Portfolios constructed before the pandemic were based on very different assumptions than what we’re seeing today.

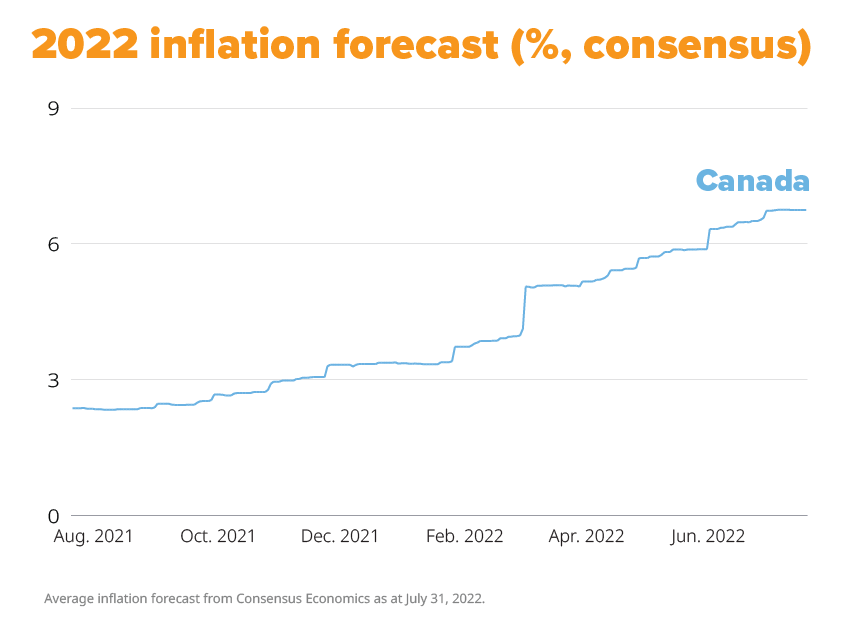

Investors currently face an environment not seen in several decades, defined by high inflation and rising interest rates designed to combat it. For many Canadians, their investment goals, risk profiles and time horizons may have also changed.

This economic recalibration had an immediate effect on equity markets, especially among the high-growth businesses that had led indices’ increases over the past decade.

Confronted by this new reality, many investors have embarked on a process of portfolio reconstruction.

Benefiting from value tilt

Over the past two decades, Canadian investors increasingly sought portfolio diversification by investing outside of Canada. This made considerable sense, as an over-reliance on Canadian stocks tends to result in a portfolio heavily overweighted in financials, energy and materials.

Domestic equities in general have underperformed higher growth markets over the past several years, as low interest rates have promoted high-growth investing, particularly in technology and health care, which are under-represented in Canada.

As investors shift from a growth bias to a value bias, Canadian equities may benefit, according to William Aldridge, portfolio manager of the Mackenzie Canadian Equity Fund.

“Canada has a great deal to offer investors,” he says. “It’s time to look at Canada again.”

Canadian equities tend to trade at lower valuations than those seen in the US, Aldridge points out. Recently, he has noticed a migration away from high-growth companies, with capital moving into more high-quality businesses.

After global markets retreated this past spring, investors may want to consider a larger weighting in Canada, due to its attractive position in inflationary environments.

Defense against inflation

Over the past few years, it’s been easy to overlook the potential benefits that Canadian equities can bring to investment portfolios. Chief among these are a measure of protection from inflationary pressures and the fact that many of the largest companies have a more defensive tilt.

“The Canadian market is unique, with high exposure to resources, such as energy, industrial minerals and precious metals, as well as a very high exposure to financials,” says Aldridge. “Put together, it can tend to be a more cyclical market, so investors need to consider the macro view when investing in Canada.”

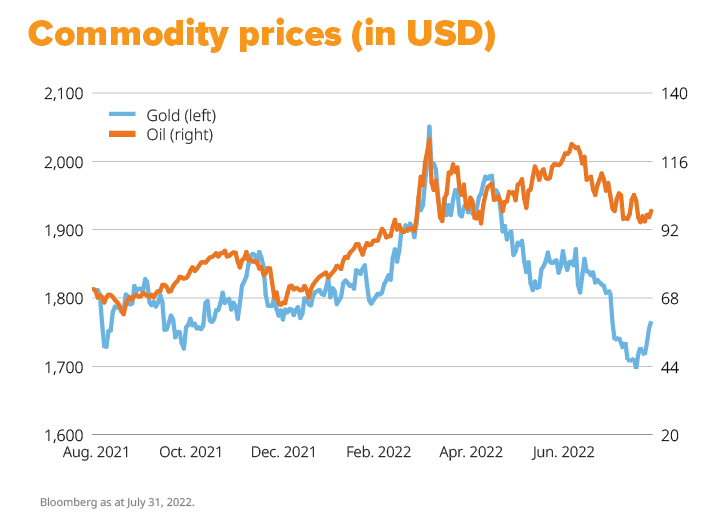

In the current inflationary environment, Canada offers opportunities for outperformance over other countries. The domestic market is overweighted to commodities, so it will benefit from recent price increases, such as seen with energy and materials.

“When investing in Canada, you need to take energy price forecasting into consideration,” says Aldridge. “It’s one of the hardest sectors to call. You have underlying commodity prices that underpin the basis of all your decision making.”

An energy renaissance?

Many investors globally had all but given up on the traditional energy sector, believing fossil fuels would become obsolete relatively soon.

“The energy sector has felt like a bear market since 2014,” Aldridge says. “In 2008-09, it made up nearly a third of the S&P/TSX Composite Index, but it got as low as 10% during market lows in 2020.”

When the war in Ukraine disrupted global supply, investors realized they had been overlooking the inherent volatility of the market and have since flocked to the most secure producers, such as Canada.

“This year energy rebounded to 20% of the index,” says Aldridge. “Suddenly energy felt like a pretty good place to be.”

He acknowledges that high energy prices can lead to lower demand and will likely accelerate the adoption of electric vehicles, and that he doesn’t expect new large-scale oil sands developments in the future.

Dividends hold upside potential

Historically, compounded dividends are a significant contributor to long-term equity performance and Canadian companies offer higher dividend yields overall

With a constructive outlook on earnings growth within the Canadian equity market, Aldridge believes some of those rising profits will be used by companies to reinvest in their businesses, make acquisitions, repurchase shares and raise their dividends.

The potential for higher dividend payouts through the economic reopening provides both a return enhancement over the long term and helps mitigate downside risk during inevitable risk-off periods.

Having a dividend cushion can help reduce investor shock and the temptation to make ill-timed decisions to exit equity positions and imperil their long-term plans – another indirect benefit of attractive dividend yields and rising payouts.

“I have no doubt that over the next decade we’ll see world-leading companies built in Canada,” Aldridge says. “We have what the world needs in terms of resources and we operate in a stable jurisdiction, which gives comfort to those looking to Canada for supply.”

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This article may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of August 22, 2022. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.