What is private credit?

Private credit funds provide loans directly to private companies to help them improve their operations and profitability.

Investors may find private credit appealing because of its potential for enhanced yield and total return as well as the diversification benefits it can bring to their overall portfolios.

The growth of private credit

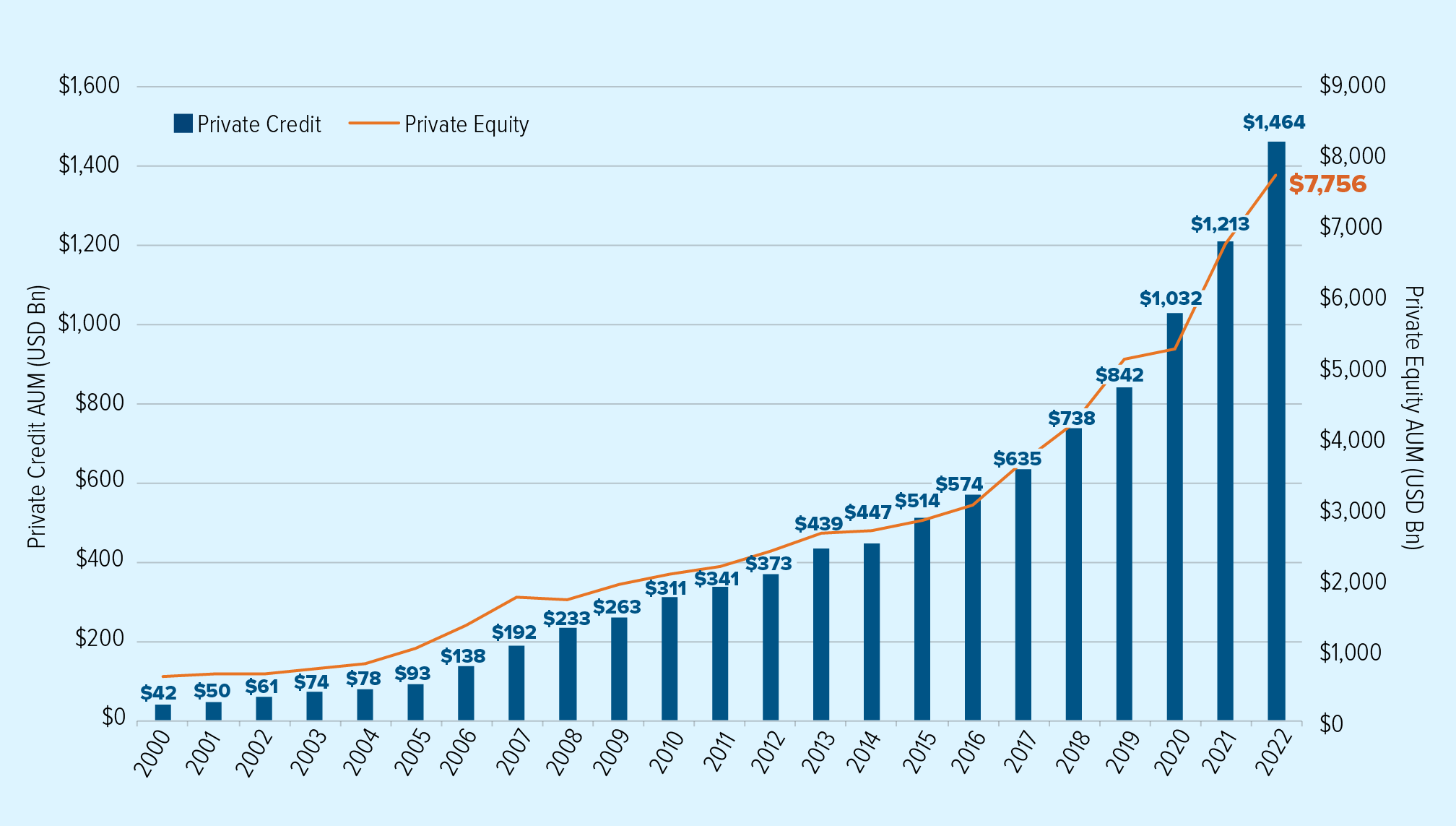

The private credit market has seen rapid growth in recent years. After the global financial crisis, regulators restricted the ability of banks to serve this market. This led to a funding gap, now filled by alternative credit providers.

The rapid growth in private equity activity has also fueled the need for creative, flexible and knowledgeable lending partners, which has further contributed to the expansion of private credit.

Growth of Private Credit and Private Equity

Source: Preqin: December 2022

Source: Preqin: December 2022

How it’s related to private equity

Private credit lenders often provide the financing that private equity managers need to buy and build the private businesses in their portfolio.

Strong relationships with private equity firms can often lead to a greater likelihood of a private credit firm participating in a larger number of attractive deals.

Key risks

Private credit funds can be structured for a range of risk/return objectives. Before investing, investors should consider the degree of risk of any given fund. Some key risks include:

Credit risk

This is the probability that a borrower will fail to make full and timely payments of interest and principal, and the expected severity of losses should they occur. Large credit rating agencies generally don’t cover private credit, so the onus is entirely on private credit managers to evaluate each potential borrower. They typically consider the following:

Capacity: A borrower’s ability to service its debt can be affected by broad industry structure and risk factors, its profitability and level of existing debt.

Collateral: The quality and value of the borrower’s assets that may be sold off in the event of default or borrower bankruptcy.

Covenants: The legal obligations of the borrower are designed to protect creditors. These may include regular interest and principal payments, filing audited financial statements and maintaining certain financial ratios.

Character: The nature and intensions of the company’s equity holders, corporate strategy, management team’s track record and governance practices.

Interest rate risk

Private credit is generally issued with floating rate payments, which adjust up or down with interest rates. This makes private credit less susceptible to rising rates.

Fund level leverage

Some private credit managers use borrowed money to provide additional exposure to private debt beyond their fund’s net asset value. This will amplify the risk/return characteristics of an unlevered portfolio and comes with its own borrowing cost.

Valuation practices

Valuation frequency and methodology vary from one private credit fund to the next. These valuation practices can affect the price volatility of private credit funds. Investors should understand the practices of a given private credit manager before investing.

Liquidity

The average expected holding period of loans inside a private credit fund will affect the amount of liquidity.

Investors should understand the liquidity characteristics before investing in a private credit strategy, as this will affect their ability to exit their position if they need to.

It can be difficult and/or expensive for a private credit manager to sell a position to raise cash to fund redemptions. It’s in the best interest of investors for private credit funds to offer limited and structured redemption terms aligned with the liquidity of the underlying portfolio.

To improve liquidity for investors, some funds will supplement private credit with more liquid forms of fixed income.

The future of private credit

In the past, private markets have been out of reach for average investors, but there is reason to be optimistic about the future. Innovation in product design, such as interval funds, make private credit more accessible, with enhanced liquidity and lower investment minimum.

As capital markets continue to evolve, we believe more investors will be able to access to potential benefits of private credit.

Units of Mackenzie Northleaf Private Credit Fund (the “Fund”) are generally only available to “accredited investors” (as defined in NI 45-106). This material is not intended to constitute an offer of units of the Fund or any other fund referred to herein. Past performance is not necessarily indicative of any future results and there can be no guarantee that the Fund will achieve growth or yield similar to any growth or yield referred to herein. The Fund has material exposure to public market investments, the amount of which will fluctuate over time.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. This article may contain forward-looking information which reflect our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of December 2023. There should be no expectation that such information will in all circumstances be updated, supplemented or revised, whether as a result of new information, changing circumstances, future events or otherwise.