What is sustainable debt?

Many investors now consider more than just the financial return on their investment. They’re looking for sustainable investment funds that offer a positive return for society and the environment.

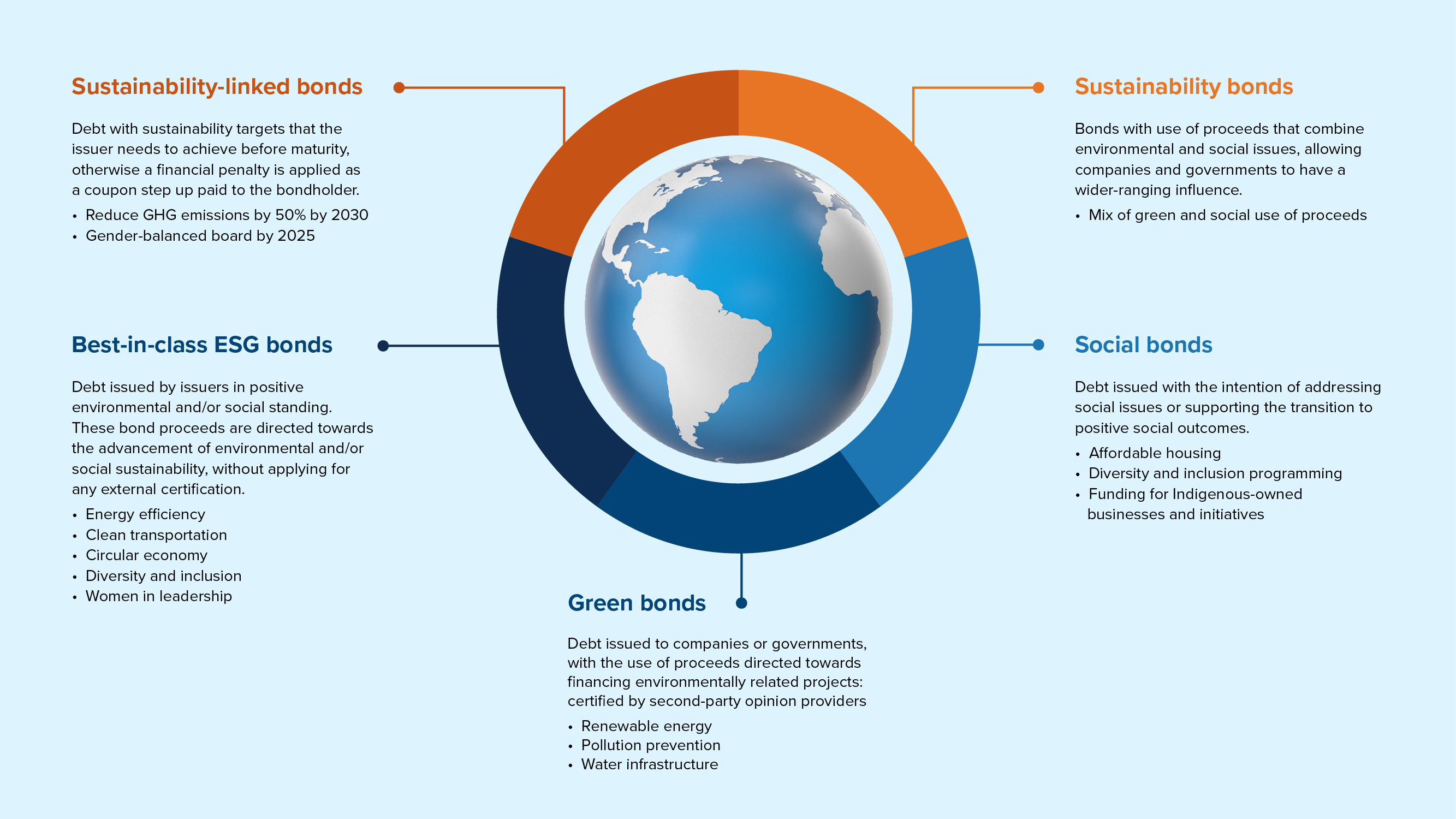

There are four main types:

- Green bonds

- Social bonds

- Sustainability bonds (combining both green and social)

- Sustainability-linked bonds (more on these later)

Companies around the world have responded to demand for green investments by issuing “green bonds”. These are designed to fund changes in corporate operations that reduce their impact on the environment.

What began as a trickle has become a tidal wave of bonds that are connected to a wider variety of initiatives addressing environmental, social and governance (ESG) issues. The concept of responsible investing now stretches well beyond the environment.

Green, social and sustainability bonds that are tied to specific projects are known as “use of proceeds” bonds. Usually issued by governments, as well as companies in the power, utilities, financial and real estate industries, their goals vary but have a few things in common:

- They fund projects that meet the standards of the International Capital Markets Association.

- They can be verified by second-party opinion providers (SPOs)

The most recent crop of these bonds is known as “sustainability-linked bonds” (or SLBs), which include detailed goals, measured by “key performance indicators” (KPIs).

Sustainable debt 101

The debate

Critics: This is just greenwashing. Companies set their own goals and can make them easy to achieve.

Supporters: ESG targets are voluntary. Companies that choose to set goals are unfairly criticized for not doing enough.

The truth: Not all ESG targets are relevant or ambitious. The best ESG bond funds are carefully analyzed to sort out the good from bad

Why responsible investing matters

What gets measured gets managed. Some companies tie executive compensation to achieving the goals. The more times a company repeats and reinforces its sustainability strategy and its ESG targets, the more likely those goals will be achieved. Companies that fail to meet their targets may face damage to their reputation.

ESG bonds are evolving to include coupon “step-ups” if the issuer fails to reach its KPIs. There’s no additional downside to the bond investor – only a potential bonus in the form of these penalty payments. This can be a powerful incentive for the issuer to boost its reputation and its sustainability credentials.

In recent years, companies have set targets ranging from reducing greenhouse gas emissions to achieving specific gender equality targets. Many issuers have more than one KPI, sending a strong signal about their commitments to positive impacts for people and the planet.

The impact of sustainable debt

There is a wide variety of sustainable debt designed to encourage positive change on several issues, including:

Climate change

Among environmental KPIs, greenhouse gas targets are the most common. Companies can follow government targets or set their own.

|

GHG reduction target |

Target date |

Reference date |

Coupon step-up |

Telus |

46% absolute emissions |

2030 |

2019 |

+1% at maturity |

Enbridge |

35% emissions intensity |

2030 |

2018 |

+0.50% at maturity |

Tamarack Valley |

39% emissions intensity |

2025 |

2020 |

+0.75% at maturity |

Gender inclusion

Since 2015, there has been a movement to include more women in corporate leadership roles, including as members of the board of directors.

|

Women in leadership target |

Target date |

Reference date |

Coupon step-up |

Enbridge |

40% of board |

2025 |

N/A |

+0.10% at maturity |

Suzano |

30% in leadership |

2025 |

N/A |

+0.25% per year |

Racial and ethnic diversity

The diversity conversation has expanded beyond gender to include race and ethnicity, as Black and Indigenous people have long been underrepresented in corporations.

|

Racial and ethnic diversity target |

Target date |

Reference date |

Coupon step-up |

Enbridge |

28% racial & ethnic representation in workforce |

2025 |

N/A |

+0.10% at maturity |

Tamarack Valley |

6% indigenous employees |

2025 |

N/A |

+0.25% at maturity |

How sustainable debt fits in a portfolio

The growth of ESG bonds has allowed sustainable investment funds to flourish.

The Mackenzie Fixed Income Team applies an ESG screen to all its investments. In 2022, the Mackenzie Fixed Income Team began encouraging corporations to issue green bonds and SLBs.

This builds on the team’s existing engagement program, which makes recommendations to corporations related to key ESG topics.

Corporate finance teams have different types of ESG-labelled debt available to them. Some of their projects can be financed with green, social and sustainability bonds. The rest of their debt financing and refinancing needs can be met with sustainability-linked bonds and loans. Regular bonds with traditional “general corporate purposes” use of proceeds will continue to dominate the bond market for the foreseeable future but labelled debt continues to gain market share.

The team looks forward to encouraging the issuance of more SLBs through the 2020s – while analyzing them to sort the good from the bad — to drive progress towards sustainability goals.

The Mackenzie Global Sustainable Bond Fund / ETF invests in a broad range of sustainable corporate credit and sovereign debt from around the world. These issuers are generally investment grade and carry a low-risk rating. The strategy aims to provide greater diversification for investor portfolios.

Gain access to green bonds, social bonds, sustainability-linked bonds and other forms of debt that aim to fuel a sustainable future.

Mutual funds:

Mackenzie Global Sustainable Bond Fund

Portfolio manager Konstantin Boehmer, co-lead of the Fixed Income Team, talks about sustainable debt, opportunities in Ecuador and the conservation of the Galapagos Islands. Listen here.

For an in-depth look at sustainability-linked bonds, read the whitepaper.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of February 28th, 2023. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise. The content of this [type of marketing communication] (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.