Written by the Mackenzie Betterworld Team

Portfolio and Sectors review

The Mackenzie Betterworld Global Equity Fund continued it’s strong start to the year returning another month of positive performance. Notably, stock selection within materials, healthcare and utilities contributed most to portfolio performance. CRH (+19%), a leading provider of building materials solutions for road and critical utility infrastructure, commercial building projects and outdoor living reported strong 2023 results above expectations. The company is due to be added to the S&P 500 index. Constellation Energy, the largest producer of carbon-free generation in the US and one of the nation's largest retail energy suppliers serving both residential and C&I customers (Commercial & Industrial) was up (+40%) for the month. On their Q4 earnings call, management provided a compelling outlook into the stability of its earnings/cashflow, investment drivers and upside opportunities. This included 2024 guidance of 20% above consensus estimates, upside opportunities for power demand from AI and Data Center growth, IRA production tax credits not included in guidance, opportunities to participate in large scale green hydrogen production, dividend growth of 25% in 2024 and a 10% target for future growth.

Within the Mackenzie Betterworld Canadian Equity Fund, consumer discretionary contributed most to overall fund’s performance from a sector perspective. Portfolio holding SunOpta was up +22% for the month. The company is attractively positioned from a risk/reward perspective as management grows production capacity and efficiencies in the health and wellness space. SunOpta continues to target a 2025 run rate for EBITDA of $125 million. The company also has a strong relationship in place with Starbuck to supply plant-based beverages (oat milk, almond milk).

Outlook

- Recent inflation statistics combined with solid macro data in the U.S. do not seem to support an aggressive central bank easing and pushes timing further into 2024.

- Particularly down south, the conversation around the economy has shifted from soft landing vs hard landing to now a soft-landing vs no-landing at all if GDP data shows reacceleration.

- This contrasts with Canada where economic activity has been expanding but it is subject to negative revisions to estimates. For example, 2024 US GDP forecasts sit at +2% while forecasts for Canada are around +0.6%.

New Holding

Alcon

- Switzerland based Alcon, is the largest medical device ophthalmology company in the world.

- The company is a global leader in the ophthalmic market, with a 30% share of the USD25bn industry. Alcon is the number one player in intraocular lenses (i.e. lens that is implanted in the eye) and consumables in surgical ophthalmology. The company is also the number-two player in contact lenses globally.

- Alcon’s business is aligned with UN SDG 3 “Good Health and Well Being”, and we like the company’s contribution to UN SDG 10 “Reduced Inequalities” thanks to their goal to help improve vision for 5 million people afflicted with untreated cataracts in low- and middle-income countries.

- Alcon represents one of the few pure-play investments in the attractive and structurally growing ophthalmology industry. The company also benefits from economic and demographic trends driving the eyecare business, as demand is fueled by a growing global middle class and aging demographic.

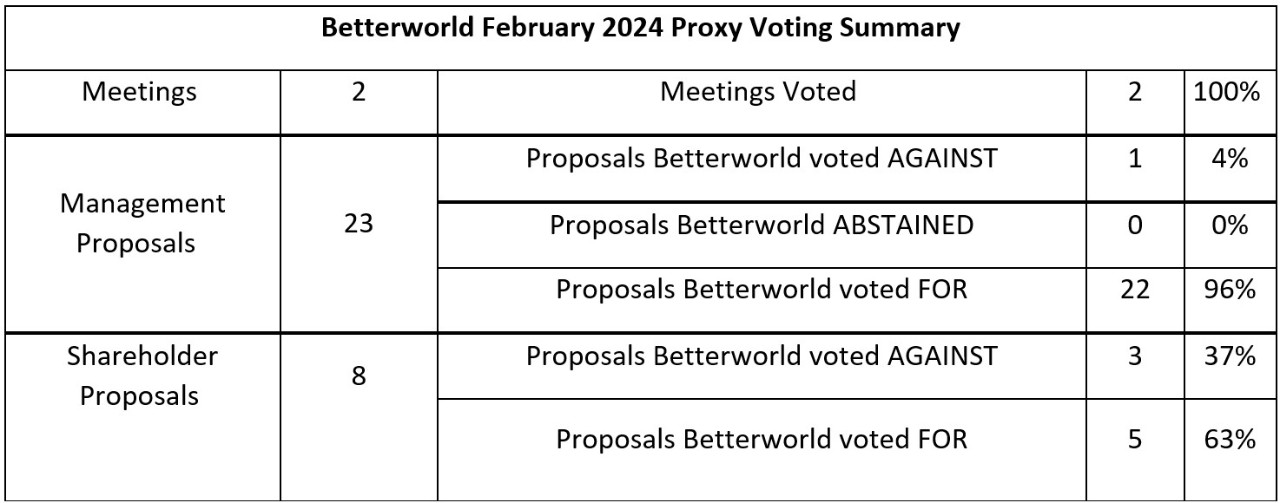

Proxy Voting

In February, the Betterworld team participated via proxy in 2 company meetings with Deere and Apple.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

The contents of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) are not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This document may contain forward-looking information which reflect our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of February 28, 2024. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

This material is for informational and educational purposes only. It is not a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. It is not intended to address the needs, circumstances, and objectives of any specific investor. Mackenzie Investments, which earns fees when clients select its products and services, is not offering impartial advice in a fiduciary capacity in providing this sales and marketing material. This information is not meant as tax or legal advice. Investors should consult a professional advisor before making investment and financial decisions and for more information on tax rules and other laws, which are complex and subject to change.

©2024 Mackenzie Investments. All rights reserved.