The move from gasoline-powered vehicles to electric vehicles (EVs) is like a freight train: progress was slow to start, but its momentum is building and it will become unstoppable. It has to be, if the world is to reach its commitments to net zero and a reduction in fossil fuel consumption that will limit global warming.

In 2022, 10.5 million EVs were sold around the world. While this is impressive, this number needs to rise dramatically. A crucial part of that process is the development — and improvement — of EV batteries. There are three key aspects of battery production that need to be improved:

- Cost: it costs an average of $151 per kilowatt-hour to produce electric batteries for EVs. The price point needs to be closer to $100 for electric vehicles to be competitive with gas-powered vehicles.

- Battery density: the higher the battery density, the further an EV can travel when fully charged.

- Charging: we need to improve the safety and speed of battery charging, as well as the number of charges a battery can handle before it loses efficiency.

Let’s take a look at how batteries work, their different components and the kinds of innovations that will be needed to reach that $100 cost point. We’ll also look at the investment opportunities we feel are worthwhile in this sector.

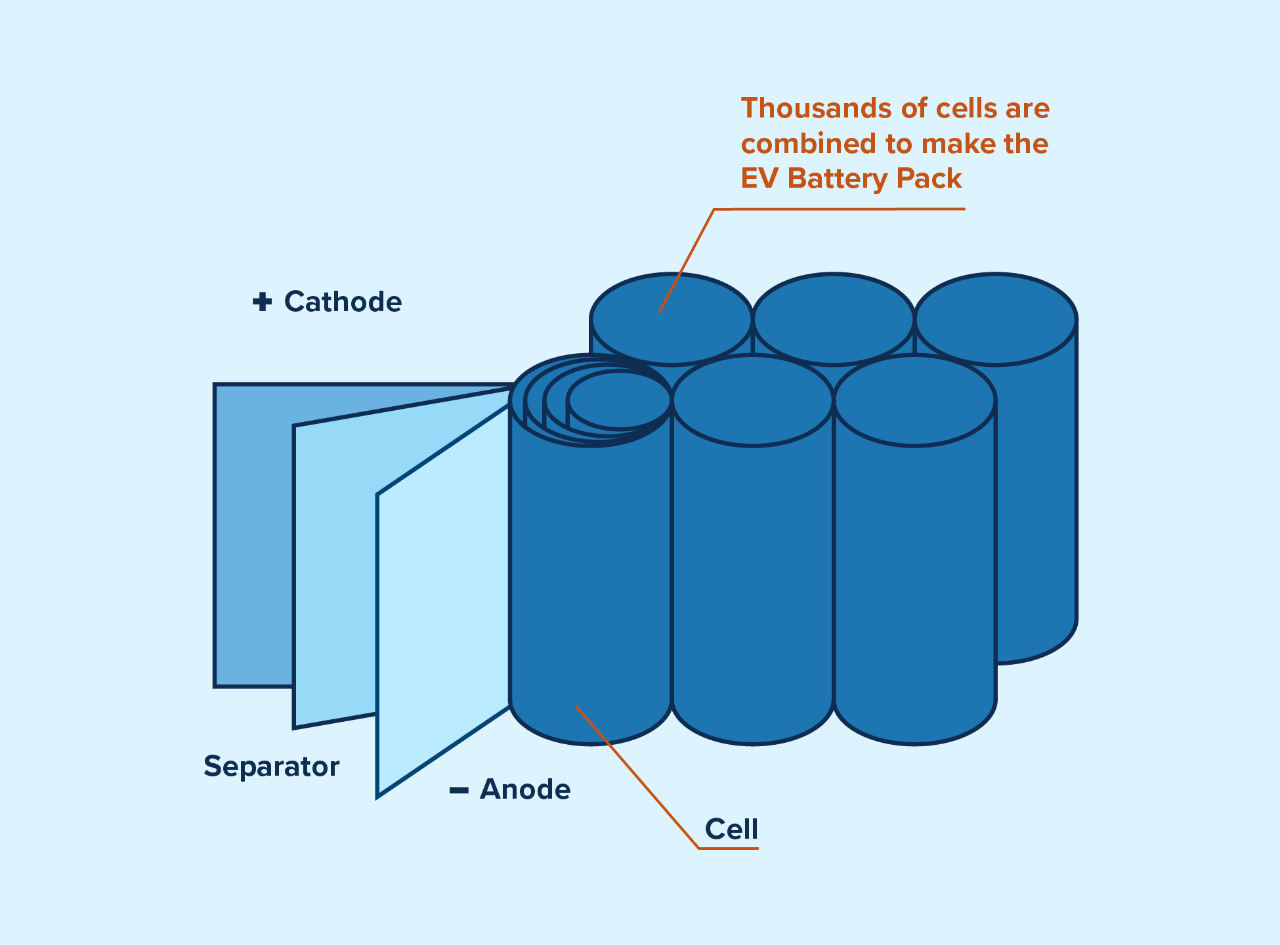

Electric vehicle battery components

Energy-dense lithium-ion batteries have been around since Sony commercialized them in the 1990s. However, while billions have been spent on developing and improving them, meaningful breakthroughs have been few and far between.

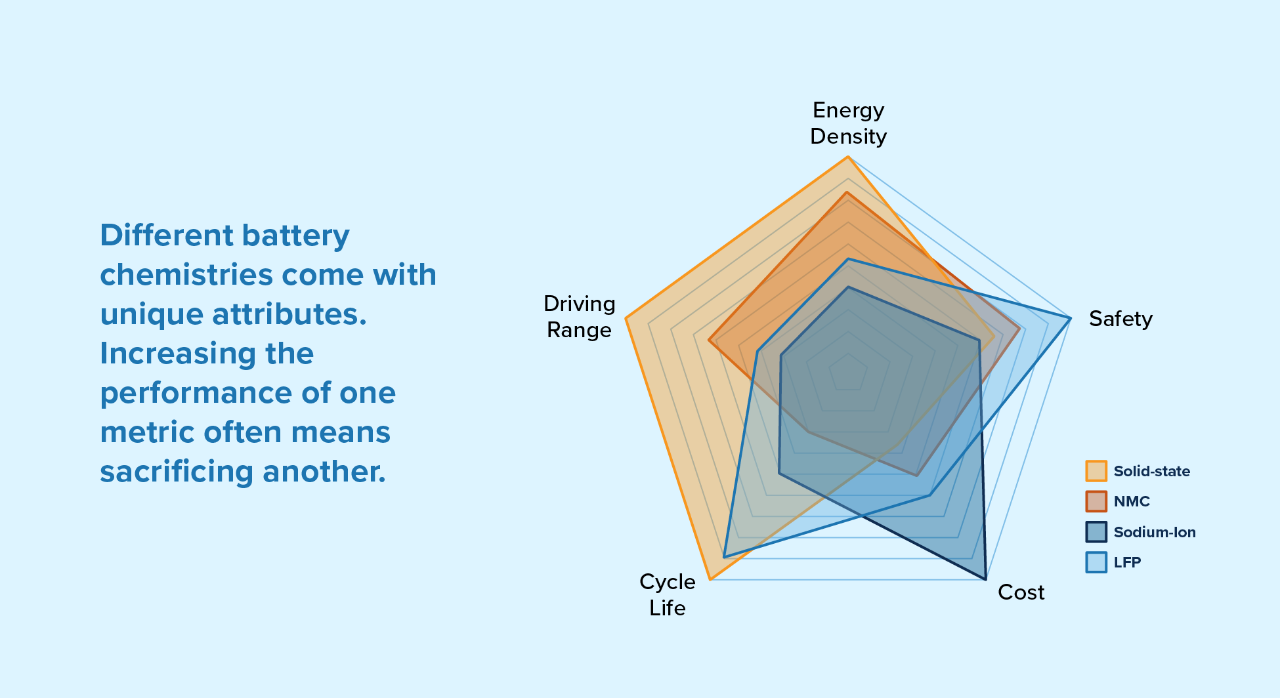

Every EV battery has a number of components that can vary in cost and performance. One of the key challenges of producing cheaper EV batteries is that when one aspect is improved upon, it comes at the sacrifice of another.

Here’s a breakdown of the key components of EV batteries.

The potential game-changer: solid state batteries

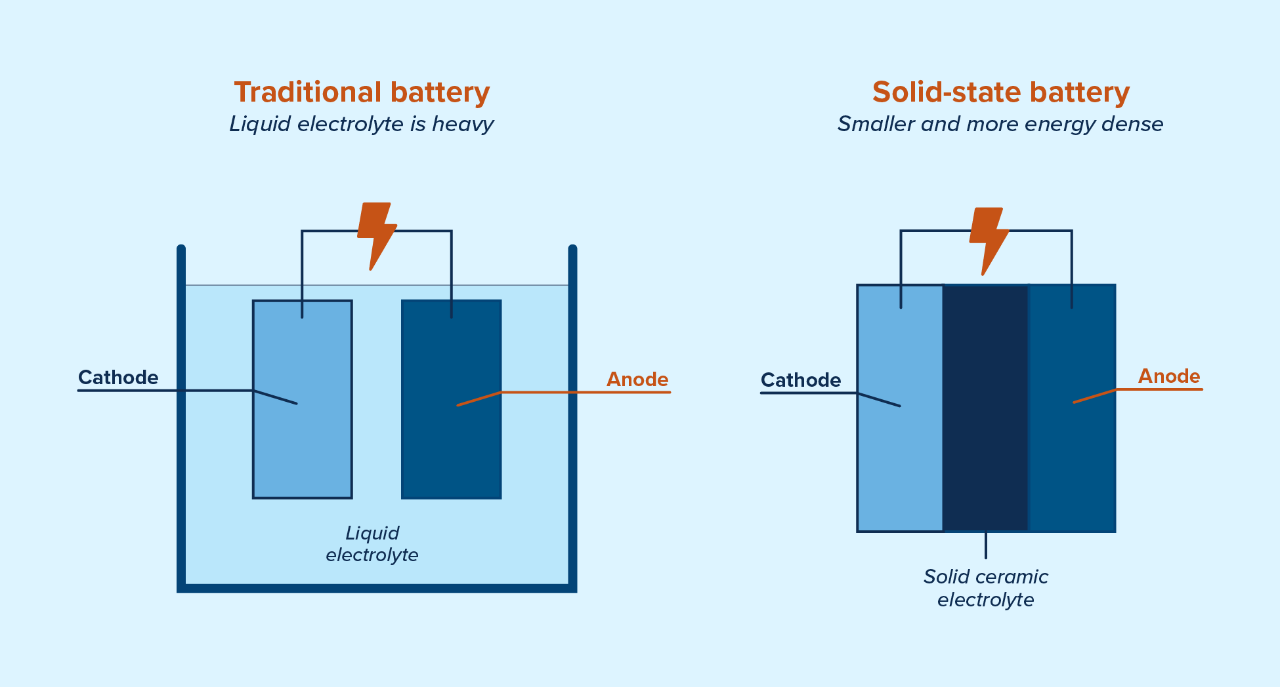

Newer types of EV batteries use a solid electrolyte made mostly of ceramic. Its anode is very different as well: it builds itself as a layer of lithium metal during charging. This means the battery is lighter and can be considerably smaller. The theory is that solid-state batteries will have improved energy density, charge times, safety and lifespan.

In late June 2023, Toyota announced that it will have electric vehicles for sale powered entirely by solid-state batteries by 2027. They claim these vehicles will have a range of 1,200 kilometers and can be fast charged in about 10 minutes. Several car manufacturers and battery companies have solid-state batteries in development. Nissan expects a 2028 launch date, and Dongfeng Motor Corporation of China put fifty solid-state powered cars on the road last year.

However, several technical challenges have plagued the development of solid-state batteries, to the point that its manufacturers have not delivered for early investors. QuantumScape — backed by heavyweights such as Bill Gates and Jeremy Grantham — has seen its market value drop from US$30 billion to under US$4 billion in just a few years. Another solid-state battery company, Solid Power (which has partnerships with Ford and BMW), has seen its share price decline about 60% in the past two years.

While we expect manufacturers to overcome most of the technical challenges, we’re less certain that they can produce solid-state batteries at scale and remain economically competitive.

Asia’s domination of the EV battery market

In spite of massive investment in battery manufacturing plants from Western governments, Asian manufacturing continues to be far ahead. Japan and Korea are major players, while China manufactures 66% of all batteries sold. China also manufactures the lion’s share of cathodes, anodes and electrolytes.

The same country also controls between 60% and 95% of manganese, cobalt, graphite, lithium and nickel — all key materials for battery production. And China simply does it cheaper: for example, it’s one-third of the cost to process lithium for electric vehicle batteries in China compared to in North America.

So are there investment opportunities with EV batteries?

Investing in EV batteries is a tricky proposition. The sheer scale of production could bring great returns if you pick the right company, but given that there are hundreds to choose from, many of which are already trading at high valuations, the odds are not great. So, what opportunities are out there for investors?

Here at Mackenzie Greenchip, we focus on investing in companies that we believe will power a more sustainable future. Our team has been adept at finding value within growth companies in the rapidly growing environmental market.

When it comes to electric vehicle batteries (which we consider to be an overly hyped sector), the Greenchip team focuses on companies that produce derivative products. Two examples are, plastic battery coating manufacturers (such as Japan’s TDK) and high-voltage chip manufacturers. Electric vehicles need three times as many high-voltage chips as regular cars, so the demand is growing considerably.

Investing in these derivative companies has worked well for Greenchip’s funds. We know the evolution of this space is changing constantly with innovation, technology and research. And while we believe that there will certainly be good opportunities to invest directly in EV batteries, Greenchip’s approach is a patient, pragmatic one that refuses to pay over the odds.

You can listen to our discussion on the difficulties of investing in EV batteries in this podcast or read this in-depth white paper, The race for a better EV battery.

And you can learn more about the Mackenzie Greenchip Global Environmental All Cap Fund and the Mackenzie Greenchip Environmental Balanced Fund.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.