Why partner with us

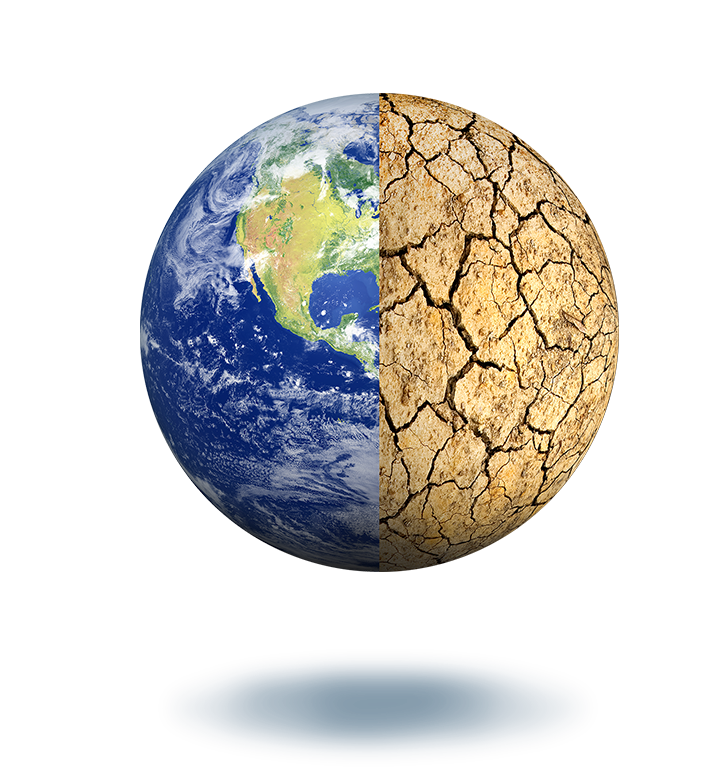

Our commitment to sustainability is reflected in the high standards we hold ourselves to, as well as advancing sustainable practices among the companies we invest in.

Be part of the change.

Our mission is to create a more invested world together, where all stakeholders can be better off. See how we’re driving change toward a sustainable future in our 2023 Sustainable Investing Report.

Investing in the energy transition is complex and requires a myriad of solutions. As pioneers in sustainable investing, we’re positioned to help navigate this transformational investment opportunity.

Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

The content of this page (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.