As central banks appear to be approaching the end of their tightening cycle, it may be time to adopt a new approach to cash and cash equivalent allocations in client portfolios.

Where we’ve been

In the wake of the loose monetary policy that followed the global financial crisis and COVID pandemic, cash allocations were viewed as a drag on performance. The slogan “cash is trash” was widely adopted by advisors and investors alike.

But as the saying goes, one central banker’s trash is another’s treasure. The inflation concerns that followed the COVID era put an abrupt end to accommodative monetary policy. Overnight rates across many developed economies increased rapidly, boosting returns paid to savers. Over the past 18 months, Canada’s overnight rate rose at its fastest pace in 40 years.

Cash, once again, was king.

In this rising rate environment, bond yields rose along with underlying rates, while prices of bond funds and ETFs fell. This is a departure from the traditional source of portfolio insurance and diversification from equity risk.

Many investors were surprised to learn that money can be lost in the supposedly safe fixed income market. Suddenly, bonds were topical for all the wrong reasons. Interest rate risk and duration management became major talking points during investment reviews.

Against this backdrop, astute advisors strategically reallocated funds to guaranteed investment certificates (GICs) and high interest savings account exchange traded funds (HISA ETFs), shielding client accounts from volatile fixed income.

Where we are

A tight housing market and a highly rate-sensitive economy have driven concerns about a hard landing in Canada.

As consumers feel the grip of aggressive monetary tightening, and both inflation and growth slow, markets have begun to forecast a shift in the Bank of Canada’s tone. While its widely believed the Bank will maintain a “higher for longer” rate posturing in an effort to reach its inflation target, the market now broadly believes there will be no further increases. Some even believe we will see a slight reversal in policy at some point in 2024.

Looking on the bright side, as the pace of rate hikes has slowed over 2023, we have begun to see positive performance from Canadian short-term fixed income. With bond yields currently at levels not seen since the financial crisis, institutional asset allocators have begun to increase holdings in fixed income assets.

Currently there is a tremendous opportunity for those astute advisors who shifted client assets into cash earlier to reallocate to fixed income, taking advantage of the current higher for longer rate environment and the prospect of falling rates in the future.

Where we’re going

As the saying goes, “all good things must come to an end.”

In our view, for holders of GICs and HISA ETFs, the best days are likely in the past. Traditionally, in a stable rate environment a portfolio of short-term bonds will outperform cash and cash equivalents, including GICs and HISA ETFs, primarily due to term premia and credit spread capture. In a falling rate environment this outperformance can be quite material as bond prices rise when yields decline.

As 2023 concludes, there are also external factors negatively affecting the prospects of cash proxies:

- Due to recent regulatory changes by the Office of the Superintendent of Financial Institutions (OSFI), HISA ETF yields are expected to decline when the new rules come into effect in early 2024.

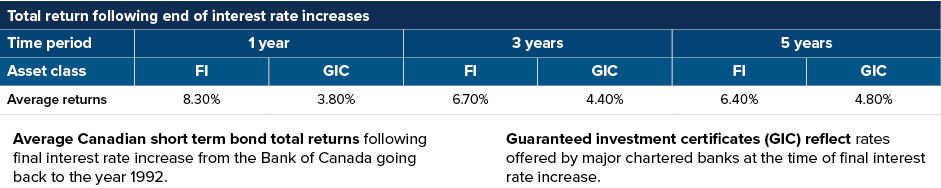

- GIC rates are significantly affected by the underlying yield of government bonds. If the market is correct and we have, in fact, seen the last rate hike from the Bank of Canada, GIC rates likely only have one direction to go: down. If we look back to past instances of a tightening cycle ending, on average, short-term fixed income outperforms GICs over every time horizon.

Source: Mackenzie Investments as of October 31, 2023

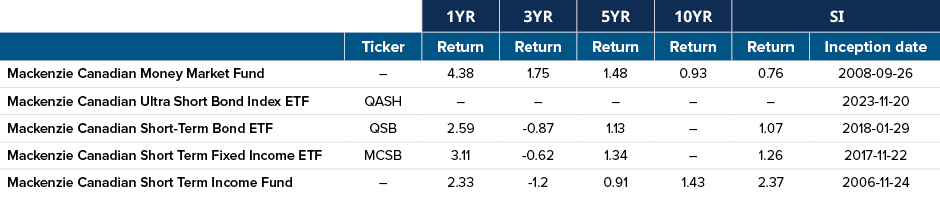

Source: Mackenzie Investments as of October 31, 2023

In addition to the prospect of higher returns, short term fixed income funds and ETFs provide benefits not available to holders of GICs or HISA ETFs.

Tax treatment

While bond coupon payments are subject to the same full taxation as interest payments from HISAs and GICs in non-registered accounts, any capital appreciation for bonds priced at a discount is treated as a capital gain and taxed at a more favourable rate. Currently the vast majority of short-term bonds in Canada are priced at a discount — an incredible opportunity to capitalize on capital gains.

Liquidity

GICs require investors to lock-in funds for a specified period, charging a significant interest penalty should funds be needed prior to maturity. Fixed income funds and ETFs are highly liquid, offering investors the option to access their funds at any time. This flexibility provides advisors the ability to reallocate capital based on market opportunities, not a maturity schedule.

True downside protection

Prior to the lower for longer interest regime, fixed income served as the traditional ballast in portfolios. The zero-interest rate policy radically changed this dynamic, eliminating the negative correlation between bonds and equities. As rates have risen, so too has the potential for bonds to provide stability for portfolios once again.

Investment solutions

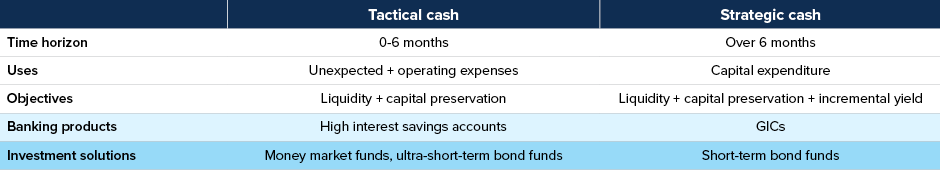

In general, how a client’s cash allocation is held depends on whether it is a strategic or tactical position. A short-term tactical position requires liquidity to ensure opportunities are not missed, whereas a strategic allocation will typically seek incremental yield, potentially sacrificing liquidity.

Whether an advisor is considering reallocation of tactical or strategic allocations, Mackenzie can provide options to best manage client cash. Money market funds and ultra-short-term bond funds can provide the liquidity and a healthy degree of capital preservation. A strategic allocation may be better served by an allocation to a short-term bond fund.

* Projected date as of November 20, 2023

Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns as of October 31, 2023 including changes in share/ unit value and reinvestment of all dividends or distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any securityholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of November 22, 2023 There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This should not be construed to be legal or tax advice, as each client’s situation is different. Please consult your own legal and tax advisor.

Unlike mutual funds, the returns and principal of GICs are guaranteed.