Portfolio Manager Monthly Insights

Hussein Sunderji, MBA, CFA

Vice President, Portfolio Manager

Semis: Conducting Things

There has been much talk and excitement over the past 18 months around artificial intelligence (AI) and its potential long-term benefits (and risks) to technological development and society at large. Thematically, AI has had significant impact on market performance over this period; this impact was initially narrow but has since broadened out as there has been a realization that the beneficiaries of AI may range far and wide.

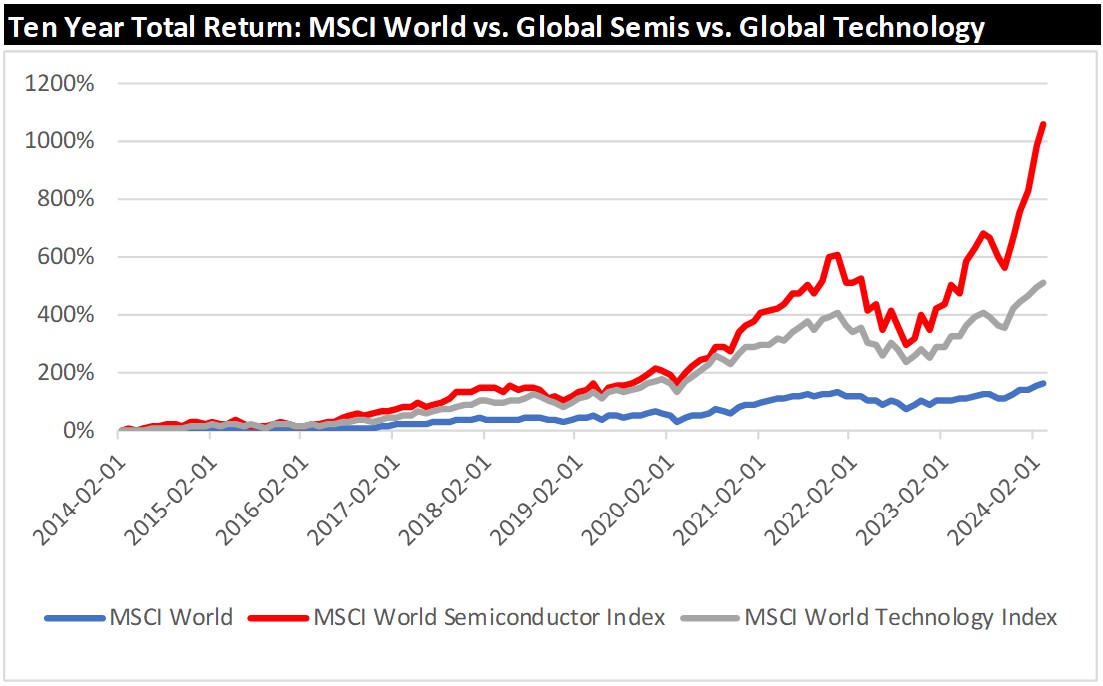

One area that has arguably benefited the most is semiconductors. The recent breathtaking performance of NVIDIA is top of mind; however, semiconductor sector and stock performance over the long-term has been about more than just NVIDIA and AI. This can be seen in reviewing performance of the global semiconductor index over a longer period – the strong through-cycle performance has come from a variety of constituents and been driven by a combination of increased ubiquity of semiconductors, increasing cost and complexity of technological development, and evolving business models and industry structures.

While on the surface it may seem like this fast-paced, cyclical, dynamic industry may not contain many opportunities for Ivy, we have been able to find companies with attractive business models, strong competitive advantages, capable and trustworthy management, and a compelling growth runway. As a result, there are several semiconductor stocks in various Ivy funds today, and overall, they have been positive contributors to performance.

Something for Everyone in Semis

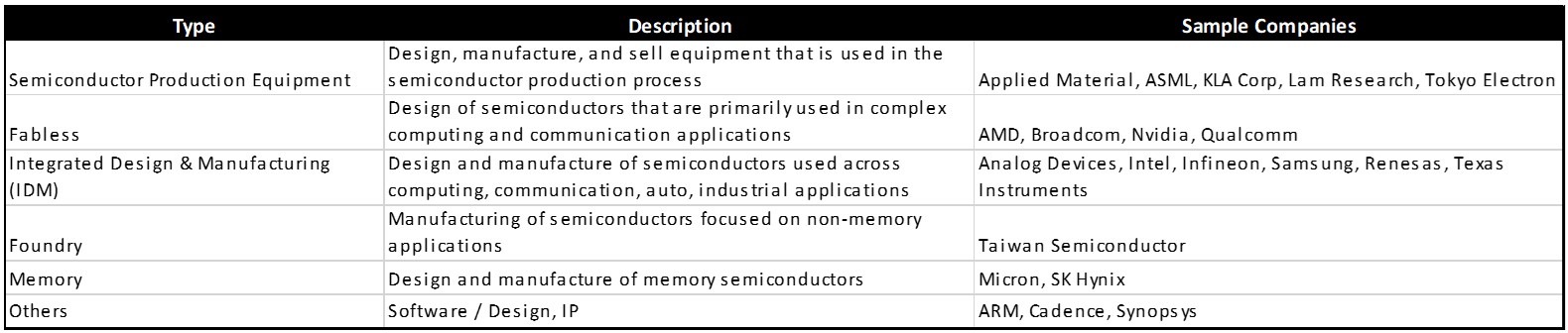

The semiconductor space is not homogenous. It is made up of companies with varied business models and end-market exposures. The table below, while not exhaustive, captures some of these differences:

While all these sub-segments have different business economics and growth profiles, the broader semiconductor space has seen strong performance on a through-cycle basis.

Source: Bloomberg

Source: Bloomberg

In addition to growth opportunities associated with AI and high-performance computing, we believe the drivers of recent semiconductor share price performance include a broader cyclical recovery, continued expansion of semiconductor content in automotive and industrial applications and increasing geographical diversification of the supply chain.

What About the Cycle?

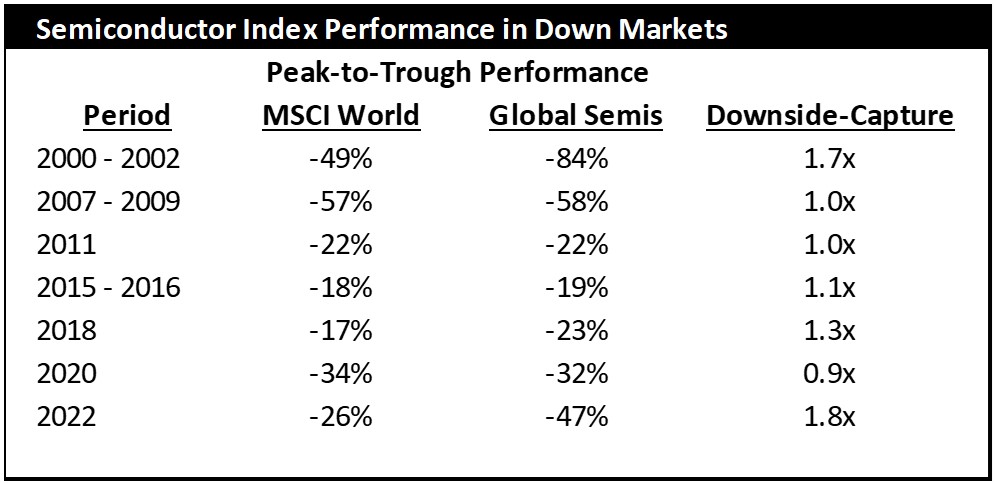

Strong long-term performance notwithstanding, semiconductor stocks have historically shown significant cyclicality. There are several reasons for this: 1) cyclicality of end-product demand, 2) cyclicality of inventories in various layers of the value chain, and 3) fragmented industry structures, which leads to price competition and build-out of excess capacity at inopportune times.

The table below shows the downside capture of the global semiconductor index in periods of historical market weakness:

Source: Bloomberg;

Note: Semi performance based on MSCI World Semiconductor Index all periods except 2000 - 2002 (S&P Semiconductor Index)

Source: Bloomberg;

Note: Semi performance based on MSCI World Semiconductor Index all periods except 2000 - 2002 (S&P Semiconductor Index)

Will these cycles persist in the future? The answer to this can have implications for assumptions around growth and valuation within the sector.

Some claimed as recently as 2020 that the semiconductor cycle would be reduced permanently due to broader sources of end-product demand and increased ubiquity. Sure enough, we then went through one of the sharpest down-cycles in 2022/2023 that we have witnessed in some time.

Our view is that the cyclical risk inherent in investing in semis cannot be ignored. However, our long-term approach allows us to use cycles to our advantage – accumulate positions in attractive businesses during times of pessimism, and ramp down position sizes during times of excessive optimism. A key pre-condition for being able to have confidence to invest during tough times is the presence of a strong balance sheet; this provides additional reassurance that the business will be able to weather cyclical downdrafts, and potentially emerge stronger on the other side.

Semiconductor Representation in the Ivy Funds

The Ivy funds have seen increased exposure to the semiconductor sector over the last several years. It is true that technological changes are rapid, and the sector is dynamic and cyclical – normally these are things that may lead to mixed visibility about future earnings power and business consistency, which are qualities that the Ivy team looks for in companies. However, there are several companies with attractive business models, unassailable competitive positions, and that benefit from scale advantages that enable them to stay on the forefront of technological change.

Below is a brief overview of some of the semiconductor stocks that are held in the Mackenzie Ivy Foreign Equity Fund:

- Samsung Electronics (SEC) – In addition to being a leading global consumer electronics company, SEC is also the world’s largest memory semiconductor player and the #2 leading foundry. Its integrated business model is unique and is designed to promote a high degree of self-reliance, nimble innovation, and scale advantage. SEC has significant net cash on its balance sheet.

- Taiwan Semiconductor Manufacturing (TSMC) – TSMC is the world’s leading foundry, with a focus on leading-edge semiconductor technologies. Its key end markets are high-performance computing, smartphone / communications, and increasingly autos and the internet of things. TSMC prides itself on its customer-first culture, and its significant scale advantage and track record have enabled it to emerge as the technology leader. TSMC also has substantial net cash on its balance sheet.

- Texas Instruments (TI) – TI is the leading global analog semiconductor company. Its analog chips help capture real-world signals and convert them to digital outputs. TI’s products are used in a variety of end markets, with a growing focus on auto and industrial applications. TI is in the midst of a significant capacity expansion plan that is focused on North America. TI has a very strong balance sheet with an A+ credit rating.

Capitalizing on Long-term Growth Opportunity While Managing Risks

Ivy’s semiconductor exposure will likely evolve over time, potentially to include other business models or sub-segments. This will be partly dependent on the evolving nature of quality, competitive positioning, and technological change in the industry, and partly dictated by valuations. While we believe that cycles will continue to persist in this industry, we also believe there are firm drivers in place to propel long-term growth. Our job as capital allocators and risk managers is to try to identify the right companies, hold them at the appropriate weights, stay grounded and focused on the long-term when the market mood is oscillating between excessive greed and fear, and be vigilant around monitoring risks related to geopolitics, technological change, and competitive advantage.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

The contents of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) are not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of April 2, 2024. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

©2024 Mackenzie Investments. All rights reserved.