Environmental

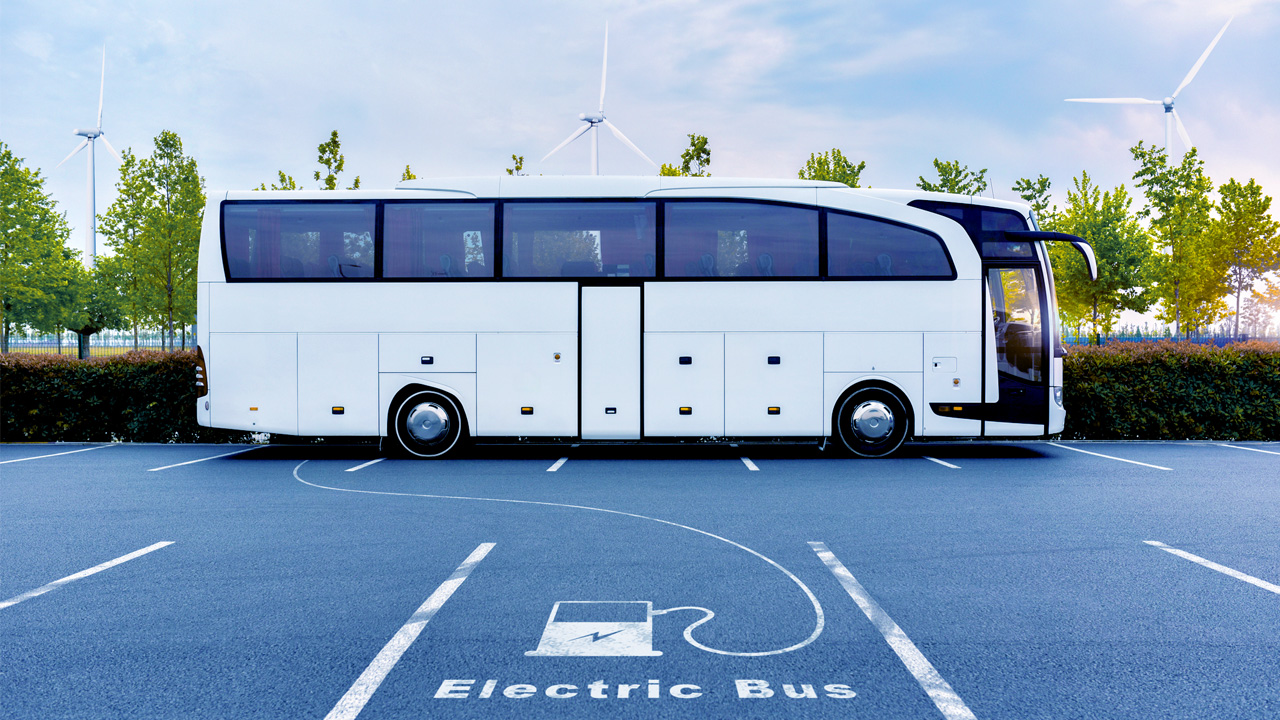

- Climate change and carbon emissions

- Energy efficiency

- Pollution/air quality

- Clean energy and technologies

- Use of natural resources

Sustainable investing refers to investment approaches that consider the risk and opportunity impacts of ESG (environmental, social, governance) factors on investment returns, or seek to bring about positive societal change through one or more ESG factors.

While ESG factors are non-financial, they can have material short-or long-term financial impacts on a company’s performance.

Below are some examples of ESG factors:

The first sustainable investing mutual fund was launched by Pax World Management in the US over 50 years ago. Growth of sustainable investments was fairly slow for the first few decades, but it started to take off in 2016, soon after the signing of the Paris Climate Agreement. According to Opimas, all investment funds targeting ESG performance grew from around $29.3 trillion asset under management (AUM) in 2016 to $51.2 trillion in 2020. Below is a history of key events that led to the development of sustainable investing.

Explore more: Each blue dot represents a milestone in sustainable investing.

1971

1989

1990

1992

1997

1999

2006

2008

2015

2016

2017

2020

Pax launches the first responsible mutual fund

Exxon Valdez oil spill and launch of Ceres Investor Network

Launch of Domini 400 Social Index promoting high ESG standards

United Nations Framework Convention on Climate Change (UNFCCC)

Kyoto Protocol extends the UNFCCC to reduce greenhouse gas emissions

Launch of Dow Jones Sustainability Indices

Launch of Principles of Responsible Investment (PRI)

World Bank issues first labelled green bond

Sustainable Development Goals set up by the United Nations

The Paris Agreement to limit warming to 1.5C by 2050

Launch of Climate Action 100+, the largest ever corporate engagement

3000 PRI signatories

1971

1989

1990

1992

1997

1999

2006

2008

2015

2016

2017

2020

Pax launches the first responsible mutual fund

Exxon Valdez oil spill and launch of Ceres Investor Network

Launch of Domini 400 Social Index promoting high ESG standards

United Nations Framework Convention on Climate Change (UNFCCC)

Kyoto Protocol extends the UNFCCC to reduce greenhouse gas emissions

Launch of Dow Jones Sustainability Indices

Launch of Principles of Responsible Investment (PRI)

World Bank issues first labelled green bond

Sustainable Development Goals set up by the United Nations

The Paris Agreement to limit warming to 1.5C by 2050

Launch of Climate Action 100+, the largest ever corporate engagement

3000 PRI signatories

There are different investing styles under the sustainable investing umbrella. At the more moderate end of the spectrum is the use of ESG factors to assess risk and enhance risk-adjusted returns by avoiding companies that have low ESG scores. At the other end is Impact investing, whose principal goal is to bring about some form of positive societal impact while also delivering attractive returns.

It’s important to note that these investing styles are not necessarily mutually exclusive. Goals and methodologies can overlap.

Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

The content of this page (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.