What is private equity?

Private equity (PE) is a well-established and rapidly growing asset class.

When compared to publicly traded equities, it offers the potential for higher returns. It’s also considered less volatile because private companies are not priced on the same second-by-second basis. It can provide a measure of stability and potentially higher growth within a portfolio’s overall equity allocation.

As the name suggests, it involves buying an ownership stake in companies that are not publicly traded. Private equity general partners (GPs) usually control these companies and hold them in a private equity fund with other companies.

As controlling shareholders, the GP applies their management expertise to improve business operations and make it more profitable. Returns are earned by selling the companies either into the public market or to another private owner.

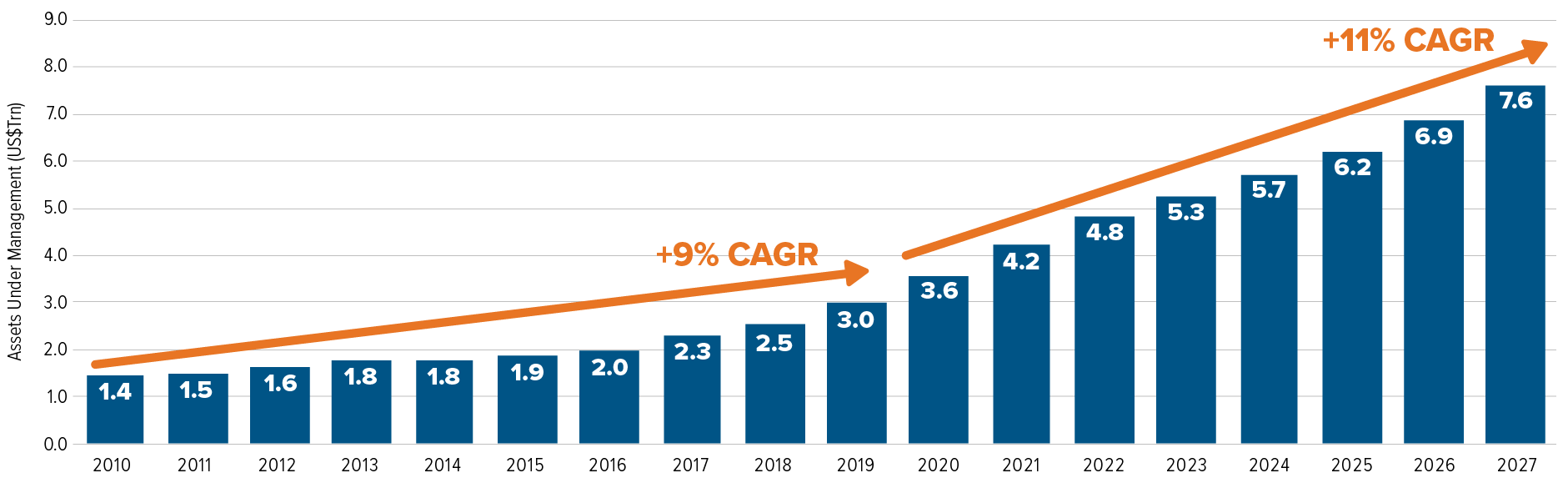

The growth of private equity

Private equity investing has been around since at least the 1960s. Over the past 10 years, growth has accelerated as private equity has gained widespread acceptance as a mainstream asset class. According to data from private markets data firm Preqin, private equity’s growth rate is poised to accelerate further in the years ahead, driven by a broadening investor base, improvements in access to the asset class and increased allocations among investors in response to strong returns and on-going volatility in public equity markets, among other factors.

Growth of private equity AUM (US$Trn)1

How to access private equity

Traditionally, private equity funds have been structured as closed-end funds and are generally limited to institutional investors, like pension funds.

More recently, private equity funds have been structured as open-ended funds, making PE more accessible to individual investors. These funds differ from closed-end funds, in that they:

- Accept new capital on an ongoing basis with limited or no capital call requirement.

- Have a seeded pool of private assets to which new investors gain immediate exposure.

- Can have a perpetual lifespan.

- Offer regular but limited liquidity to investors.

Open-ended PE funds generally seek to maintain a mix of investments at each stage of the traditional private equity fund life cycle, which allows for a measure of liquidity. They may also use some public market investments to provide additional liquidity.

Given the significant excess returns generated by top quartile managers, manager selection and diversification are particularly important in private equity. The most successful managers can add value across all stages of the private equity process.

Process and phases

Investment: Opportunities are identified and privately negotiated. To finance acquisitions, capital is gradually called into the fund from investors who made commitments during the fundraising period.

Value creation: The value of a private company is increased by organic growth, mergers and acquisitions, operational/profitability improvements, management team additions and, sometimes, restructuring. These initiatives focus on improving the business’ current and future profitability.

Harvesting: The transformed companies are sold, gains are realized, and cash is paid out to investors. The typical lifespan of individual private equity investments is between four and seven years.

PE strategies

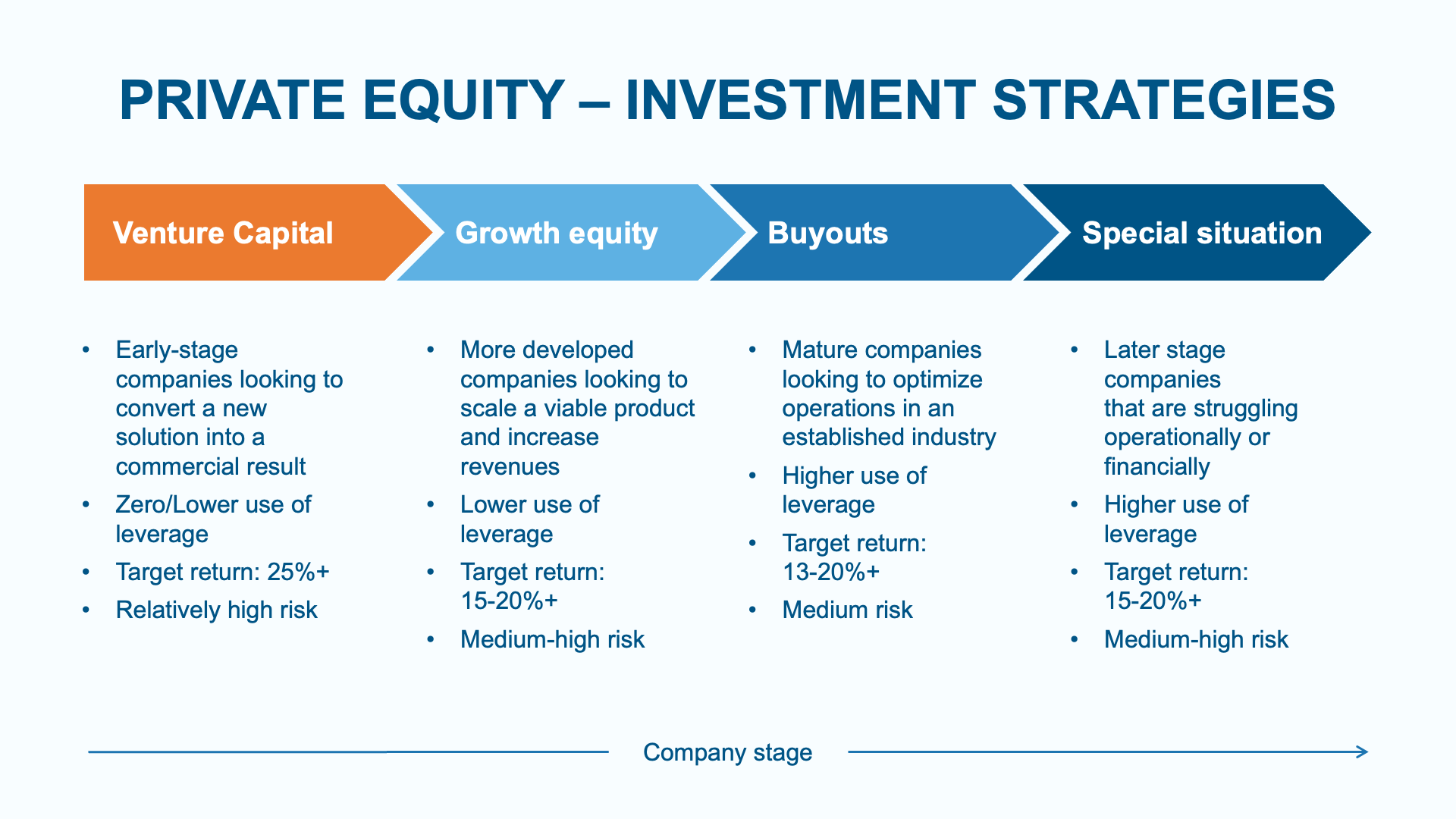

There are four broad categories of private equity, each with its own unique risk and return characteristics. Each tends to focus on companies at different stages of their life cycles.

For illustrative purposes only. Target return information is provided for general guidance and should not be relied upon when making investment decisions.

For illustrative purposes only. Target return information is provided for general guidance and should not be relied upon when making investment decisions.

The risks

Whether private or publicly traded, all equity investments involve risk. Economic factors, such as growth and inflation, can affect any business’ performance and valuations.

The private market valuation process generally helps insulate investments from the kind of volatility seen in public equities, but it does not eliminate the general risk that comes with the ownership of businesses in an uncertain economy.

Equity risk

If a private company in a portfolio underperforms, its valuation will likely decline, which will affect investor returns. This risk can be addressed within the fund through diversification across different sectors.

Liquidity risk

Private equity is suitable for investors who have a longer time horizon, as their ability to redeem their funds will be limited. This limited liquidity is generally compensated for by a higher expected return (illiquidity premium).

There are two reasons why limited, structured redemptions are in the best interest of investors:

- Private companies typically take time to mature, as the GP implements their strategies to improve operations and profitability.

- There is no active secondary market, so it can be difficult and/or expensive for a private equity manager to sell a position to raise cash to fund redemptions.

It’s essential to understand that investing in private equity requires the ability to commit capital that the investor does not require for several years. However, patient investors have the potential to reap strong returns generated through private equity.

The future of private equity

In the past, private markets have been out of reach for average investors, but there is reason to be optimistic about the future. The demand for private equity has never been higher and it’s now generally seen as an essential building block of a well-diversified portfolio.

Innovations in product design are making private equity more accessible and more liquid, with lower investment minimums. Private equity offers a range of strategies that can complement public market investments to produce better absolute and risk-adjusted returns.

As capital markets continue to evolve and investor demand for private market investments continues to grow, we believe that more retail investors will be able to benefit from the substantial value creation and attractive returns generated by private equity.

Learn more about the Mackenzie Northleaf Global Private Equity Fund >

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. This article may contain forward-looking information which reflect our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of November 2022. There should be no expectation that such information will in all circumstances be updated, supplemented or revised, whether as a result of new information, changing circumstances, future events or otherwise.