With inflation at 40-year highs, and many asset classes suffering losses, investors endured a challenging first half to 2022. Despite these turbulent markets, however, we believe there’s considerable value in investing in global equities through a consistent, high dividend strategy.

Global dividends provide a buffer against volatility

Dividends and dividend growth have accounted for an overwhelming majority of stock returns over time, both in the US and globally. With almost half of global (developed market) dividends coming from outside North America, investors should consider dividend strategies as a truly global opportunity.

A dividend strategy involves investing in companies that typically pay out sustainable, consistent, high dividend income. The theory is that these companies usually have high quality management and are able to succeed in a variety of market conditions.

Time and time again, we’ve seen global dividend equities provide a buffer against market volatility. The table below illustrates how global dividend companies have mostly outperformed the MSCI World Index during periods of market turmoil:

|

|

MSCI World High Dividend Yield Index |

MSCI World Index |

Excess return |

|

||||

Fear of inflation and rising rates |

Jan-June 2022 |

-6.64% |

-18.98% |

12.34% |

|||||

Fear of COVID-19 |

Feb-Mar 2020 |

-30.90% |

-33.10% |

2.10% |

|||||

Fear of recession due to Fed decisions |

Sept-Dec 2018 |

-9.90% |

-16.20% |

6.30% |

|||||

Fear of interest rate normalization |

Jan-Feb 2018 |

-8.10% |

-8.50% |

0.40% |

|||||

Oil price drop |

July 2015-Feb 2016 |

-10.10% |

-16.90% |

6.80% |

|||||

Lehman default/2008 recession |

Oct 2007-Mar 2009 |

-55.70% |

-54.00% |

-1.80% |

|||||

Dot-com bubble |

Mar-Oct 2002 |

-28.40% |

-32.60% |

4.20% |

|||||

The advantages of a global dividend strategy

Companies that consistently deliver significant dividends can be overlooked by investors who are often more concerned with investing in faster-growing companies. However, there are several key advantages to global dividend companies, which make a strong argument for their inclusion in many investors’ portfolios. These include:

Reliable income: companies that consistently maintain or grow their dividends provide investors with an income they can rely on and returns that has historically been higher than bond yields.

Protection during market downturns: as seen in the chart above, dividend-paying companies often outperform when markets fall. These companies are also usually more resilient and able to successfully survive recessions.

More consistent returns on investment: while stock prices can of course fall, with a global dividend strategy, investors are more likely to get a consistent return on their investment (since 1926, dividends have accounted for 32% of the total returns of the S&P 500)1.

Protection during high inflation: high dividend-paying companies have often delivered returns above inflation.

Returns beyond dividends: these are well-managed companies that can, see their share prices rise considerably, as well as provide dividend income.

How to apply a global dividend strategy to your portfolio

The Mackenzie Global Sustainable Index ETF (MDVD) holds dividend-paying companies from a range of countries (including within North America, Europe and Asia) and across a variety of sectors, with the top three currently being health care, consumer staples and financials.

It’s constructed using a rigorous, rules-based screening process to include securities that have consistently paid, grown and shown an ability to sustain dividends. The fund’s sustainable dividend strategy can offer investors enhanced portfolio yields, downside risk mitigation and global diversification, for a competitive management fee of 0.25%.

MDVD’s current dividend yield is 4.08%, and its quarterly distributions offer steady income that complements opportunities for capital gains.

As a Canadian-listed ETF that invests directly in the underlying global securities, MDVD can provide tax advantages on its distributions, compared to US-listed ETFs or Canadian ETFs wrapping US-listed ETFs.

To find out more about how to incorporate global dividend strategies into your portfolio, advisors, please talk to your Mackenzie sales team. Investors, please talk to your financial advisor.

1 Source: S&P Dow Jones Indices as of September 23, 2021

![]()

Commissions, management fees, brokerage fees and expenses all may be associated with Exchange Traded Funds. Please read the prospectus before investing. Exchange Traded Funds are not guaranteed, their values change frequently and past performance may not be repeated. The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

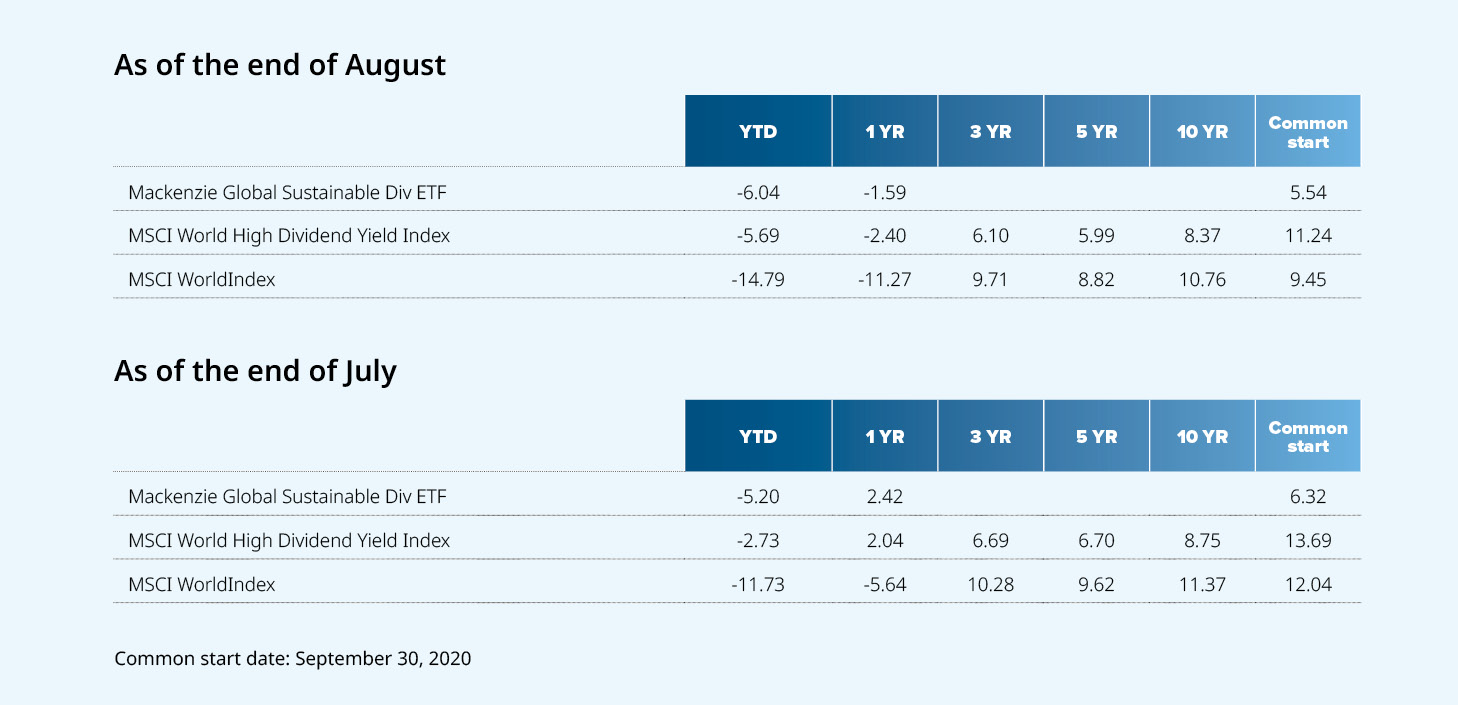

The indicated rates of return are the historical annual compounded total returns as of August 31, 2022, including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Exchange Traded Fund are not guaranteed, their values change frequently and past performance may not be repeated.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of August 31, 2022. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.