Written by the Mackenzie Fixed Income Team

Key positioning

- Yields were broadly higher in September as data continues to demonstrate a moderation in economic growth. The suggestion of a ‘higher for longer’ interest rate regime in developed economies seems to have become the standard view across market participants.

- In Canada, there is an air of caution among investors as consumers continue to digest recent interest rate hikes. Policy makers are focused on the careful balance between a slowly deteriorating economy and their stated mandate of bringing inflation in-line with a 2% target.

- In the U.S., inflation remains above target and therefore leaves the door open to further policy tightening. Fiscal considerations were a primary driver of higher yields through the long end of the curve.

- We continue to see compelling value in Emerging Markets as countries such as Brazil, Mexico, and South Africa offer attractive yield levels and show signs of effective inflation management.

- 10yr JGB yields continue to drift higher as policy makers weigh potential adjustments to long standing yield curve controls.

- From a total return basis, short term corporate bonds are interesting given an attractive yield-to-maturity of more than 5%.

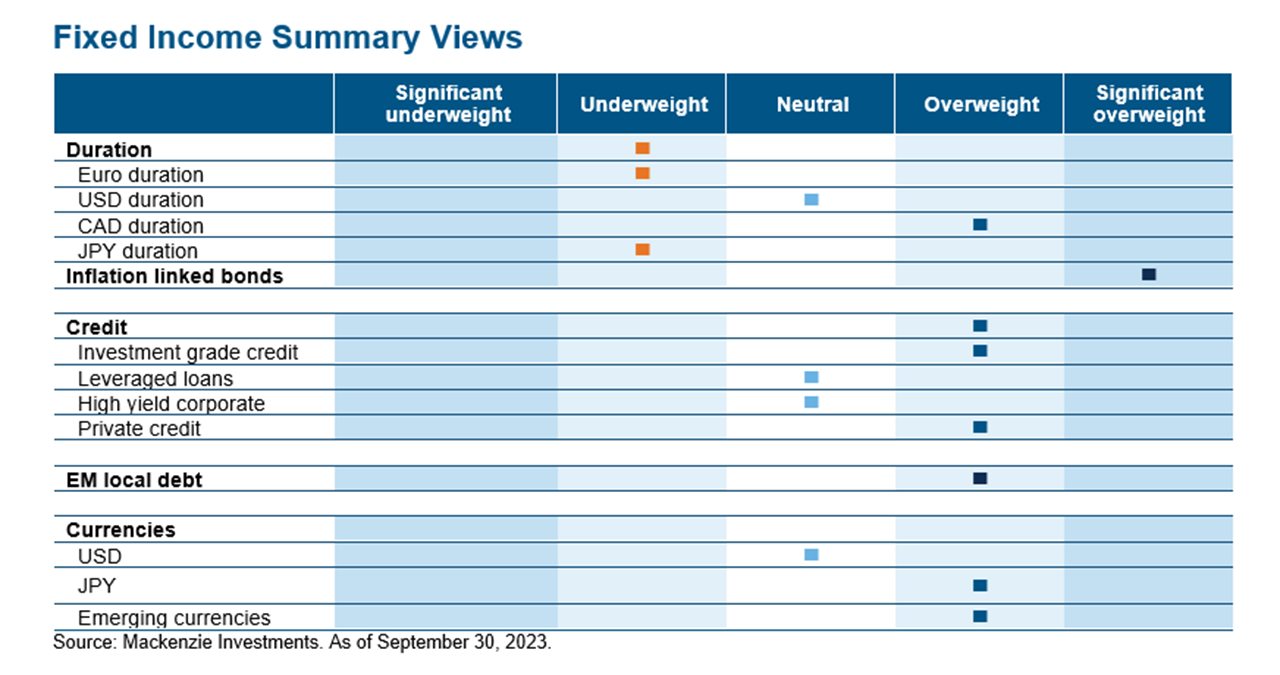

Current positioning and notable changes

Macroeconomic environment

Policy tightening may in fact be coming to an end in Canada as markets begin to price in a higher for longer monetary policy regime. Following two consecutive interest rate increases in June and July, the Bank of Canada (BoC) paused at its September meeting. BoC governor Macklem recently reiterated commitment to curbing inflation. That said, a move at its October forecast meeting seems highly unlikely. Pockets of the market currently believe that the BoC might be on hold through 2024. In our view, the bank might be getting closer to a restrictive terminal rate.

The Federal Reserve remains data driven in its decision making. The Fed paused at late September's meeting following a 25bp hike in July. The Fed’s “inside-out” strategy - hikes at one meeting and pauses at the following – suggests policymakers may be looking to ensure financial conditions are not tightening too much, particularly regional banks. That said, markets view November’s meeting as live. The market continues to price in interest rate cuts for 2024 which in our view is entirely within the realm of possibilities. The dialogue around a recession has largely taken a back seat and the pathway for a soft landing has become a lot wider. Recent comments from Governor Powell have been notably hawkish in tone.

The European Central Bank (ECB) has a seemingly more difficult task than its North American counterparts as inflation is more persistent and growth weaker on the other side of the Atlantic. Accordingly, stagflation is topical amongst European economists. This dilemma puts policy makers between a rock and a hard place so to speak. The ECB stayed the course on its journey to getting inflation under control and hiked rates to the highest levels seen since the launch of the European Union during September’s meeting.

Duration

We remain underweight duration and continue to express this positioning is a somewhat nuanced fashion across the globe. Despite higher yields in longer maturities in North America we remain patient when considering adding broad duration exposure. We continue to hold a significant overweight position in Treasury Inflation-Protected Securities (TIPS). We have a bias to a steeper treasury curve over the medium term.

In Japan, we have trimmed but continue to be short Japanese Government Bonds (JGB) across our funds as a medium-term macro trade based on the idea that Japan was “not an island” and the Bank of Japan’s (BoJ) Yield Curve Control (YCC) policy was keeping JGB yields artificially low. This was predicated in part on the notion that Japanese domestic inflation would be similar to global inflation, not only in direction, but also stickiness, and the BoJ was underestimating how quickly domestic inflation would rise. We have taken some profits on our short JGB position but continue to hold some of the position based on the notion the BoJ will likely let 10yr yields climb further into the 50-100bp range.

These duration views are reflected in several of our funds to varying extents, including the Mackenzie Strategic Bond Fund (MKB:ETF), Mackenzie Unconstrained Fixed Income Fund (MUB:ETF), Mackenzie Global Tactical Bond Fund (MGB:ETF), and Mackenzie Canadian Short Term Income Fund (MCSB:ETF).

Global and emerging markets

Global bonds recorded negative returns over the month as the Bloomberg Global Aggregate Index posted a decline during September. Government debt continues to struggle to find solid ground as a ratings downgrade and increased issuance concerns drove US yields higher. Demand for risk-on assets also cooled during the period. Emerging markets (EM) fixed income outperformed global bonds during the period, shedding value slightly as the downward trend from the month prior persisted. We continue view EMs as attractive. Among the major categories — EM Hard Currency, EM Corporates, and EM Local Currency Bonds — the latter holds distinct appeal. With early, substantial, and aggressive interest rate hikes, Emerging Markets have seen a more rapid and significant reduction in inflation compared to developed markets. Countries like Brazil, Mexico, and South Africa, offer attractive yield levels and show signs of effective inflation management. The combination of high yields, an inflationary problem that seems to be under control and appetite to start cutting rates is attractive to us. Our Funds continue to benefit from the performance here.

Investment grade corporates

Investment grade bonds in Canada traded down over the month, shedding value slightly as corporate debt outperformed government and provincial bonds during the month of September. Short-term bonds outperformed mid- and long-term maturities. In the U.S., corporate bonds shed value despite relatively stable credit spreads, higher rates the primary driver of weak performance. Investor’s appetite for fixed income assets remined strong as the corporate bonds saw robust flows with a preference for short-term solutions. While we consider that investment grade bonds in Canada have priced in a reasonable amount of recession risk given tighter bank lending standards and the lagged effect of last year’s interest rate increases could negatively impact the economy. Nevertheless, from a total return basis, short term corporate bonds are present a compelling value proposition.

High yield bonds

September saw high yield credit give back some recent gains as spreads widened slightly. Lower quality bonds outperformed driven by low duration exposure and typically higher coupons. As the narrative around tighter lending conditions continues to build, the team remains mindful of the impact on this segment of the market. That said, corporate balance sheets are generally in favourable positions as leverage remains at low levels we have not seen in more than a decade and interest coverage metrics remain near all-time highs. At this point in the cycle, active management – sector allocation and individual security selection – are critical. While we wish to capture current attractive yields, we have a bias to higher quality issuers the space. We are the positioned to avoid cyclical and consumer focused sectors, favoring instead defensive areas of the market such as utilities.

Leveraged loans

Another strong month for loans with +0.96% total return in September, and +10.16% YTD. YTD performance is the best for loans since the Global Financial Crisis. Strong performance still driven by high coupons. Over 70% of the YTD return comes from coupons. Overall, buying pressure was strong earlier in the month then abated in the second half of the period. Only 1 out of 74 sub-sectors in the LSTA benchmark recorded a negative return in September; Real Estate Management & Development (-0.05%). Lower rated loans outperformed in the month. Single B loans had a total return of +1.06% in Sept, compared to +0.63% for BBs and +0.63% for BBBs. Benchmark loans underperformed in September.

Bond stories

Investment Grade – Inflation Linked Bonds (TIPS)

Inflation Linked Bonds (TIPS) had a standout September when benchmarked against traditional US treasuries. The disparity, termed the "breakeven", between TIPS and their regular counterparts widened by 16 bps on the longer end of the curve (where we have our predominant exposure), marking a significant outperformance of TIPS. Historically, TIPS tend to fare better during major bond-market downturns. This is attributed to their lower beta, meaning they're less volatile. The logic is straightforward: bond prices usually fluctuate based on growth and inflation apprehensions. As TIPS are (theoretically) insulated from inflationary fluctuations, they inherently possess a subdued price movement, resulting in this lower beta. However, September's market dynamics were atypical. The month wasn't primarily driven by inflation or growth considerations. Instead, an external factor, often a minor player in government bond pricing, emerged: supply and demand concerns. Given that both TIPS and traditional bonds are equally susceptible to such forces, performance was weak overall.

High Yield – Trulieve

Trulieve is an industry leading, vertically integrated cannabis company and multi-state operator (MSO) in the US with established hubs in the Northeast, Southeast, and Southwest, anchored by leading market positions in Pennsylvania, Florida, and Arizona. Big news for the industry came on August 30th as the US Department of Health and Human Services (HHS) called for easing restriction on marijuana by reclassifying it as a Schedule III substance in a letter to the Drug Enforcement Administration (DEA). This news comes one year after President Biden's directive to HHS to "review expeditiously how marijuana is scheduled under federal law." Stock prices doubled or better in September on the news and bond prices moved up 10 points or better for the most liquid bonds, including the TRUL 26s. There has also been positive news at the state level in New Jersey, Maryland, New York, Ohio, Pennsylvania, and Florida that will benefit most of the MSOs through this decade. Trulieve is best known for its first mover position in the Florida market; it retains a 40% market share despite increased competition from most of the other top MSOs. Adult recreational use in the Florida market remains Trulieve's primary potential growth driver in the coming years. The company has a proven track record of growth - both organic and through acquisition - and has the longest track record of profitability in the industry. Financial policy has always been conservative with leverage in the 1x to 2x range through most of its history. This conservative financial policy was on full display with a press release on September 21st announcing the open market purchase of $57 million of face value of its senior secured notes due October 6, 2026 for a purchase price of $47.6 million, which represents a 16.5% discount to par. The company had $160 million of cash on their balance sheet at the end of Q2, so they felt comfortable deploying some of their excess cash to pay down debt. All eyes are now on their June 2024 maturity of $130 million as they have made public comments in the past that they may pay off that debt at maturity rather than refinance and should be easily repaid by the maturity date.

Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns as of September 30, 2023, including changes in share value and reinvestment of all distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in investment products that seek to track an index.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of September 30, 2023. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

The content of this commentary (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

All information is historical and not indicative of future results. Current performance may be lower or higher than the quoted past performance, which cannot guarantee results. Share price, principal value, and return will vary, and you may have a gain or a loss when you sell your shares. Performance assumes reinvestment of distributions and does not account for taxes. Performance may not reflect any expense limitation or subsidies currently in effect. Short-term trading fees may apply.

This material is for informational and educational purposes only. It is not a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. It is not intended to address the needs, circumstances, and objectives of any specific investor. Mackenzie Investments, which earns fees when clients select its products and services, is not offering impartial advice in a fiduciary capacity in providing this sales and marketing material. This information is not meant as tax or legal advice. Investors should consult a professional advisor before making investment and financial decisions and for more information on tax rules and other laws, which are complex and subject to change.

The rate of return is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the mutual fund or returns on investment in the mutual fund.