When we take the time to truly look at our world, it’s hard not to be in awe of the expansive landscapes, majestic creatures, and delicate plant life.

Biodiversity describes the wide variety of life on our planet, spanning genetics, species and ecosystems; more simply, plants, animals and their surrounding habitats. Everything from the smallest flower to the largest blue whale reflects a piece of an intricate puzzle, which moves in an elaborate cycle to provide the fresh air, clean water and natural resources that we collectively rely on to survive.

Beyond its beauty, biodiversity drives an underappreciated degree of our global economy in the form of natural capital. But it is increasingly at risk from climate change, chronic natural disasters and human activity. Here, we highlight how the bond market has embraced biodiversity and how your portfolio can help protect our planet.

The economics of biodiversity

The World Economic Forum estimates that over half of the world’s GDP depends on biodiversity and the resulting natural capital which supports economic activity.1

When the global ecosystem is thrown out of balance, it can have a dramatic ripple effect across economic productivity. For example, highly nature dependent industries, such as agriculture and forestry, are threatened by land degradation, declining crop yields and a rise in diseases and fungi that threaten plant life and core food sources.

Despite the economic and environmental importance of biodiversity, ecosystem loss is critical and growing. Land degradation threatens old growth forests, and an estimated one million species face extinction.2 Both acute climate disasters and chronic climate change continue to ravage some of the world’s most vulnerable and ecologically significant regions.

Further, as extreme weather events become increasingly frequent and severe, flooding, wildfires and power shortages threaten our way of life around the world. Destruction of the natural world poses a risk to global supply chains. The consequences include continuously elevated inflation and a climate refugee crisis.

Blended finance

The world of finance has long been defined by two measures to assess performance: risk and return. While each of these metrics may benefit from ESG integration, the most unique shift comes from addressing a third, potentially uncorrelated pillar: impact.

Blended finance is a concept that aims to have a positive impact by using development funding to leverage additional investment towards developing nations. Biodiversity and ecological stewardship can be a key to improving local economies by creating jobs and realizing the value of natural capital.

For governments and development banks, these opportunities have inspired some of the world’s most innovative transactions to source and mobilize investment in the most pristine and naturally significant ecosystems. Here are a few examples:

Wildlife Conservation Bond (Rhino Bond):

Threats to global biodiversity are perhaps most clearly seen through the increasing number of species that are now endangered. Deforestation, poaching and habitat encroachment leave countless species at risk of extinction, from tiny bumblebee bats to the tallest giraffes.

In early 2022, the bond market saw the introduction of the first ever Wildlife Conservation Bond, a unique structure which links investor returns to positive outcomes. The aptly named “Rhino Bond” funds sustainable initiatives while investors forego their coupon payments, which are instead used to fund wildlife sanctuaries in South Africa.

At maturity, the World Bank and partner agencies will reward investors for their investment with a unique conservation success payment, linked to the growth rate of the black rhino population. By aligning the interests of investors, issuers, agencies — and rhinos — the bond market entered the biodiversity space like never before.

Debt-for-nature swaps:

While revolutionary, the Wildlife Conservation Bond structure is limited by its costly requirement for incremental financing from project sponsors, including the Global Environment Facility. As central banks raised the cost of capital, the sustainable finance market experienced contraction alongside other debt issuers.

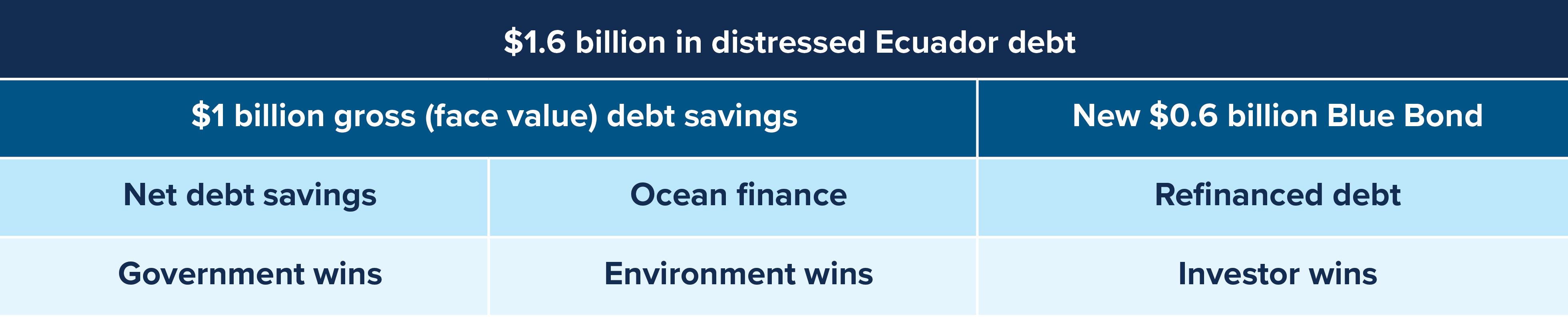

In May 2023, Ecuador completed the landmark “Galapagos Bond”, launching the world’s largest debt-for-nature swap in one of the world’s most biodiverse regions. In this transaction, Ecuador exchanged old bonds trading at distressed levels for new bonds in support of environmental protection.

This deal was made possible by Ecuador’s partnership with the Inter-American Development Bank and US International Development Finance Corp. The bond is expected to double the annual conservation funding efforts within the region, while committing to improved sustainable fishing regulations and reporting on the nationally protected Hermandad Marine Reserve. This region represents a key habitat for critically endangered species, as well as oceanic migration, and the bond’s innovative structure provides protection in line with the Global Ocean Alliance’s “30 by 30” pledge to protect 30% of marine territory by 2030.

Investing in a better future

As investors, we often find ourselves looking past the short-term swings to focus on the future. Just as we hope our decisions will successfully help investors fund education, home ownership and retirement, we also aim to align our investments with a more sustainable world we hope to create.

We believe that our sustainable fixed income opportunities are also sound financial choices. When faced with opportunities to do good, while doing well, investing in sustainable fixed income solutions balances the needs of the present with the opportunities of the future.

Explore our sustainable fixed income solutions:

Mackenzie Global Sustainable Bond Fund

Mackenzie Global Sustainable Bond ETF (MGSB)

_________________________________

1 WEF New Nature Economy Report (2020)

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of January 16, 2024. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise. The content of this [type of marketing communication] (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.