Nuclear resurgence benefits from fossil inflation

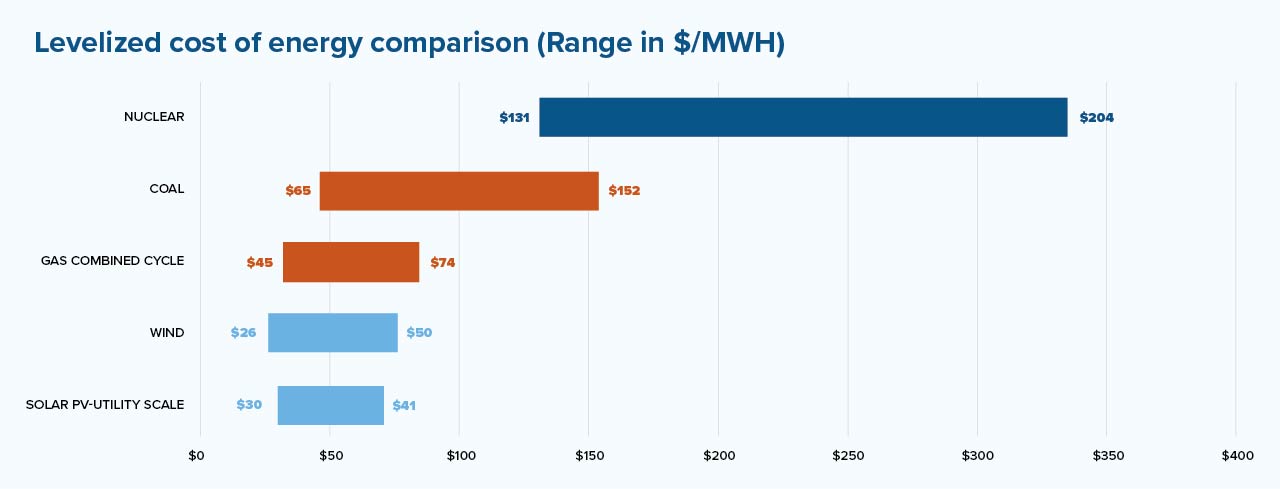

One thing reinvigorating nuclear is the soaring costs of other generating technologies. The tool the industry uses to compare economics is called “levelized cost of energy” (LCOE). It calculates the present value of the total cost of building and operating a power plant over an assumed lifetime amount of energy production. Until recently, the average LCOE for nuclear was about double that of new coal or natural gas plants, which in turn was about twice as expensive as large-scale wind and solar projects. So why would any power utility choose nuclear?

Key takeaway

Nuclear may only be 10% of global generation, however, we cannot afford to just let nuclear power continue to die a slow death. SMRs offer some hope, while backing reactor refurbishment seems economic and buys us time to let other clean technologies develop. Despite the economic and environmental challenges, we need nuclear to be part of our energy future.

As the war in Ukraine intensified, the British Parliament quickly convened nuclear industry bosses, pension managers, and insurance executives. He told them his government wanted to increase nuclear electricity output to one-quarter of the country’s total generation using a new generation of nuclear reactors - at “warp speed”. The world desperately needs this kind of energy urgency, but transition realism is needed too. You see, while Britain currently has six reactors supplying 16% of their electricity, three of these are scheduled to close in the next two years and then two more by 2028. With only one new reactor coming online in the next decade, Britain’s target is entirely based on the success of an unproven technology called Small Modular Reactors (SMRs). We believe it is technology whose costs are unknown, whose safety is uncertain, and that is at least a decade away from meaningful generation.

Yet Britain’s renewed nuclear excitement is suddenly shared by many as concerns over energy security, energy inflation, climate change, and the limitations of current renewable technologies converge – an old technology has suddenly become new again!

It is hard to overstate how quickly our existing reactor fleet is aging

Looking at a graph of annual reactor construction, one notices that the halcyon days for nuclear were in the 1970s and 80s. Today there are 440 nuclear reactors operating around the world. That may sound like a lot, but it’s only 20 more than were operating in 1987. Twenty-first century large-scale reactors are generally safer and meant to last a little longer, but not much has really changed in the technology over the past fifty years. What has changed is that we consume a lot more electricity today and, because cheaper alternatives emerged, a lot less of it comes from splitting atoms. In the late 1980s, nuclear accounted for 16.5% of global generation - today it’s barely 10%. Given that it is one of few “emissions-free” technologies, this is a problem.

According to the US Energy Information Administration, there are 94 reactors still operating in the United States, the most of any country, yet on average they’re 39 years old! This is somewhat concerning when the designed operating lifespan of these was originally in the 30-40-year range. They account for 20% of the country’s generation. Still, there are only two new US plants under construction, both in Georgia. These were supposed to start generating in 2016, but like so many recent projects, their opening has been pushed out until 2023.

France has a much greater nuclear challenge with 56 reactors providing a whopping 70% of the country’s electricity. In 2015, the government, concerned about both the concentration and the age of its power portfolio, introduced a policy to reduce the country’s reliance on nuclear to 50%. That target has since been pushed to 2035. A robust replacement policy seems logical; however, the country has only one reactor, in Normandy, under construction and only three others under consideration. The only other reactor currently being built in all of Western Europe is at Hinkley Point in Somerset England.

The biggest challenge to nuclear might be NIMBYism

The events at Chornobyl and Fukushima created an almost irrational fear of nuclear energy. (We understand that “irrational” will be a controversial adjective for many, but we see pollution and danger in all power technologies – even wind and solar – that are less widely understood. Burning coal has killed far more people than nuclear ever has). Yet nowhere is this fear more prevalent than in Germany, a country that currently needs all generating options left on the table just so its citizens don’t freeze next winter. Sadly, it remains political suicide for the German government to extend the planned shut down of its last three reactors beyond the end of 2022.

We should all be more concerned with the quarter of a million tons of radioactive waste stored in (sometimes corroding) temporary vessels, usually right next to operating reactors. In 2020, The Nuclear Waste Management Organization of Canada estimated the long-term storage cost for Canadian nuclear waste was $26 Billion. Using similar math, the global bill would be close to $700 billion. Whatever the final costs end up being, the real issue will be finding communities willing to have this highly toxic material buried in their backyards.

Nuclear development is still active in emerging markets

About fifty new large-scale reactors will be commissioned in the geographic East in the next five years, primarily in China, Russia, South Korea, and India. There are several explanations why. First, annual electricity demand has been soaring in emerging markets (Russia would be the exception). For example, Chinese electron consumption grew at an incredible 6.5% per annum average from 2010-20201. As such, all potential energy sources have been needed just to meet soaring demand. While wind and solar are the fastest growing generation technologies by capacity, new nuclear was required as “base load power” to help balance transmission systems. The alternative in most emerging markets would be to burn even more coal. While GHG emissions are a concern, air particulate emissions - sulfur, and other airborne chemicals from burning coal - create social stability issues, particularly for the Chinese and Indian governments. You can see the nuclear appeal.

Russia, on the other hand, has less growth, less air pollution, and an abundance of natural gas that it could burn for cheap baseload power. One can only assume they value their nuclear program for different reasons. But value it they do - Russia has 37 operable reactors, three under construction and plans to open another seven by 20302.

Geopolitics has always been part of the nuclear calculus

Through its Belt and Road program, China has agreements with countries like Pakistan to build on their existing nuclear capabilities and Russia is helping Iran construct a second reactor. According to the World Nuclear Association, almost 30 countries are considering, planning, or starting nuclear programs – most of them would be classified as developing countries. All of them are likely to, or already, partner with Rosatom or one of the two Chinese nuclear agencies. Nuclear colonialism is indeed a thing.

Nuclear resurgence benefits from fossil inflation

One thing reinvigorating nuclear is the soaring costs of other generating technologies. The tool the industry uses to compare economics is called “levelized cost of energy” (LCOE). It calculates the present value of the total cost of building and operating a power plant over an assumed lifetime amount of energy production. Until recently, the average LCOE for nuclear was about double that of new coal or natural gas plants, which in turn was about twice as expensive as large-scale wind and solar projects. (Meaningful hydro assets have mostly been exploited so the LCOE for hydro, while attractive, is not competitively relevant). The chart below shows 2021 LCOE ranges.

Based on this chart, why would any power utility choose nuclear? Well, LCOE doesn’t differentiate between baseload power and intermittent power. As such, the graphic above overstates the economic advantages of wind and solar and underestimates the real value that nuclear (and coal and gas) bring to the entire electricity system. Further, the chart would not have accounted for recent inflation. In the past twelve months, natural gas prices have doubled in North America and tripled in Europe. The cost of a ton of coal has also tripled, and many operators now face rising emissions taxes. For the first time in 15 years, the cost of renewable equipment is also on the rise. Input costs like polysilicon for solar (up 500% in the past 18 months!), and steel and concrete for wind towers are soaring. Material costs would be increasing for nuclear too, but these have far less impact on nuclear LCOE. Commodity inflation has caused the economic gap between nuclear and alternatives to narrow.

The economics of extending reactor lifetimes is also looking more attractive

Operators, and regulators, have been finding ways to extend generating lifespans beyond original decommissioning dates. In some cases, it is becoming technically and economically feasible to add 30 years (maybe even longer) to plant lifetimes.

Ontario provides a useful case study of how thoughtful energy planning combined with careful engineering can buy time to manage difficult regional energy transitions. (Nothing has been more politically and environmentally sensitive than discussing Ontario’s electricity policy over the past decade, so I realize everyone won’t agree with the next sentence.) We believe that the province’s 2012 decision to refurbish ten aging reactors looks like a very good one in hindsight.

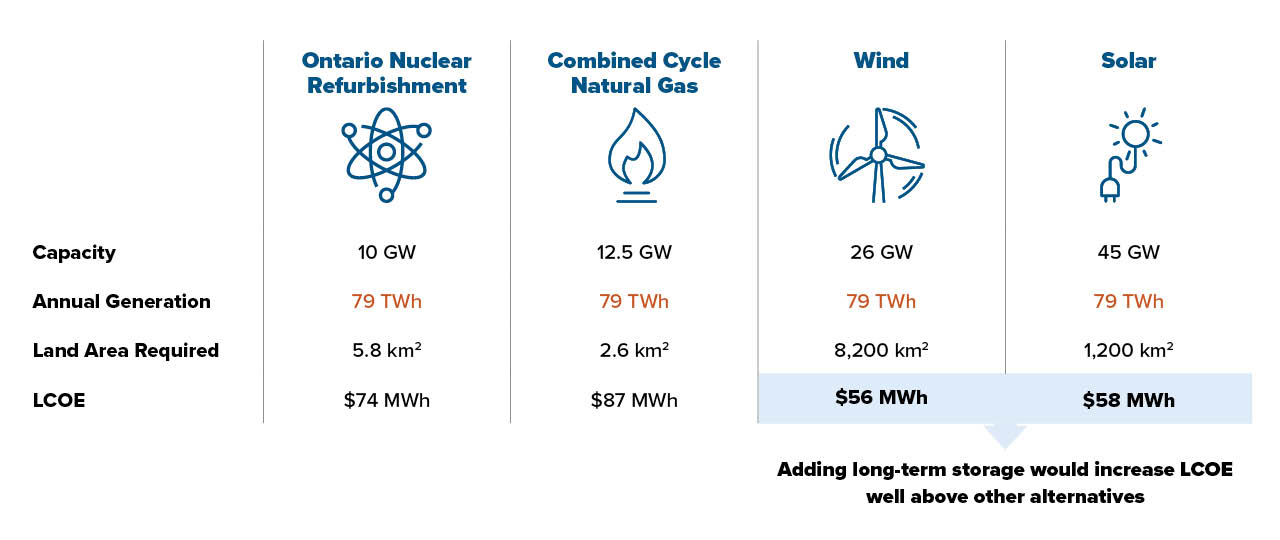

If delivered on time and on budget, and right now it is looking promising, Ontario will have four refurbished reactors operating in Darlington by 2026 and six more at the Bruce Plant in Port Elgin by 2033. Combined, they will provide 10GW of important base load power into the late 2060s at an estimated refurbishment cost of $26 billion CAD. Considering that nuclear currently provides about 60% of the province’s power, transitioning to an alternative technology was going to be very disruptive, less predictable, require new land allocations, and be more expensive.

The graphic below provides the Greenchip team’s best estimate of how Ontario’s nuclear refurbishment compares today to natural gas, wind, and solar (capacity levels adjusted for operating conditions in Ontario). The economics look good, but the real value of nuclear refurbishment is that it may provide enough time for the world to develop economic grid level storage for renewables and other low carbon technologies.

Small modular reactors offer some hope for a nuclear future but it’s far from certain.

In addition to its nuclear refurbishment program, Ontario has granted a 10-year licence to a GE/Hitachi consortium to develop a 300MW SMR on the Darlington site. There were many SMR companies they could have chosen from.3 According to a recent Economist article, there are over 50 SMR designs being developed globally. The promises of SMRs, generally defined as reactors designed to produce under 300MW, are many but let’s highlight two: they’re potentially cheaper, due to simpler modular construction; they’re potentially safer, due to smaller reactors, different vessel shapes, and even different cooling materials like lead, sodium, or helium. Some promise to also sell heat, while others promise to gobble up existing spent fuel. The problem with all these promises is that they haven’t been proven yet. We are watching closely and remain hopeful but believe meaningful SMR generating contributions are at least a decade away.

Nuclear investment opportunities do exist.

Over the past fifteen years, Greenchip has rarely backed unproven technologies. We are more likely to invest in large-diversified industrials or even engineering firms that have emerging clean technologies as a part of their overall business. For example, Hitachi, which has partnered on several nuclear projects is a current holding. Nuclear accounts for less than 1% of their revenues. Given the risks related to SMR developments stated above it is unlikely that we would back an SMR start-up, but, thankfully other investors are. Bill Gates has backed TerraPower and Flour and several Japanese and American investors backed NuScale Power. Just last week, New Brunswick Power invested $30 million in ARC Clean Energy which is developing Canada’s first commercial grade SMR. If all – or any of - those promises pan out, the returns could be enormous. That said, the large industrials and engineering firms will benefit too, they always do!

Our exposure has not been limited to diversified industrials though, the Mackenzie Greenchip Global Environmental Balanced Fund participated in the $500 million of green bonds issued last November to help finance the Bruce Nuclear refurbishment. Whether it be reactor refurbishment or backing SMR technologies, there will be no shortage of capital required to develop whatever form the nuclear future takes. Fifteen years ago, we decided nuclear had to be part of a successful energy transition and included it in our investment universe. This January, the “Technical Expert Group” defining the European Union’s green taxonomy, agreed with us.

1. Source: International Energy Agency (https://www.iea.org/countries/china)

2. Source: World Nuclear Association (https://world-nuclear.org/information-library/country-profiles/countries-o-s/russia-nuclear-power.aspx)

3. Source: https://www.economist.com/science-and-technology/developers-of-small-modular-reactors-hope-their-time-has-come/21808321

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of April 13th 2022. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.