With a growing number of Canadians heading into retirement each year, many investors are focused on yield in order to turn their investment portfolios into a source of dependable long-term income.

While interest rates are higher today than in early 2022, so is inflation. The search is on for investments that can generate a strong and consistent stream of income that’s high enough to outpace inflation without taking on excessive risk.

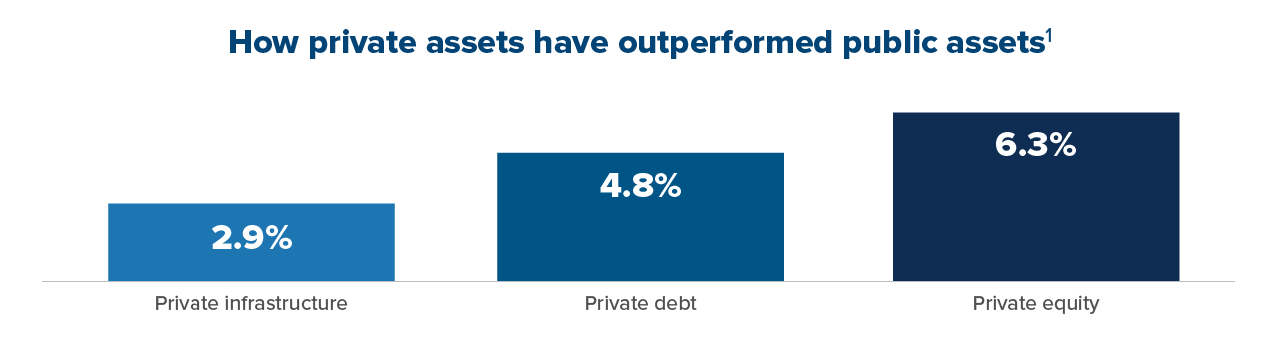

In this environment, we believe private investments have the potential to truly shine. Historically, these investments, including private equity, private credit, and private infrastructure, have delivered a return premium above that of their publicly traded counterparts, summarized in the graphic below.

1 Quarterly returns in CAD. Private equity excess return is calculated as the average difference between the rolling 10-year returns of the Cambridge US Private Equity legacy definition) Index and the MSCI World TR Index between December 2009 and December 2022. Private infrastructure excess return is calculated as the average difference between the rolling 10-year returns of the Preqin Private Infrastructure Index and the S&P Global Infrastructure TR Index between December 2017 and December 2022. Private debt excess return is calculated as the average difference between the rolling 10-year returns of the Preqin Private Debt Index and the ICE BofA Gbl Brd Mkt TR HCAD between December 2010 and December 2022.

The chart above illustrates the average return difference between liquid and illiquid versions of the same asset classes, assuming a 10-year holding period. It shows that a significant return difference exists in each of these major asset classes.

In 2020, Northleaf Capital Partners (“Northleaf”) and Mackenzie Investments established a strategic relationship providing individual investors access to private markets. Here, David Ross, head of private credit at Northleaf, one of Canada’s largest global private markets investment firms, discusses this rapidly growing asset class in the Canadian retail market.

DISCLAIMER: Units of Mackenzie Northleaf Private Credit Fund (the “Fund”) are generally only available to “accredited investors” (as defined in NI 45-106). The information contained herein is qualified in its entirety by reference to the Offering Memorandum (the “OM”) of the Fund. The OM contains information about the investment objectives and terms and conditions of an investment in the Fund (including fees) and will also contain tax information and risk disclosures that are important to any investment decision regarding the Fund. This material is not intended to constitute an offer of units of the Fund or any other fund referred to herein. Past performance is not necessarily indicative of any future results and there can be no guarantee that the Fund will achieve a yield similar to any yields referred to herein. The Fund has material exposure to public market investments, the amount of which will fluctuate over time.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. This article may contain forward-looking information which reflect our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of Oct. 13, 2023. There should be no expectation that such information will in all circumstances be updated, supplemented or revised, whether as a result of new information, changing circumstances, future events or otherwise.