Sustainable Investing Report

Responsibility creates value and opportunity

Our Sustainable Investing Report details our approach to sustainability and our progress in integrating environmental, social and governance risks and opportunities into our investment and corporate practices.

Sustainability is enabled by our culture

At Mackenzie, we’re invested in creating a world where all stakeholders can be better off and contribute to a positive impact on people and the planet.

Our corporate sustainability efforts

Embedding sustainability

For Mackenzie, sustainable investing means considering the full value chain of the companies we invest in. Through our diverse investment teams, we are proud to offer our clients a range of investment choices covering a variety of sustainable investing solutions.

Delivering on our sustainable investing goals

Updates from the Sustainability Centre of Excellence

In 2023, Mackenzie partnered with Bloomberg to use its cloud-based Data License Plus (DL+) ESG Manager to host the acquisition, management and publishing of multi-vendor ESG data. This helps us integrate ESG data from multiple vendors into our investments.

Overview of our stewardship priorities

As long-term stewards of capital, we strive to operate responsibly and encourage the companies we invest in to do the same. We believe that stewardship and good governance require both a firm-wide and a portfolio-level focus to be most effective.

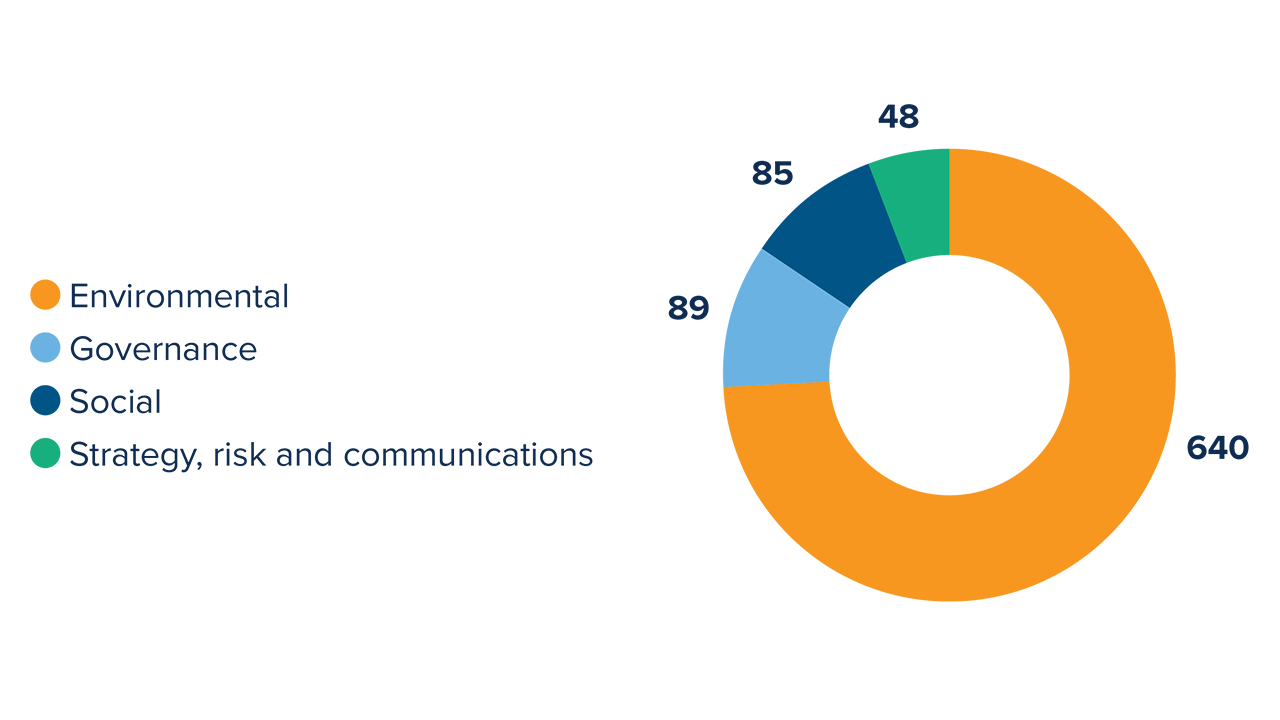

Mackenzie engagements

Firm-wide proxy voting

Proxy voting is an essential part of active ownership consistent with our fiduciary duty and approach to good governance.

We vote with a view to the best interests of investors, taking into consideration material ESG risks.

Our proxy voting record for mutual funds and ETFs is available here.

2023 Proxy voting across Mackenzie

Total meetings voted |

Total proxy ballots voted |

Votes with management |

Votes against management |

% of votes with management |

% of votes against management |

7,269 |

500,255 |

412,230 |

80,037 |

82% |

16% |

Climate action – we are invested in the energy transition

We believe that physical and transitional climate-related risks have the potential to negatively affect the value we can deliver to our clients, with a broader impact on other stakeholders. At the same time, the climate crisis presents opportunities for companies or issuers to actively evolve their businesses and create innovative solutions.

Our strategy

2023 Highlights

Progress on interim target: Through our direct and collaborative efforts, we have seen an increase of our initial committed assets from 30% (baseline 2021) committed to Science Based Targets initiative, to 40% as of the end of 2023.

Engagements: As a founding member of Climate Engagement Canada, and as part of our stewardship responsibilities, we continued our engagements with the 100 companies contributing to the majority of our financed emissions across our equity portfolios. In 2023, we engaged with 48 companies on their short-term and mid-term climate action plans.

The Mackenzie Greenchip Global Environmental All Cap Fund, managed by the Mackenzie Greenchip team, which focuses exclusively on environmental sectors, exceeded $2.8 billion in AUM in 2023 to become Canada’s largest environmental thematic fund.

Delivering on our Sustainable Investing Policy

At Mackenzie, our goal is to simplify sustainable investing for our clients. We are transparent about our efforts with the companies we invest in while offering solutions focused on the causes that interest our clients. As active investors, we prioritize constructive engagement over divestment in an effort to maximize our impact.

To enable comparisons between our portfolios, we adjust our portfolio metrics to approximate 100% ratings coverage for all dataset utilized within our ESG Analysis for equity and corporate fixed income instruments. Due to the nature of ESG Data coverage, non-eligible securities, such as Cash & Equivalents, ETFs, Government Securities, Commodities, Derivatives, Short Positions, and Mutual Funds have been excluded from the analysis, as they are not applicable and/or available. The ESG-Labelled Debt indicator is applicable for fixed income instruments only – including corporate and sovereign securities. As per our methodology, we have only reported ESG metrics for funds with above 70% portfolio weight coverage taking into account only the eligible securities. This threshold is not applicable for our ESG-Labelled Debt or Science-Based Targets metrics.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of December 31, 2023. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

The content of this Sustainability Report (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

MSCI ESG Research LLC’s (“MSCI ESG”) Fund Metrics products (the “Information”) provide environmental, social and governance data with respect to underlying securities within more than 23,000 multi-asset class Mutual Funds and ETFs globally. MSCI ESG is a Registered Investment Adviser under the Investment Advisers Act of 1940. MSCI ESG materials have not been submitted to, nor received approval from, the US SEC or any other regulatory body. None of the Information constitutes an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. None of the Information can be used to determine which securities to buy or sell or when to buy or sell them. The Information is provided “as is” and the user of the Information assumes the entire risk of any use it may make or permit to be made of the Information.

Each Fund’s ESG characteristics and performance may differ from time to time. Each Fund’s ESG scores do not evaluate the ESG-related investment objectives of, or any ESG strategies used by the Fund and is not indicative of how well ESG factors are integrated by the Fund. Other providers may also prepare fund-level ESG scores using their own methodologies, which may differ from the methodologies of the data providers shown in this report. Please refer to the simplified prospectus for each Fund for further information about each Fund’s investment objectives and strategies.

The information relating to assets under management (AUM) contained herein have not yet been subject to audit review.

Copyright ©2024 Sustainalytics. All rights reserved.

The information, data, analyses and opinions contained herein: (1) includes the proprietary information of Sustainalytics and/or its content providers; (2) may not be copied or redistributed except as specifically authorized; (3) do not constitute investment advice nor an endorsement of any product, project, investment strategy or consideration of any particular environmental, social or governance related issues as part of any investment strategy; (4) are provided solely for informational purposes; and (5) are not warranted to be complete, accurate or timely. Neither Sustainalytics nor its content providers are responsible for any trading decisions, damages or other losses related to it or its use. The use of the data is subject to conditions available at https://www.sustainalytics.com/legal-disclaimers