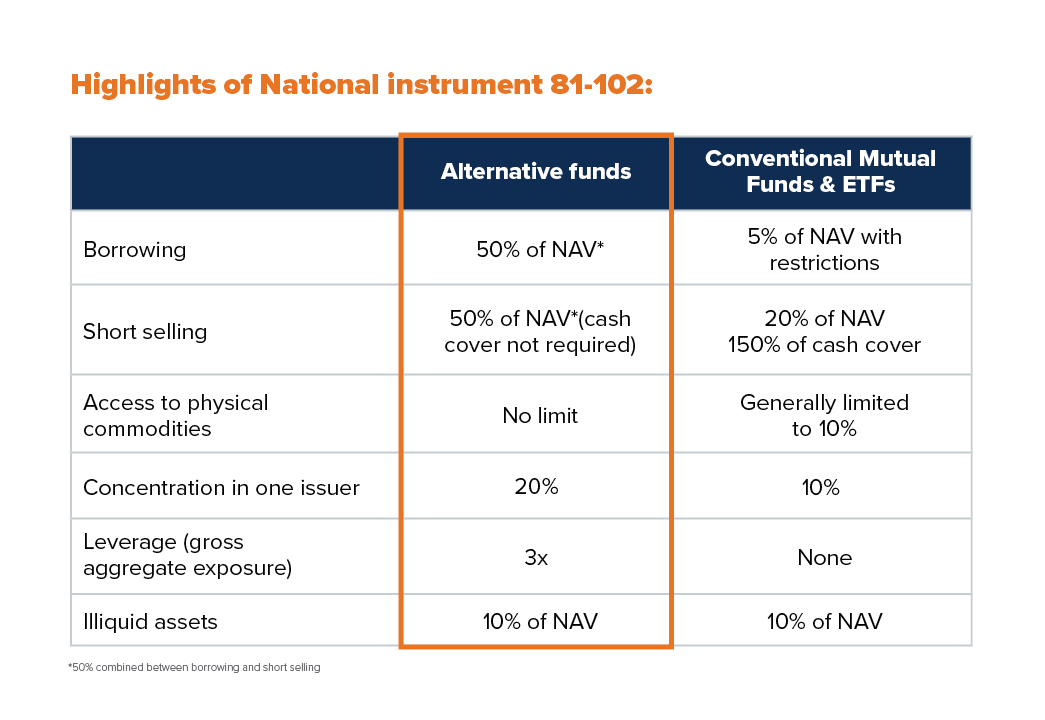

National Instrument 81-102:

Liquid alternative mutual funds, under the recent regulatory changes, are subject to similar ongoing disclosure requirements as conventional mutual funds and other prospectus-qualified investment funds. These regulations impose high standards of transparency and independent oversight in terms of the investment strategy, holdings and reporting for alternative mutual funds, which is beneficial for all retail investors.

Directional vs. non-directional

Directional vs. non-directional is the extent to which an investment tactic or strategy is connected to one of the broader asset class markets (for example, large cap equities or government bonds). A directional strategy would seek outperformance from the increase (decrease) in markets, by timing or levering (shorting) the market return to generate above market returns.

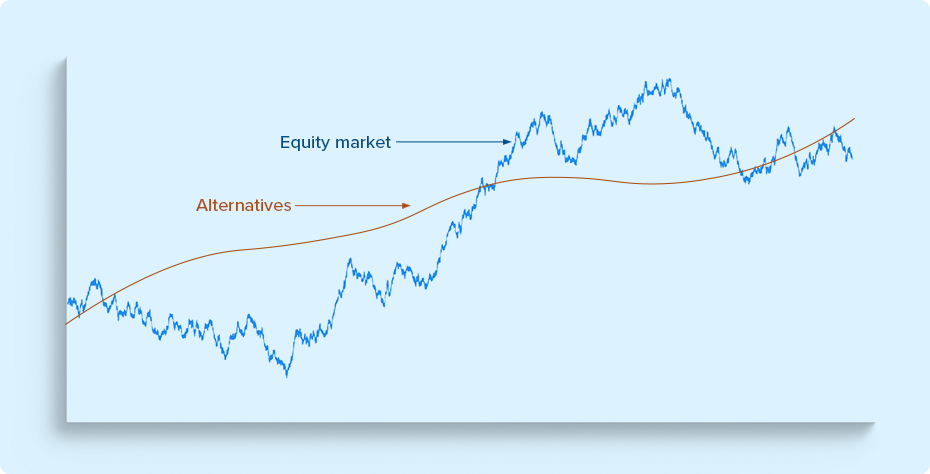

The value comes in the market movement, and the strategy would harness and/or amplify that for performance. Non-directional strategies look for value in places unconnected to general market movements, like pricing or other market anomalies. In the same manner, non-directional strategies use leverage and shorting to expose and/or amplify the desired exposure. The following is a simplified illustration of a non-directional investment.

A focus on absolute return

Many liquid alternative funds target a positive “absolute return” that doesn’t depend on a general upward direction in stock and/or bond markets as outlined below.

In many cases, absolute return funds aim to deliver a target return while delivering low volatility compared to a traditional balanced portfolio. The goal is also to maintain low correlations or low beta to global stock and fixed income markets. Having access to multiple alternative strategies gives managers the ability to stay on top of changing market conditions, including changes in correlations. Multi-strategy funds typically have the benefit of being able to dynamically adjust weightings depending on the market environment.