Written by: Mackenzie Resource Team

Tackling climate change will require a major mobilization of capital, innovation and resources

Addressing climate change is a major focus for the world – not only for this generation, but generations to come. To avoid the most negative impacts of climate change, all major economies have committed to reduce greenhouse gas emissions by 50% by 2035. While the consensus for this ambitious target is strong, what this endeavour actually requires is not as widely understood. Here, we explore the magnitude of the changes needed to meet emission goals.

We present an honest plan for a green future, which will necessitate a significant mobilization of capital and innovation – and large amounts of critical resources, such as copper, lithium, nickel and natural gas, to build renewable power grids, electric vehicles (EVs) and other solutions. This mobilization of capital and resources will create many opportunities for investors, but also requires responsible, active management of environmental and social risks related to resource extraction.

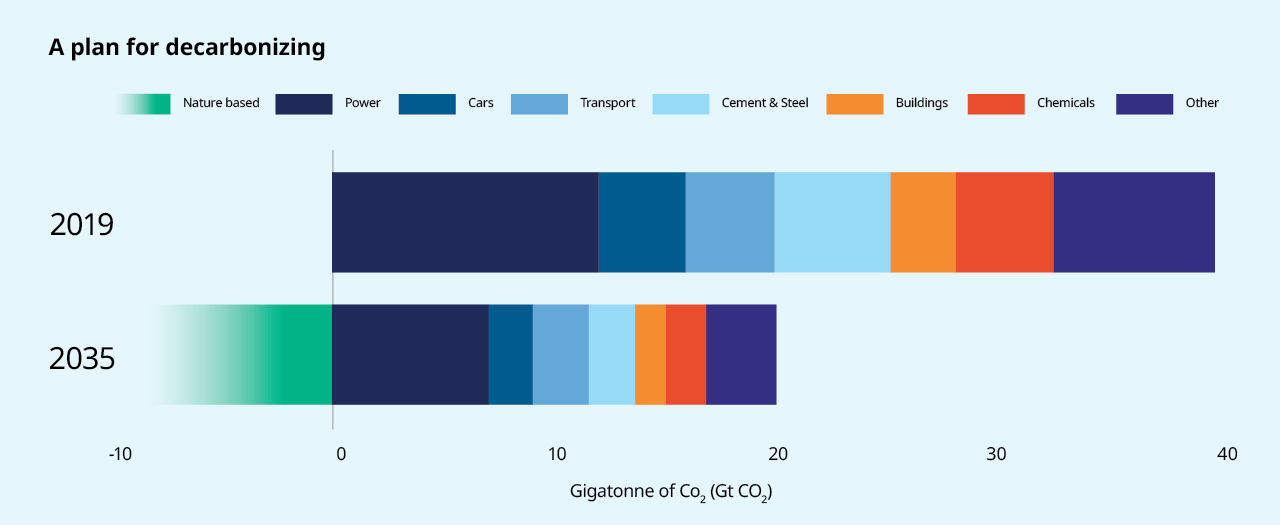

The world needs to cut approximately 20 Giga-tonnes (Gt) of annual emissions by 2035, down from 40Gt today. Societies also need to make room for continued global economic growth. The biggest cut (5Gt) comes from phasing out coal and expanding the electrical grid with renewable energy sources. The second-biggest cut (2Gt) comes from phasing in electrical cars. Largely untapped nature-based solutions, such as reforestation, could also be a large opportunity for improvement, with annual abatements of up to 15Gt. Resources are thus both part of the problem, and essential to the solution for the planet – but are typically under-represented in investment.

Solution 1: Greening the grid

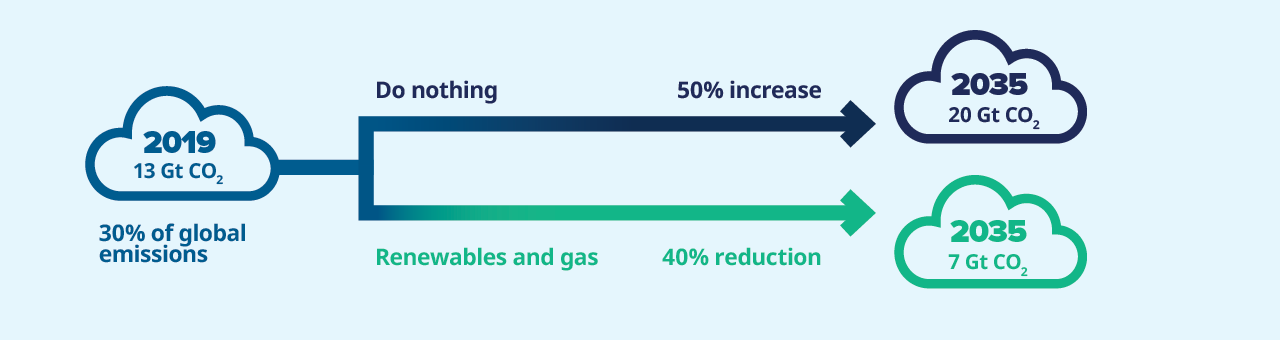

Electrifying the world’s power grid with renewables will likely be the most significant decarbonizing force to help meet the 2035 goals. Currently, power generation accounts for 30% of global emissions, with coal contributing two-thirds of that. After accounting for increased demand from population and economic growth, we believe a 40% cut in emissions is possible.

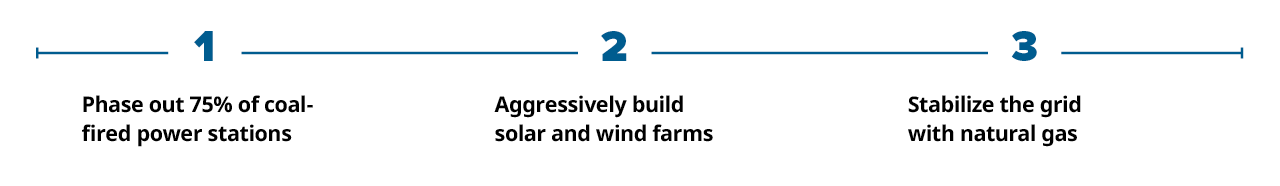

How can this cut be achieved?

What is needed?

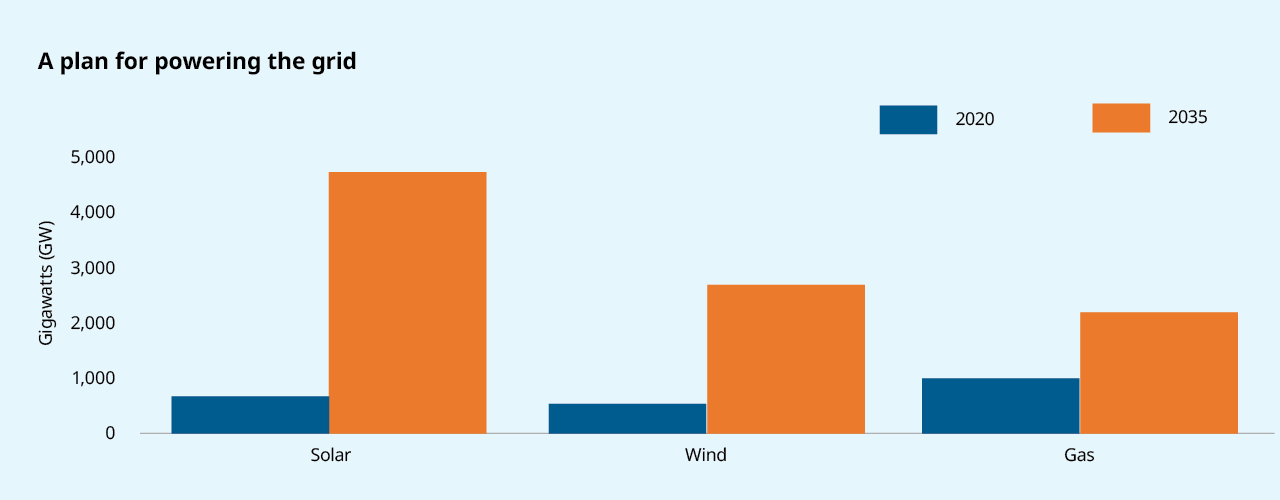

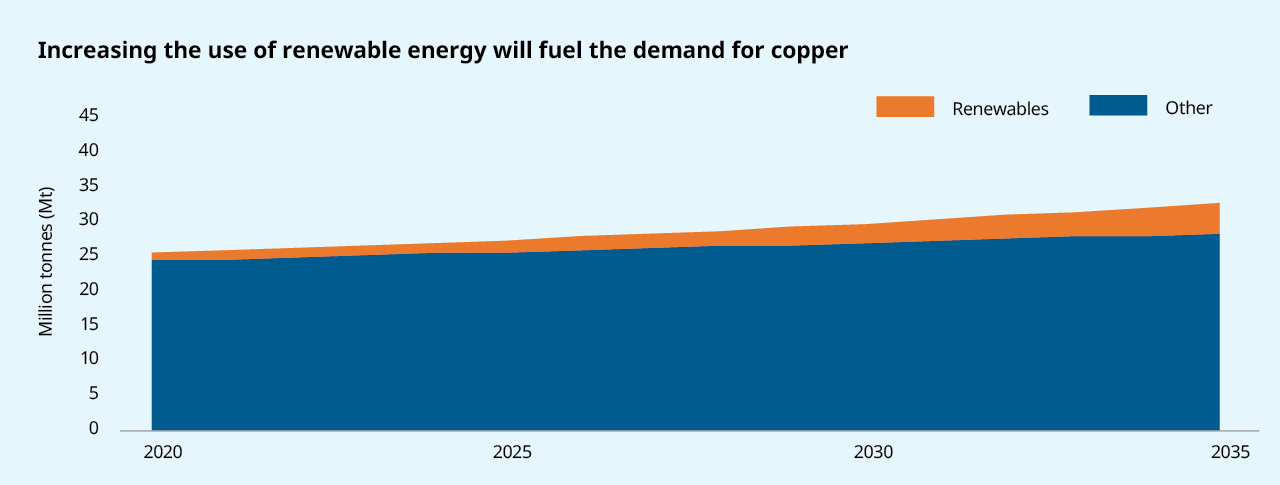

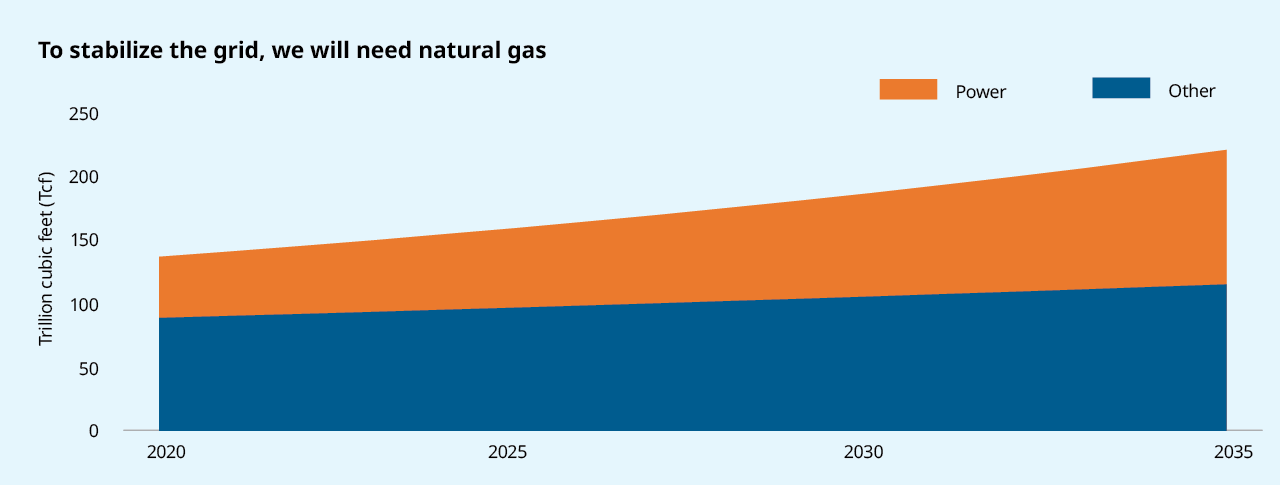

Steel, aluminum, carbon fibre, silicon, silver, etc. will be needed, and especially more copper and natural gas. Demand growth rates for copper could double, while natural gas demand could increase by 50%.

Solar and wind are excellent solutions for reducing green-house gas emissions, but consumers are vulnerable to power shortages when the wind doesn’t blow and when the sun doesn’t shine. At some point in the future, we believe that battery systems will be scalable enough to fill the gap. For now, an honest plan for a green future will require natural gas to stabilize the power grid.

Solution 2: Driving change

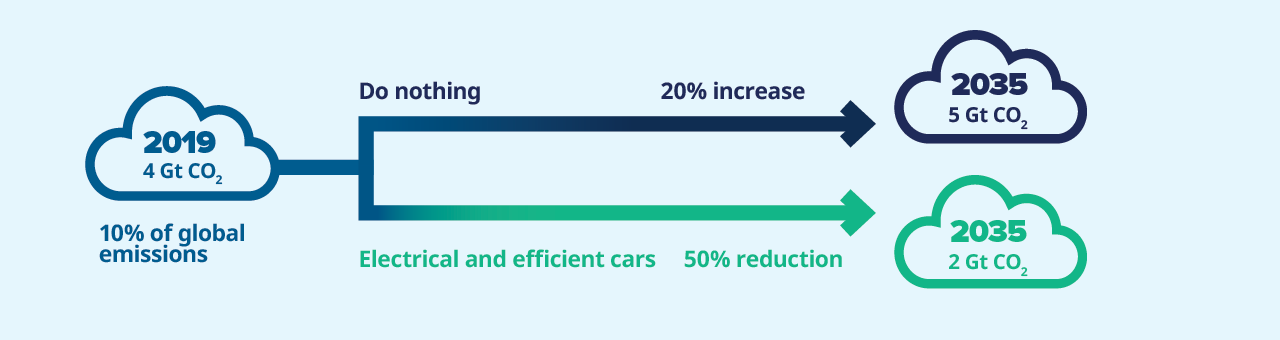

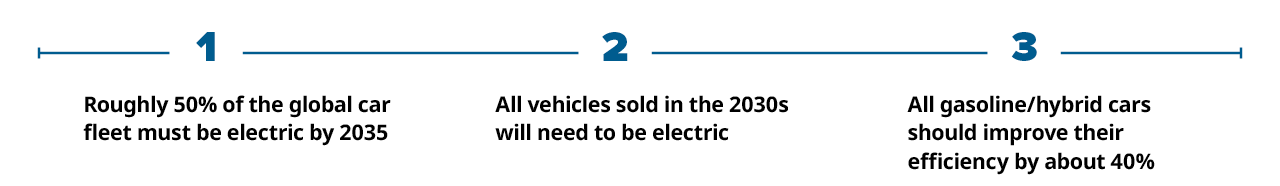

Today, passenger vehicles account for 10% of global emissions. As consumers move increasingly to EVs over the coming years, we anticipate a 50% emission reduction by 2035.

How can this cut be achieved?

What is needed?

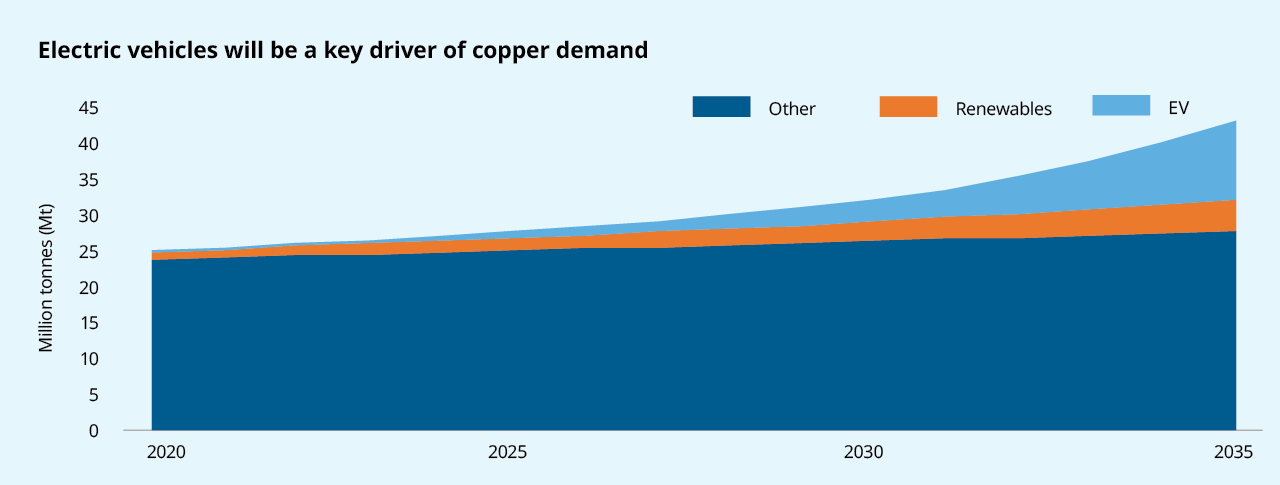

The growth rate for copper demand could triple as this metal is an important component of EVs. Other metals, such as nickel, cobalt, aluminum, and lithium, will also be in high demand.

Demand for resources

Decarbonizing the global economy will rely heavily on resources to be successful. Yet, most resource businesses are priced at such low valuations that shareholders and executives cannot justify making commitments to new projects. The underinvestment in new supply has been underway for a decade and has led to today’s shortages – even before the ramp-up from decarbonization demand. The scale of society’s environmental ambitions is so massive that a repricing of essential commodities will be required to induce more production. The enormity of the task suggests that this demand cycle will likely be measured in decades, not years.

An honest plan for a green future needs many things, but above all else, it needs an honest acknowledgement of the scale and scope of transformation that is required. We recommend a broad portfolio of resource producers that will allow society to find the most efficient alternatives to lower emissions, rather than an emphasis on any singular commodity or solution.

Responsible investing requires active engagement with management to ensure that the companies we invest in are equally contributing towards society’s goals of reducing the environmental footprint. Thus, we focus on diversified resource investments that meet stringent financial, environmental, social and governance criteria, and that should see growing demand – and higher prices – for the essential commodities they produce. These are the commodities that will allow us to build the solutions today that we need for a greener tomorrow.

Sources: IEA, IPCC, Thunder Said Energy, Bernstein, Mackenzie Investments’ estimates.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of March 31, 2022. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.Sources: IEA, IPCC, Thunder Said Energy, Bernstein, Mackenzie Investments’ estimates.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of March 31, 2022. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.