Written by the Mackenzie Betterworld Team

Portfolio and Sectors review

The Mackenzie Betterworld Global Equity Fund posted positive returns for a third consecutive month continuing its upward trajectory since the start of the year. Notably, stock selection within healthcare and communication services contributed most to portfolio performance. The team’s holding in Disney (+9% in local currency on the month) saw Bob Iger’s initiatives to return to growth being recognized by investors, putting the company in a favourable position to win the proxy contest with Trian/Nelson Peltz. Alphabet (+9% in local currency on the month), also contributed positively. The company remains an AI beneficiary as they continue to develop a credible alternative to the Microsoft AI franchise. A smaller holding of the fund, Bloom Energy, was a notable performer (+28% in local currency on the month). Bloom Energy produces large-scale power generation platforms that provide highly reliable baseload electricity to businesses, essential services, and critical infrastructure. The company specializes in solid oxide fuel cells – which in simple terms transform chemical energy from a resource such as hydrogen, into electricity without combustion. This type of technology is far more energy efficient, thereby reducing consumption requirements as well as greenhouse gas emissions.

The Fund’s holdings in Information Technology, such as Palo Alto Networks (-9% in local currency on the month) and Adobe (-10% in local currency on the month) detracted from performance during the month. Palo Alto is seeing its sales cycle become more extended. The team believes that growing cyber risk makes this a temporary dip before corporate demand increases again for cyber security. With respect to Adobe, the company declined on Q1 earnings being below expectations. On the positive side, this years Adobe Summit demonstrated numerous GenAI platforms the company is working on. The Betterworld team believes this will support increasing earnings growth for the company in the future.

Within the Mackenzie Betterworld Canadian Equity Fund, exposure to the materials sectors contributed most to the fund’s performance. Portfolio holdings Agnico Eagle and Capstone were up +24% and 21% respectively for the month. The recent rise in the price of gold and copper have been tailwinds for both companies.

The Fund’s exclusion of fossil fuels, and therefore lack of investment in the energy sector, detracted most from performance as oil prices rose throughout the month.

Company Engagement

The Walt Disney Company is a diversified media conglomerate operating media networks, theme parks and resorts, film and TV studios, and direct-to-consumer (DTC) streaming services. It is the global leader in theme parks, with hotels and cruise lines being family-oriented. The company also distributes branded merchandise through retail, online, and wholesale businesses. Its DTC segment provides various entertainment and sports content to consumers around the world. Disney is a leading entertainment company with best-in-class intellectual property that supports long term content monetization opportunities.

With aggregate sports representing 19% of revenues, the Betterworld team met with Walt Disney to discuss the recently announced ESPN sports licensing deal with betting brand Penn Entertainment. The team felt the idea of having gambling under the same roof as Disney to be a concerning initiative. After discussing with Disney, they were able to clarify that the company would only be assisting in the marketing of Penn’s apps and in exchange, would receive $1.5 billion cash and $500 million of equity warrants during a 10-year deal. This is a licensing model that gets recognized as advertising revenue and ESPN sports programming will not be directly integrated into the betting app. Disney emphasized that they do not want to become part of the sports betting book.

The Betterworld team intends to regularly monitor company reports and schedule a follow up meeting to discuss the progress of the agreement.

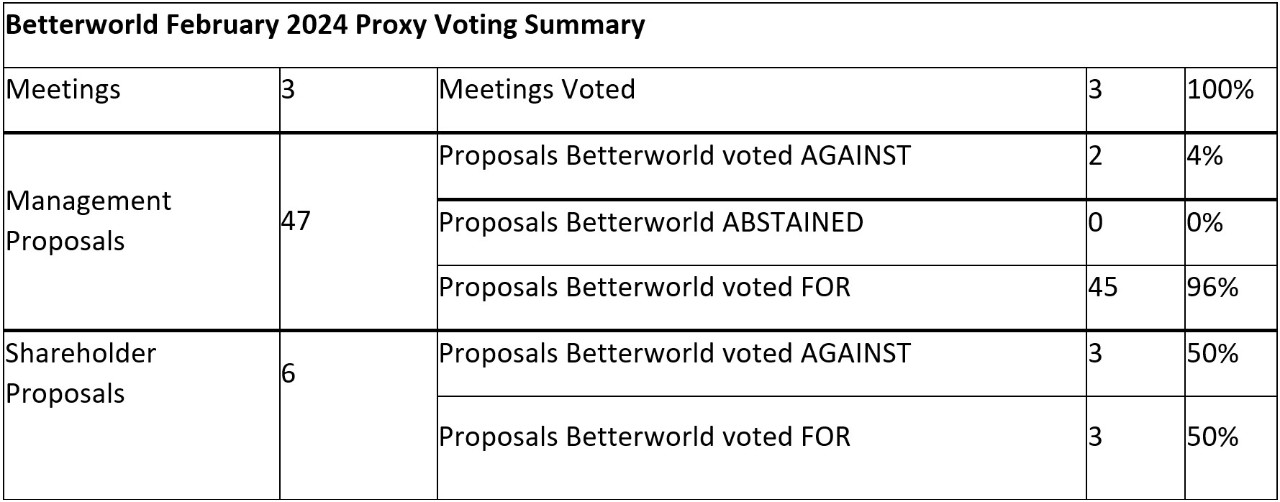

Proxy Voting

In March, the Betterworld team participated via proxy in 3 company meetings with Starbucks, Orsted and Novo Nordisk.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

The contents of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) are not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This document may contain forward-looking information which reflect our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of March 31, 2024. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

This material is for informational and educational purposes only. It is not a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. It is not intended to address the needs, circumstances, and objectives of any specific investor. Mackenzie Investments, which earns fees when clients select its products and services, is not offering impartial advice in a fiduciary capacity in providing this sales and marketing material. This information is not meant as tax or legal advice. Investors should consult a professional advisor before making investment and financial decisions and for more information on tax rules and other laws, which are complex and subject to change.

©2024 Mackenzie Investments. All rights reserved.