy for any investor to incorporate these companies into their portfolio.

Find out more about the Mackenzie Corporate Knights Global 100 Index ETF

The Corporate Knights website contains a wide variety of information on corporate sustainability and also has a list of FAQs related to its methodology for selecting the companies for its Global 100 Index.

You can read more about the smart way to invest in sustainable leaders on the Mackenzie Corporate Knights Global 100 Index ETF feature page.

Mackenzie also has a dedicated sustainable investing info page, which provides a wealth of information, including opportunities in net-zero investing, renewable energy and sustainable bonds.

Advisors, to find out more about how MCKG could complement your clients’ portfolios, speak to your Mackenzie Sales Team.

Investors, speak to your financial advisor to learn more about sustainable investing and the Mackenzie Corporate Knights Global 100 Index ETF.

Commissions, management fees, brokerage fees and expenses all may be associated with Exchange Traded Funds. Please read the prospectus before investing. Exchange Traded Funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the prospectus before investing.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This article may contain forward-looking information which reflect our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of May 5, 2023. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise. This should not be construed to be legal or tax advice, as each client’s situation is different. Please consult your own legal and tax advisor.

All rights reserved. “Corporate Knights Global 100” and other trademarks related to the Corporate Knights Global 100 Index (the Index) are trademarks of Corporate Knights Inc. (Corporate Knights) and are used by Mackenzie Financial Corporation under license.

Every effort is made to ensure that all information contained in this publication is accurate, but no responsibility or liability can be accepted by Corporate Knights for any errors or for any loss resulting from use of this publication. Corporate Knights does not make any claim, prediction, warranty or representation whatsoever, express or implied, either as to the results to be obtained from the use of the Index or the fitness or suitability of the Index for any particular purpose. Corporate Knights does not provide investment advice and nothing in this document should be taken as constituting financial or investment advice. Inclusion of a security in an index is not a recommendation to buy, sell or hold that asset. The Corporate Knights maintains the Index, but does not manage actual assets. Calculation of the Index is performed by a third party.

The general information contained in this publication should not be acted upon without obtaining specific legal, tax, and investment advice from a licensed professional. No part of this information may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior written permission of Corporate Knights. Distribution or use of the Index to create financial products requires a licence.