Investor’s Guide: Market Volatility

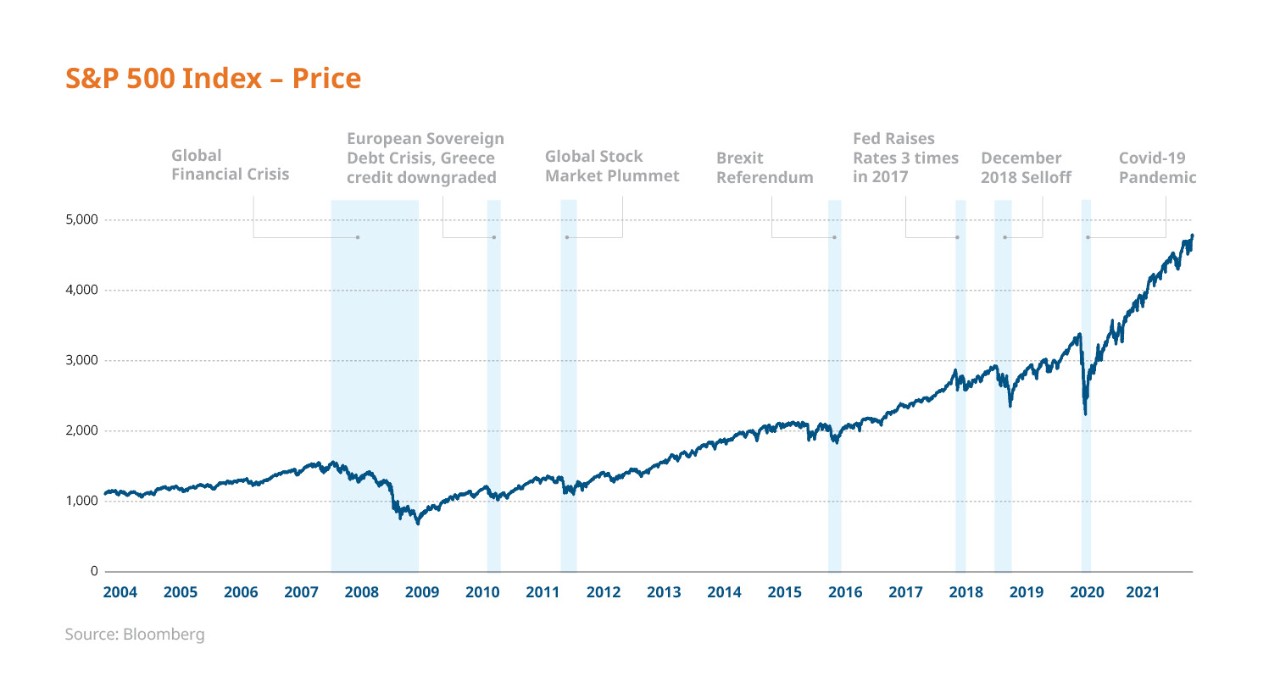

The market has faced many economic downturns over time. Historically, despite many periods of increased volatility, markets have remained resilient.

Keeping money in the market over the long run means investors get the full benefit from all up-market movements. Over the past 15 years, investors who stayed invested even during the worst periods ensured full participation during the best recorded days.

Additional Resources

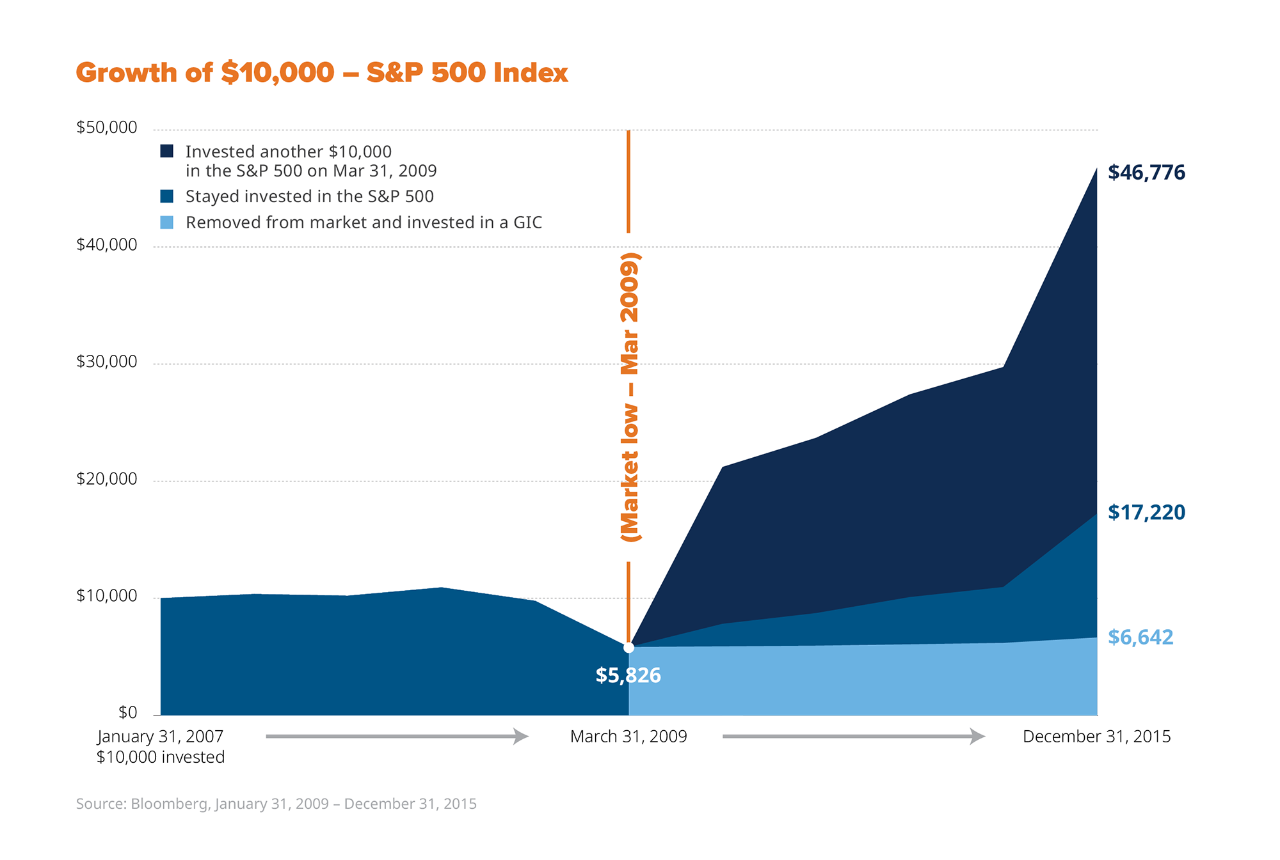

When markets decline, it’s tempting to sell and wait for stability before jumping back in. But it’s virtually impossible to know when markets will rebound. Trying to time the market by buying a GIC may sometimes look like a smart move, but your long-term investment performance will likely be worse than if you had simply stayed invested through the bad times.*

Additional Resources

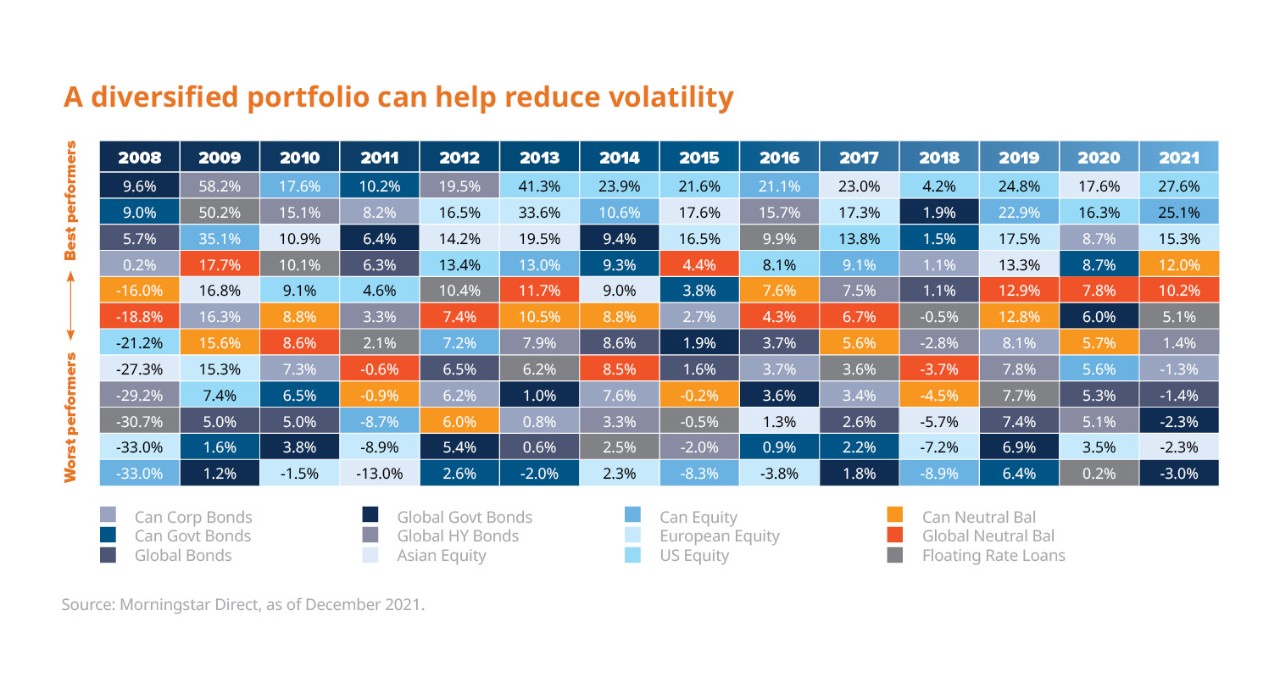

Deciding where to invest can be daunting; last year’s winner might be next year’s loser. That’s why a balanced approach, one that invests across many sectors and geographies, makes sense. By diversifying your portfolio across different asset classes, you can achieve greater consistency in returns, and ultimately protect yourself against market volatility.

Additional Resources

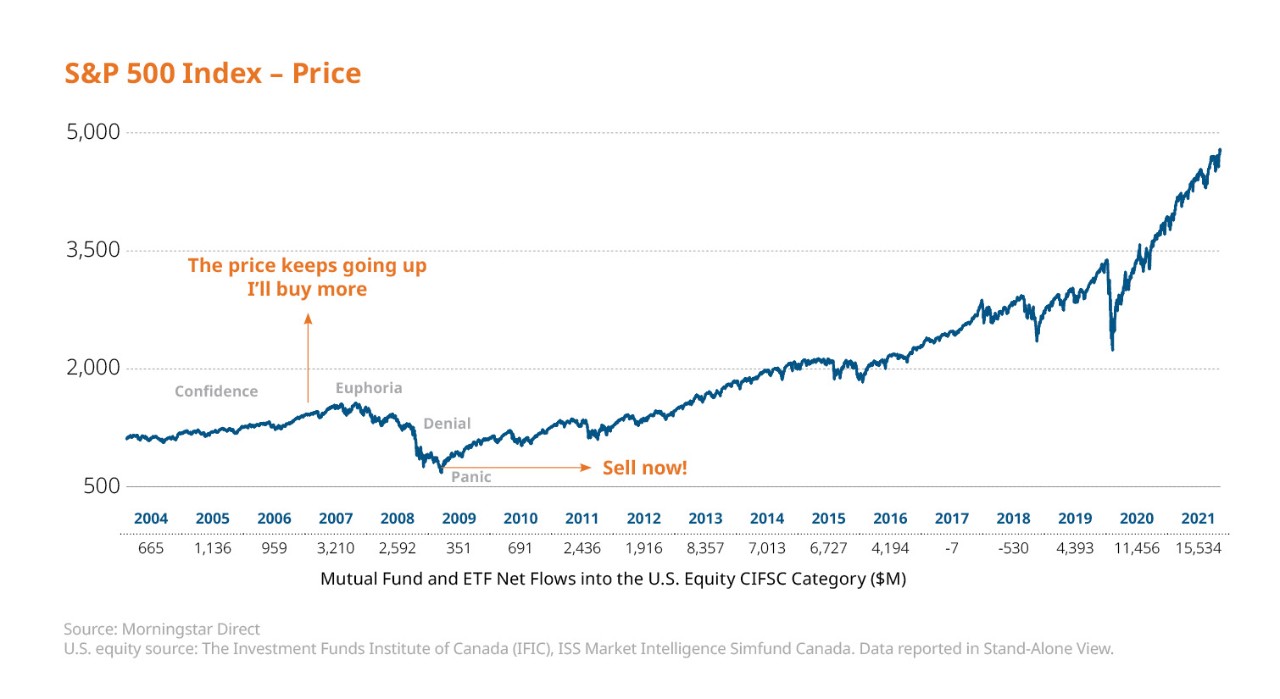

It’s not easy for investors to manage their emotions. They tend to panic and sell just as markets are set to rise and get excited and buy just as markets are set to decline. Although you can’t control market volatility, you can control your emotional responses. Your advisor will keep you focused on your long-term goals so you can resist the temptation to invest impulsively.

Additional Resources

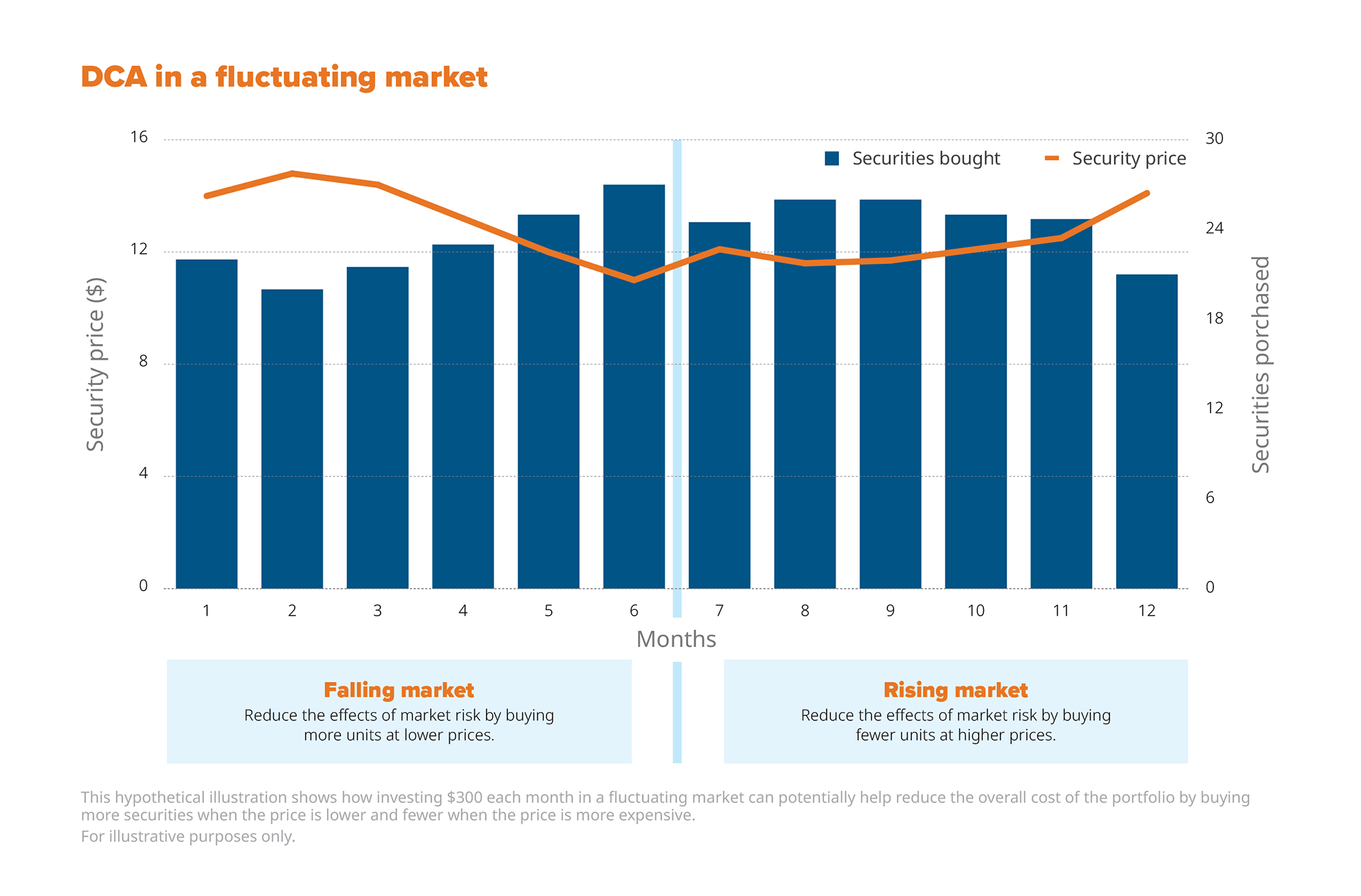

The concept of “buy low and sell high” sounds attractive, but it can be difficult to follow due to the unpredictable nature of short-term market prices. To take advantage of these changing prices, one effective investment strategy is dollar cost averaging.

Dollar cost averaging involves buying equal dollar amounts of a given investment on a regular basis. Rather than investing all your money at once, making a commitment to invest a smaller amount on a regular basis can lower your average cost per unit by purchasing more units at lower prices.

Additional Resources

The market has faced many economic downturns over time. Historically, despite many periods of increased volatility, markets have remained resilient.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

The content of this web page (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.