The unique advantages of infrastructure are now available to all investors

Private and public infrastructure are investment assets that have been growing massively in popularity for more than a decade. For example, private infrastructure assets held by institutional investors (such as large pension plans) have grown from US$213 billion in 2011 to US$668 billion in 20211 That figure is expected to grow to US$795 billion by 2025.

Until recently, private infrastructure assets were available only to very wealthy or institutional investors. All that has changed, with private and public infrastructure funds now available to a broader set of individual investors. So, what are infrastructure assets? How do they work? And why are they so popular with large investors?

How do infrastructure assets work?

Infrastructure assets provide services that are essential to the functioning of society, such as:

- Water utilities

- Pipelines

- Airports

- Roads and bridges

- Renewable energy projects

- Communications infrastructure (such as transmission towers and data storage facilities)

A burgeoning population, increasing urbanization, and climate change are all fuelling the growing need for infrastructure investment. Also, many existing infrastructure assets need refurbishment and modernization.

Private investor capital is expected to continue to play a key role in financing these essential projects, in part through infrastructure funds. Infrastructure projects tend to produce consistent cash flows and earnings that are less sensitive to market fluctuations than other assets. For this reason, these funds can provide an extremely effective way of generating returns and reducing volatility in your portfolio.

How infrastructure assets protect against inflation

Revenue from infrastructure assets is usually underpinned by long-term contracts and linked to inflation, either directly or indirectly, through a variety of ways:

- Pricing in contracts can be linked to the consumer price index.

- Regulated price escalators allow for measured increases in prices under certain circumstances.

- Infrastructure companies tend to have significant pricing power, given their monopolistic markets.

This inflation-proofing, along with the essential nature of the services infrastructure assets provide, means that they typically tend to outperform traditional equity investments during market downturns and periods of high inflation.

How infrastructure outperforms during market downturns

Revenue from infrastructure investments is typically determined in advance, via long-term contracts secured by infrastructure companies for their services. Because of this, the performance of infrastructure assets tends to be relatively more resilient to fluctuations in the business cycle than companies operating in other sectors of the broader economy.

How infrastructure returns stack up against equities

Investor total returns on infrastructure investments typically consist of a combination of dividends and capital gains. Over the last 15 years, these returns have been attractive relative to the broad equity market and they have also been less volatile2 .

The difference between private and public infrastructure funds

Private infrastructure funds generally use investor capital to assemble portfolios of private assets (those which are not publicly traded) in which the fund has a controlling interest (meaning the fund manager has control over the direction of companies held by the fund).

Fund managers add value by sourcing and negotiating the purchase of individual infrastructure projects for the fund, by taking a hands-on approach to managing and/or improving them, and potentially selling them to other investors at a higher valuation.

Public infrastructure funds use investor capital to assemble portfolios of publicly traded companies that engage in business activity around the broader infrastructure sector. The fund would hold a minority interest in any given company. Fund managers can add value by actively buying and selling these companies, or alternatively, diversified exposure to the entire space can be achieved through lower-cost indexing strategies.

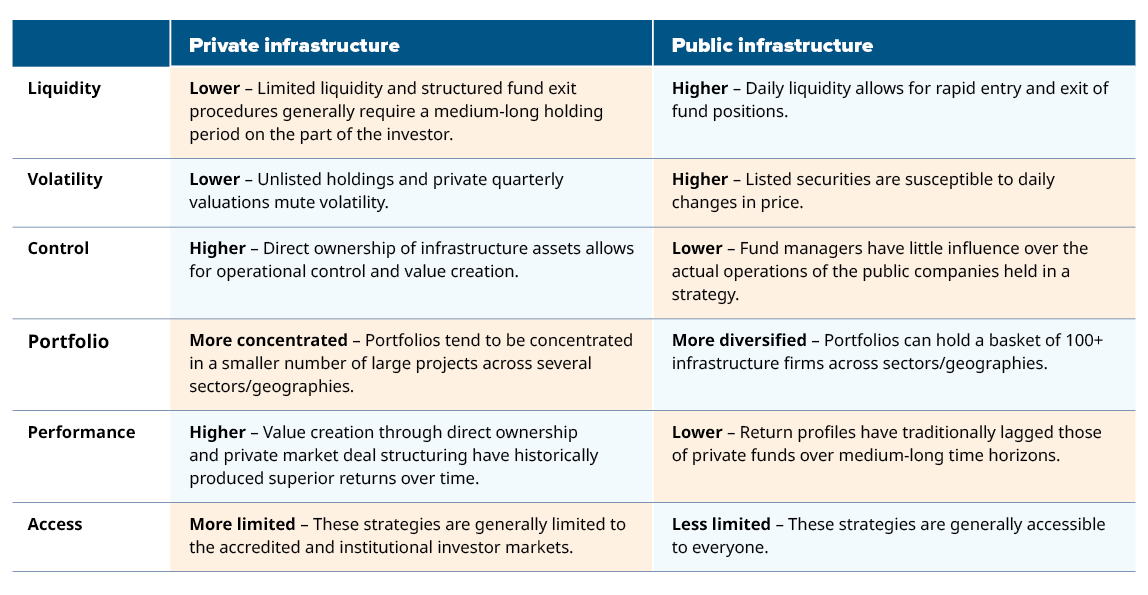

The table below highlights some key differences between the two:

Private infrastructure funds often require investors to lock in their capital for multiple years. Even after this lock-in period, withdrawals from the fund may be limited to predetermined intervals. These assets also often require large minimum investments.

This limited liquidity and high investment levels typically restrict private infrastructure access to accredited and institutional investors.

Qualifying investors who can handle a lack of liquidity in a portion of their portfolios can benefit from private infrastructure as part of a long-term strategy. They can expect to experience superior growth and income from their portfolios over time.

Public infrastructure funds, while historically less productive and more volatile than the private variety, nonetheless perform well compared to global public equity markets, both in terms of lower risk and higher dividend yields.

These funds have much greater liquidity, which allows investors to adjust their public infrastructure allocation, according to market conditions. Owning public infrastructure funds can provide investors with protection against inflation and volatility, as well as simply delivering attractive returns over time.

How Mackenzie can help you tap into infrastructure’s advantages

Portfolios with traditional stocks and bonds had a tough start to 2022 due to high inflation and increased volatility. There are two Mackenzie funds that can allow investors to enjoy the benefits of infrastructure assets at a time when other traditional assets are struggling. Investors may be well served in the short and long term with the introduction of a dedicated infrastructure sleeve. Learn more about Mackenzie’s infrastructure solutions:

Mackenzie Northleaf Private Infrastructure Fund (for accredited investors only)

Mackenzie Global Infrastructure Index ETF (QINF)

Find out more about how these infrastructure funds could complement your portfolios. Advisors, please contact your Mackenzie sales team; investors, please talk to your advisor.

Sources

1 Mackenzie Investments: The unique properties of private infrastructure.

2 Sources: Bloomberg, Preqin Ltd. Fifteen-year annualized returns and volatility as of 2020-12-31. Volatility measured as the annualized standard deviation of quarterly returns. Public infrastructure, private infrastructure, and global equities represented by the same indices as in Figure 2. Fixed income represented by the Bloomberg Global-Aggregate Total Return Index.

Commissions, management fees, brokerage fees and expenses all may be associated with Exchange Traded Funds. Please read the prospectus before investing. Exchange Traded Funds are not guaranteed, their values change frequently and past performance may not be repeated. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions, and do not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Exchange Traded Funds are not guaranteed, their values change frequently, and past performance may not be repeated. The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of August 3, 2022. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

The Mackenzie Northleaf Private Infrastructure Fund is offered to accredited investors (as defined in National Instrument 45-106- Prospectus Exemptions) by way of Offering Memorandum.

An investor should carefully consider whether their financial condition and investment goals are aligned with an investment in the Mackenzie Northleaf Private Infrastructure Fund. The Mackenzie Northleaf Private Infrastructure Fund will allocate the assets comprising its portfolio across various strategies, including, without limitation: (i) private infrastructure strategies implemented primarily through exposure to a diversified portfolio of private infrastructure assets and investments globally and (ii) public markets strategies implemented primarily through exposure to a portfolio of public infrastructure securities, fixed income securities and money market instruments. Due to the illiquid nature of private assets, the Fund is subject to a “ramp-up” period that is expected to last many months meaning its actual asset allocations will likely be different than its target asset allocations.