Self-assessment

If you know your financial goals, you’ll be in a stronger position to select the right advisor. Start by jotting down a few details about your near-term and longer-term goals, as well as your attitudes towards investing.

When you partner with a trusted advisor, you can spend less time thinking about your money and invest your energy into the things that matter most to you.

Studies have found that Canadians who rely on professional advice to guide their financial decisions report higher levels of satisfaction, trust their advisor and credit that relationship with helping them achieve better savings and investment habits. ¹

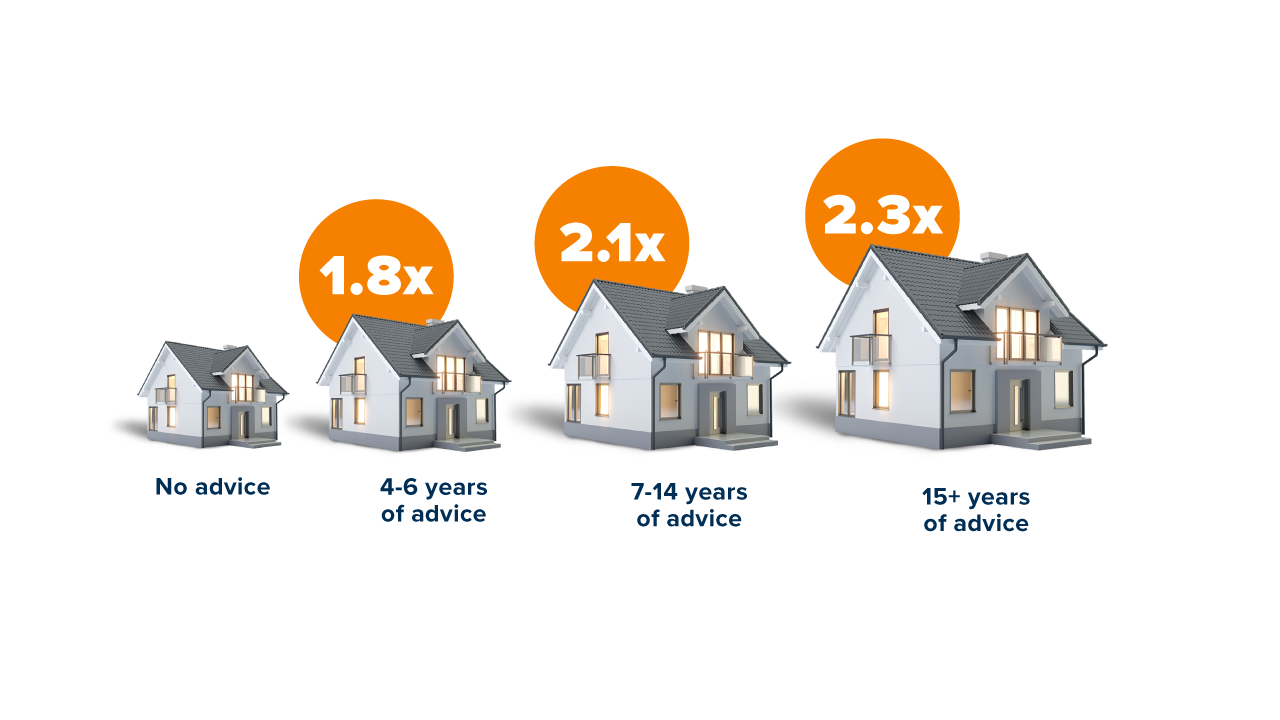

Further research has shown that households that partner with an advisor had more than double the wealth of non-advised households with similar incomes.2 The impact of financial advice tends to compound over time.

This is one investment you can make on your own. It’s a serious decision, but it doesn’t have to be difficult, if you break the task down into five easy steps.

It’s important to understand the roles and responsibilities of both you and your advisor. The best advice relies on having a full and accurate picture of your financial situation.

It’s also important to understand that sometimes the markets will behave erratically. Most advisors are more than happy to talk to you about volatility and help you stay to course toward your financial goals.

1 Canadian Mutual Fund Investors’ Perceptions of Mutual Funds and the Mutual Fund Industry, IFIC, 2016.

Source: More on the Value of Financial Advisors. CIRANO (2020).

2 Cirano Research Study, March 2020. In 2018, the average household with a financial advisor for 15 years or more had asset values 2.3 times higher than an average “comparable” household without a financial advisor. This number varied between 2.73 in 2010 and 2.9 in 2014.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

The content of this web page (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.