Why you should consider a private credit strategy

Fixed income high yields have been increasingly difficult to come by, without taking on increased risk. Many investors are turning to alternative ways to try and secure high-yield fixed income investments while still maintaining acceptable risk levels in their portfolios.

Private credit typically offers much higher yield than traditional fixed income.

Private credit funds — which involve non-bank lending to private companies — are fixed income alternatives that are designed to deliver superior yield, capital preservation and enhanced diversification potential.

Private credit has traditionally been difficult to access because of large minimum investment requirements and long lock-up periods. Minimum investments have historically been in the millions of dollars, while lock-up periods can be anywhere from three to 10 years. The Mackenzie Northleaf Private Credit Fund, however, delivers the potential benefits of private credit without these obstacles.

Why the Mackenzie Northleaf Private Credit Fund

Our fund delivers the potential benefits of private lending that were previously available only to institutional investors. This alternative fixed income investment combines attractive performance and yield potential with investor-friendly innovation and expert oversight.

Strong yield and return potential

Our fund focuses on the private loan market, which has historically offered attractive yield and total return, and will invest in an underlying private credit fund that is leveraged with the aim of boosting performance.

Exceptional levels of due diligence and lender safeguards are expected to deliver improved capital preservation potential compared to other high-yield fixed income investments (like high-yield bonds). By accessing private lending, our private credit fund opens up new investment options that can help improve your portfolio’s diversification.

Convenient structure

Our fund is a best-of-both-worlds solution that combines the benefits of private credit exposure with enhanced accessibility. The convenient structure provides eligible investors with access to private credit with a low minimum investment requirement and far greater liquidity than traditional private credit investments.

Access to private credit funds expertise

Northleaf Capital Partners is a global private markets investment firm, whose products are available to accredited individual investors through Mackenzie. Northleaf has the unique expertise and partnership relationships necessary to source and acquire attractive lending opportunities.

How it works

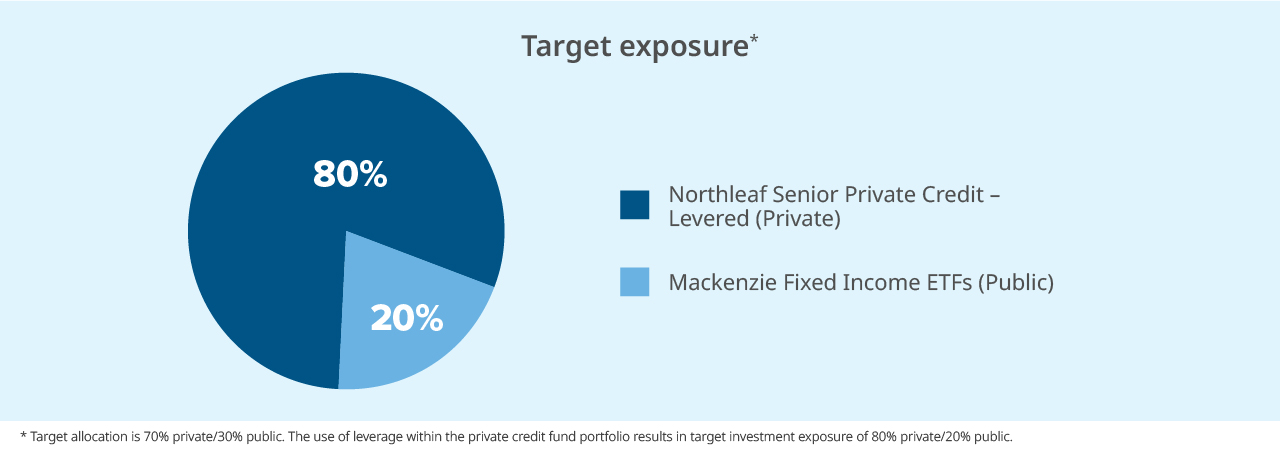

Managed by Mackenzie’s Fixed Income Team, in partnership with Northleaf Capital Partners, our private credit fund is primarily comprised of Northleaf’s Senior Private Credit - Levered fund and Mackenzie’s Fixed Income ETFs.

By adding publicly traded corporate bonds and loans into the mix (through our ETFs), our fund is able to deliver both liquidity and the superior yield potential of private credit.

Our fund will make variable quarterly distributions comprised of income generated from the underlying investments.

Find out more by reading our guide to investing in private credit.

And you can learn more about the fund on the Mackenzie Northleaf Private Credit Fund page.

For Use by Investment Advisors and Accredited Investors (as defined in NI 45-106) Only. Issued by Mackenzie Financial Corporation (“Mackenzie”). This document is provided to you on the understanding that, as an investment advisor or accredited investor you will understand and accept its inherent limitations, you will not rely on it in making or recommending any investment decision with respect to any securities that may be issued, and you will use it only for the purpose of discussing with Mackenzie your preliminary interest in investing in Mackenzie Northleaf Private Credit Fund (the “Fund”). The information contained herein is qualified in its entirety by reference to the Offering Memorandum of the Fund (the “OM”). The OM contains additional information about the investment objectives and terms and conditions of an investment in the Fund (including fees) and will also contain tax information and risk disclosures that are important to any investment decision regarding the Fund. Due to the illiquid nature of private assets, the Fund is subject to a “ramp-up” period that is expected to last many months meaning exposure to public assets will be higher (and exposure to private assets will be lower) than indicated by any Target Allocation or Target Exposure. The use of leverage within a fund increases both the opportunity for gain and the risk of loss. This document does not constitute legal, tax, investment or any other advice. Prospective investors should consult with their own professional advisors regarding the financial, legal and tax consequences of any investment. This document may contain “forward-looking” information that is not purely historical in nature, and such information may include, among other things, projections, forecasts or estimates of cash flows, yields or returns, volatility, scenario analyses and proposed or expected portfolio composition. The words “anticipates”, “assumes”, “believes”, “budgets”, “could”, “estimates”, “expects”, “forecasts”, “intends”, “may”, “might”, “plans”, “projects”, “schedule”, “should”, “will”, “would” and similar expressions are often intended to identify forward-looking information, although not all forward-looking information contains these identifying words. The forward-looking information contained herein is based upon certain assumptions about future events or conditions and is intended only to illustrate hypothetical results under those assumptions (not all of which will be specified herein). Not all relevant events or conditions may have been considered in developing such assumptions. The success or achievement of various results, targets and objectives is dependent upon a multitude of factors, many of which are beyond the control of the investment advisor. No representations are made as to the accuracy of such estimates or projections or that such projections will be realized. Actual events or conditions are unlikely to be consistent with, and may differ materially from, those assumed.