As of February 1, 2024, Darren McKiernan and the Global Equity & Income Team have established a 10-year track record on Mackenzie Global Dividend Fund. Since taking over management of the fund, the team has outperformed 92% of the Morningstar Global Equity category in Canada.* The fund has had a higher annualized 10-year return than the peer group, with better risk- adjusted performance over this period.

Source: Morningstar Direct as of June 30, 2024

In addition, the fund has delivered balanced performance across geographies, a testament to the team’s investment philosophy and process being applied across global markets.

*Source: Morningstar Direct and Mackenzie Analytics, June 30, 2024. Fund performance (gross of fees) is shown. Relative regional performance: U.S. regional performance compares returns of the Fund’s U.S. holdings to S&P500 benchmark; European regional performance compares returns of the Fund’s European holdings to MSCI Europe benchmark; Asia regional performance compares Fund’s holdings in Asia to MSCI AC Asia benchmark. Performance shown since Portfolio Manager change.

The team has achieved this attractive 10-year track record by adhering to their investment philosophy and approach:

- A consistent and disciplined approach focused on owning a well-diversified portfolio of high quality, dividend-paying companies that compound returns on invested capital.

- Developing and drawing from a proprietary list of companies – the “Dividend Dream Team” – that reside at or near the top of the value chain within their respective industries.

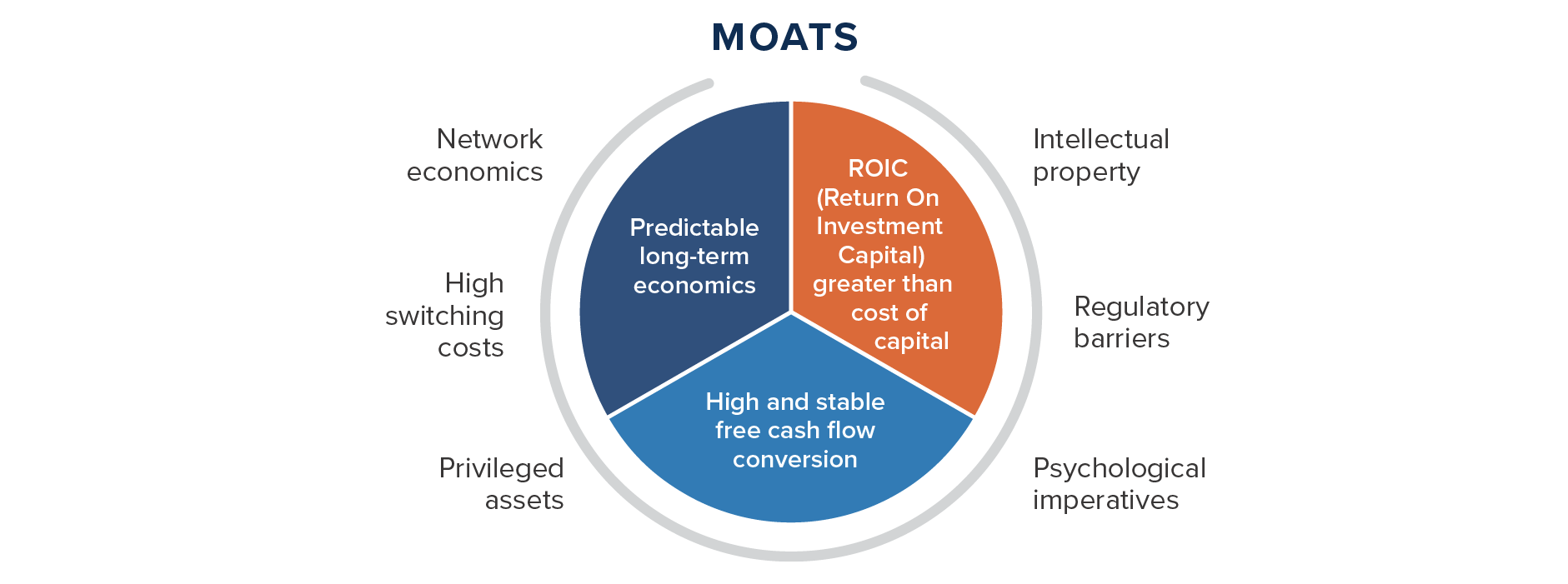

This investment approach helps guide the team in their search for the best dividend-paying companies around the world. They look to identify attractive companies that enjoy some form of competitive advantage and barriers to entry. The team refers to these advantages as “moats” – factors that allow companies to achieve sustainable profitability over time. Some examples of this are intellectual property, such as a drug patent, or network economics, such as a securities exchange.

The Mackenzie Global Dividend Fund is not beholden to a specific yield target which means the team can apply a flexible approach to dividend investing, allocating capital between higher yielding dividend-payers or dividend-growers based on valuations. This flexibility allows them to navigate the fund through different market environments. We believe these factors have contributed to the returns the fund has achieved.

Source: Morningstar Direct, returns over 1 year are annualized as of June 30, 2024.

Contact your Sales Representative to learn more about the Mackenzie Global Dividend Fund.

*Portfolio Manager fully implemented new strategy etfective February 1, 2014.

Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns as of June 30, 2024, including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution, or optional charges or income taxes payable by any securityholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index. Percentile rankings are from Morningstar Research Inc., an independent research firm, based on the Morningstar Global Equity category, and reflect the performance of the Mackenzie Global Dividend Fund for the 1-, 3-, 5- and 10-year periods as of June 30, 2024. The percentile rankings compare how a fund has performed relative to other funds in a particular category and are subject to change monthly. The number of Global Equity funds for the Mackenzie Global Dividend Fund for each period are as follows: one year – 1,901; three years – 1,598; five years – 1,434; 10 years – 700.