Mackenzie Monthly Income Portfolios are designed to provide predictable income and capital preservation with reduced volatility. The Portfolios help investors stay in the market by providing a downside mitigation strategy on its riskier components. Our Portfolios currently use an options based hedging strategy combined with geographic and multi-asset diversification to achieve a performance profile with less downside than a traditional balanced fund. *

Hedging in the Monthly Income Portfolios

In addition to the diversification provided by the asset mix, Mackenzie Monthly Income Portfolios employ a custom option strategy to help protect against extreme losses. Our proprietary options approach is designed to provide a smoother investment experience by allowing for upmarket participation alongside down-market protection that options can provide. It aims to provide continuous downside mitigation against large market declines and does not rely on a portfolio manager (PM) to make market bets. The options protection is always in place.

Managing beta

Beta indicates how volatile a security or portfolio is compared to the market. A beta of one indicates that the portfolio will move in sync with the market index, on average. A beta of greater than one means the portfolio is more volatile than the market. In the equity portion of the Monthly Income Portfolios, we currently seek to maintain a constant beta, or sensitivity, of 0.7 to movements in the S&P 500; this means that if the S&P 500 moves down 10%, our equity aims to be down by only 7%. By continuously managing the beta around 0.7, the portfolios limit downside risk while still allowing for upside participation in the market

Continuously managing options

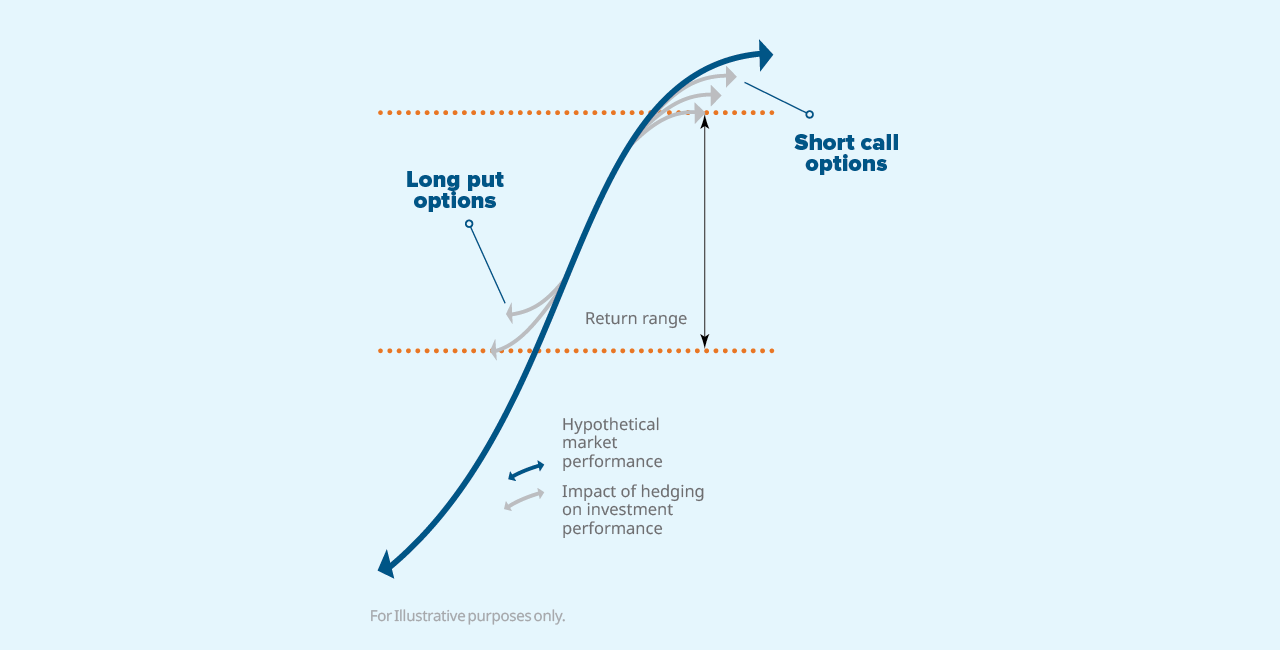

Mackenzie Monthly Income Portfolios employ a “collar” strategy which involves buying puts and selling calls on the same index. The sale of call options on the equity exposure locks in some upside gains and collects premium income that may be used to offset the cost of the put options purchased to provide downside mitigation The net effect creates a floor and ceiling for returns, which we expect will produce more consistent outcomes. In general, equity put options are 5-10% out-of-the-money at the time of purchase, with maturities of nine to twelve months. The equity call options are sold at 4-8% out-of-the-money with shorter maturities of three to six months. By structuring the equity option strategy this way, we believe the Portfolios are more likely over time to collect more premium income from the calls to pay for the puts.

In the Monthly Income Portfolios

Buying put options limits the downside of an investment by locking in a selling price. Put options gain in value as the market approaches that selling price. Writing call options places, a ceiling on potential gains by locking in a selling price. Essentially, the Portfolios reduce the cost of downside protection by selling some upside.

Hedging strategy on fixed income

The Monthly Income Portfolios also have protection built into their fixed-income component. Since high yield bonds can become extremely volatile during times of equity market weakness, the Mackenzie Unconstrained Fixed Income Fund currently hedges 90% to 100% of its high yield bond exposure against extreme losses. The fund currently purchases put options on an ETF with exposure to a broad range of US high yield corporate bonds, which we expect will mitigate the impact of extreme market downturns. The current high yield bond hedging strategy is managed dynamically to ensure an appropriate trade off between cost and protection. In general, the put options are purchased fairly out-of-the-money. The strike price and term structure of the puts are determined by the fixed income portfolio management team based on the current and expected volatility level and the cost of the options at the time of purchase.

The Mackenzie Monthly Income Portfolios

Many clients are at the stage in life when they are no longer socking away large amounts in savings and are instead now drawing income from their investment portfolios. Their time horizons are shorter and many simply do not have the capacity or the desire to experience another big bear market in equities. These investors, with a lower risk tolerance, benefit from portfolios that incorporate some degree of downside mitigation. While downside mitigation always comes at some cost; Mackenzie Monthly Income Portfolios have been designed to provide that protection efficiently to minimize those costs. Since the Portfolios were launched, this design feature has proved highly effective in providing our investors with an attractive mix of regular, predictable cash flow, downside mitigation and investment growth.

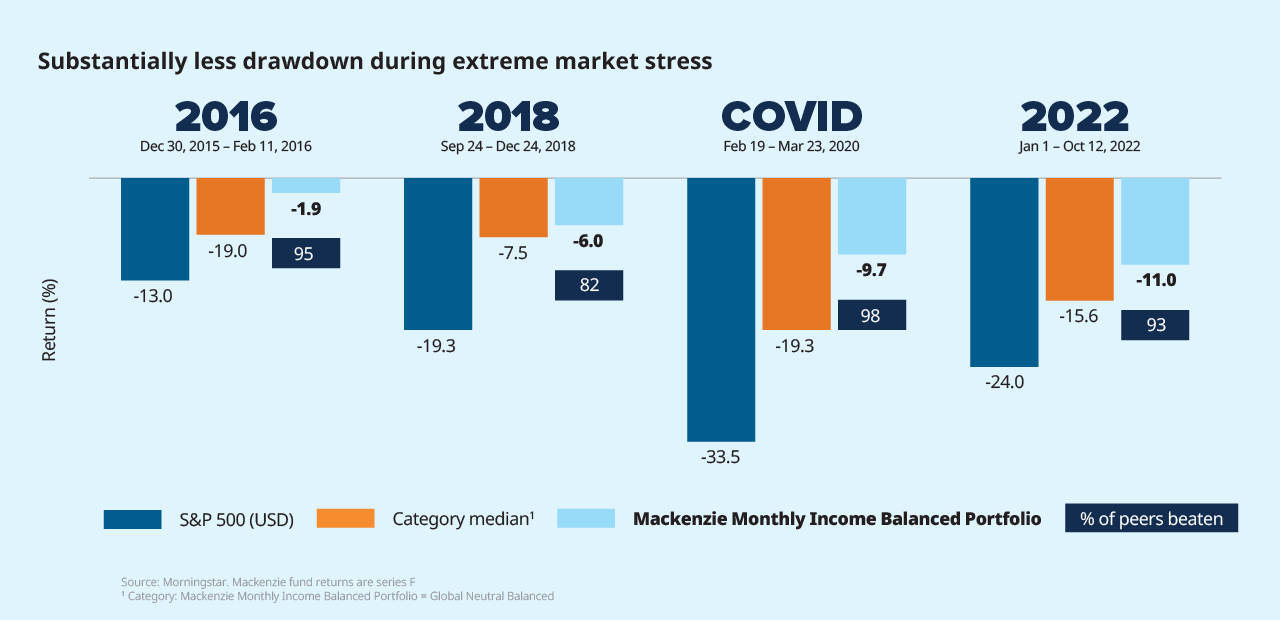

Strategy in action

The graphs and data below show how the Mackenzie Monthly Income Balanced Portfolio has demonstrated strong downside mitigation during large drawdown events.

The Mackenzie Monthly Income Portfolios

- Provides monthly income: 4% annualized monthly distribution**

- Help to protect your money during market downturns

- Implicit diversification across asset classes and regions

- Explicit hedging strategy on both equity and fixed income components

- Offer some growth potential to offset longevity and inflation risks: Are managed by a seasoned team with extensive asset allocation and risk management experience.

More information on options

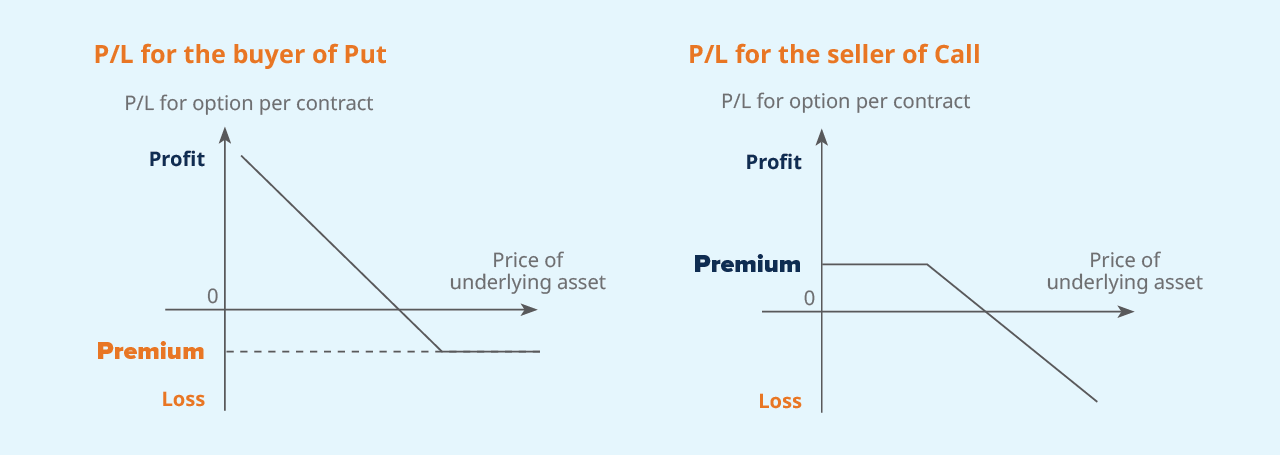

Put options

Put options give investors the right to sell an underlying asset at a strike price. If the price of the underlying asset falls below the strike price, the put becomes more valuable because the party that bought the put option can sell the asset at the higher strike price. A put option can limit the extent of portfolio loss in the event the underlying asset(s) declines in value. The cost of buying the put can be thought of as the cost of insurance. Mackenzie Monthly Income Portfolios’ current options strategy buys put options on their equity and high yield bond exposures.

Call options

Call options are the opposite of put options; they give investors the right to buy an underlying asset at a strike price. If the price of the underlying asset rises above the strike price, the holder of the call option benefits because they can buy the asset for less than its current price. A call “writer” sells call options and pockets the premium that the buyer paid to purchase the option but could experience a loss if the price of the underlying asset goes towards/ above the strike price before expiry.

* Mackenzie Monthly Income Portfolios currently employ and will commonly use the options-based protection described in this note. However, in addition to or instead of using options, the Portfolios may use derivatives such as swaps, futures and forward contracts for hedging and/or non-hedging purposes. The Portfolios are also permitted to use investments in non-derivative assets to reduce volatility, such as bonds and cash.

Commissions, trailing commissions, management fees, brokerage fees and expenses may be associated with investment funds. Please read the prospectus before investing. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

The content of this whitepaper (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

To the extent the Fund uses any currency hedges, share performance is referenced to the applicable foreign country terms and such hedges will provide the Fund with returns approximating the returns an investor in a foreign country would earn in their local currency.

** Series A, F, AR, PW, PWF, PWX, O.

The payment of distributions is not guaranteed and may fluctuate. The payment of distributions should not be confused with a fund’s performance, rate of return or yield. If distributions paid by the fund are greater than the performance of the fund, your original investment will shrink. Distributions paid as a result of capital gains realized by a fund, and income and dividends earned by a fund are taxable in your hands in the year they are paid. Your adjusted cost base will be reduced by the amount of any returns of capital. If your adjusted cost base goes below zero, you will have to pay capital gains tax on the amount below zero.