Income in Retirement Challenge

Laurent Boukobza,

Vice President

ETFs

June 22, 2021

With Canada’s population aging at a rapid rate and demographics shifting, having enough income in retirement is becoming a key concern for investors.

Eight million Canadians will be over 65 by 2026, and 20% of the population will be spending on average 25-plus years in retirement. Retirement wealth is expected to grow to $5.45 trillion by 2030; the 55-plus age group will account for two-thirds of Canadian financial wealth (excluding real estate) 1.

While this is clearly a lot of money, this doesn’t mean that all of those eight million retirees will have a comfortable retirement. There has been a long and continuous decline in defined benefit pension plans (particularly in the private sector), and Canadians now have to rely more than ever on their savings to provide income in retirement.

As retirees make the move from contributing to their savings to withdrawing from them, they are suddenly faced with a balancing act between withdrawal levels, capital preservation, a need for growth, tax efficiency, estate objectives and risk management. Withdrawing from retirement savings requires a drastic change in investing priorities.

The three pillars of retirement portfolios

When you move into retirement, priorities change and there are three key pillars to consider: providing income, downside mitigation (managing risk during market declines) and inflation protection (growth). During the stage when investors are building their nest egg, they naturally focus mostly on growth. However, this focus shifts to capital protection as they approach and enter retirement.

During the saving years, downside market volatility can be used to the saver’s advantage through ongoing deposits when markets decline (dollar-cost averaging). Once retired, with no regular salary coming in, it becomes far more difficult to contribute to retirement savings and replace any investment losses due to market downturns. In fact, these losses can be locked in if you’re forced to sell some investments to provide income.

Here’s how those three pillars break down:

Providing income

Given that government pensions fall short by close to $23,000 per year for the average retiree’s needs,

anyone without a defined benefit pension plan or company pension, would need to have substantial savings to compensate for this shortfall. Additionally, they would need to draw an adequate amount from their savings to ensure enough income, without their savings running out.

We estimate that a retirement portfolio needs to generate a total return of between 4–7%. With 10-year rates hovering around 1.5%, a retirement income portfolio consisting of only fixed income is unlikely to be feasible. Successfully building a well-diversified portfolio to balance these risks and deliver this kind of return will make the difference between a comfortable retirement and a financially stressful one.

Downside mitigation

Protecting their savings from downside losses is extremely important for retirees who don’t want to see their savings run out at some point. With increased life expectancies, this is a common concern. The current, historically low interest rates provided by bonds (among the safest investments for retirees) means those retirees seeking income could find this to be a difficult situation.

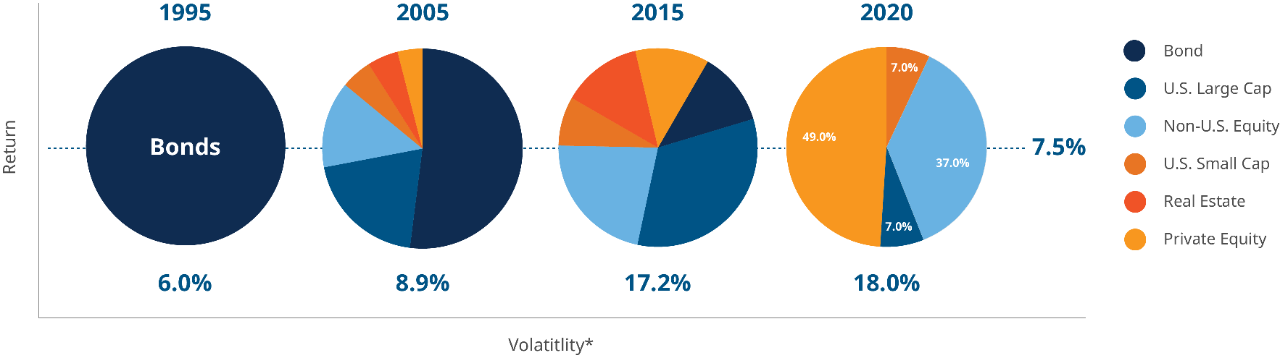

Not long ago, obtaining the necessary returns was far more straightforward. In 1995, for example, you could have a portfolio of 100% bonds and expect a return of 7.5% with volatility of around 6%.

For illustration, now, to have the same 7.5% return, a portfolio would need to have three times the expected volatility (18%2) and would need to include real estate, private equity and global public equities, as shown below:

Higher growth brings increased risk

So, is the solution to increase the equity risk in a portfolio in order to generate more income and growth?

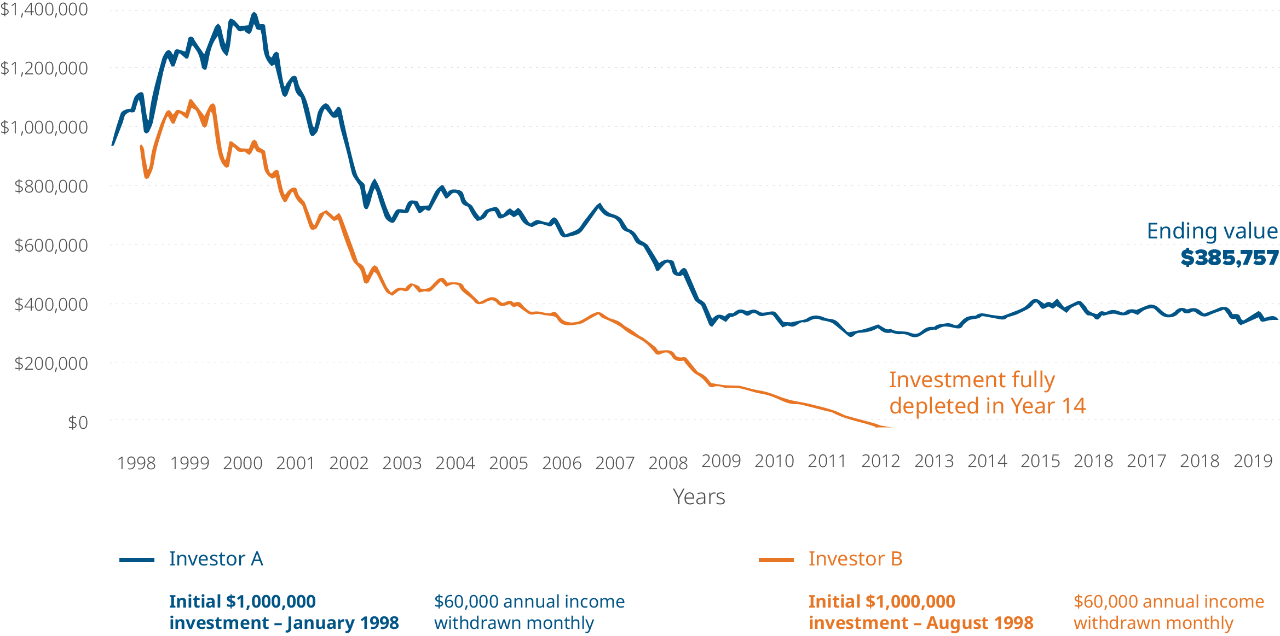

It can be, but that risk needs to be managed. Sequence of returns risk is the impact of the timing of a bear market, which is crucially important. If your portfolio doesn’t have risk mitigation mechanisms built into it and you are forced to sell during a downturn, the losses are realized and locked in. If this happens early in retirement, it could have a devastating effect on your savings’ longevity. Bear markets happen on average every six years, so retirees need to plan for this.

The chart below3 demonstrates this very clearly. The orange line shows how $1 million in retirement savings can be depleted in 14 years because withdrawals began just as a bear market came into effect. Compare this to the blue line, which shows what happens when the same amount of money had time to grow before the bear market hit.

Real market data: With withdrawals

Managing for inflation (Growth)

The growth portion of the portfolio is the part that investors should leave alone in the short term. Retirement is increasingly lasting a long time, so the portfolio needs time to grow, given that safer and lower income-generating strategies are unlikely to deliver sufficient income to meet cash-flow needs. These investments can handle more risk and the greater growth potential that comes with it. Retirees should be sure not to rely on these investments for immediate cash flow needs so they’re not forced to sell at a badly timed moment.

Putting it all together

A retirement portfolio should be built with a balance between income, downside mitigation and growth.

This can take different forms; increased diversification between asset classes can be achieved with balanced ETFs. Strategies such as put options and collars can help with downside mitigation by benefitting from assets that lose value or limit large gains. Portfolios should also be monitored and readjusted regularly to avoid locking in unrecoverable losses.

Plans should also include managing for withdrawals. One strategy is to keep between one- and two-years’ worth of expenses in cash, which can be used in the event of a market crash. This will avoid the need to sell assets that will bring about a loss, while still maintaining your necessary cash flow. You can then wait for the storm to pass, benefit from the rally and replenish your cash when markets recover.

Core assets should provide the stable part of the portfolio and focus on generating sustainable income, as well as downside mitigation. Individual ETFs that seek to achieve this type of portfolio include Mackenzie Unconstrained Bond ETF or all-in-one options, such as Mackenzie Asset Allocation ETFs.

You could also consider high-yielding, non-traditional fixed income and equity income ETFs. These would be considered “satellite” investments, not the core North American bonds that many Canadian portfolios hold. For example, emerging market bond index ETFs and high yield bond index ETFs. This could help balance higher income with the incremental risk. The Mackenzie Emerging Markets Local Currency Bond Index ETF, Mackenzie US High Yield Bond Index ETF, Mackenzie Floating Rate Fixed Income ETF and Mackenzie Global Sustainable Dividend Index ETF are great examples of these types of ETFs.

It’s also very important to consider the benefits of proper tax planning when consolidating your investments, decumulating and estate planning. Having access to financial professionals who can deliver

the right solutions specifically designed for retirement portfolios and tax planning can help ensure that you have a comfortable retirement, rather than a stressful one.

Find out more about building portfolios that provide retirement cash flow while mitigating risk. For advisors, speak with your Mackenzie sales team; for investors, talk to your financial advisor.

If you like this blog, you may also like:

Blog Series: Solving your investment problems |Part 2: Achieving comprehensive diversification

Sources:

1 Canadian Institute of Actuaries, Statistics Canada

2 Callan Associates, Wall St. Journal

3 Morningstar, based on S&P 500