A “compounder” approach has the potential to deliver what investors are looking for: a source of enduring and accretive returns in their global equity portfolio. By zeroing in on business models that are resilient, adaptable and hard to replicate, investors can tap into growth through the best companies in their respective industries.

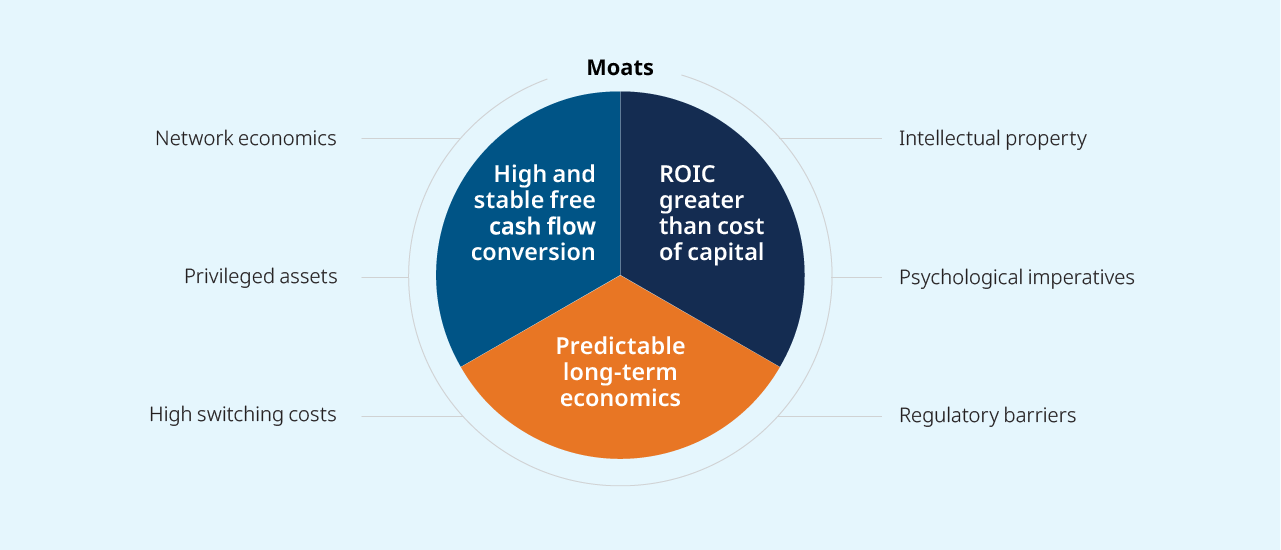

However, it isn’t always about the stock price. Investors typically succeed when they focus on businesses that generate high free cash flow and strong returns on invested capital over the long term. “Compounder companies” with these characteristics are likely to contribute to the risk-adjusted returns over time that investors seek. It starts with a moat, which is a critical factor that protects its business model and margins from competition. Compounder companies are great businesses found in all corners of the world that share a set of common characteristics and sources of capital growth.

These companies can be relatively small and unknown, possessing unique tangible or intangible assets that drive healthy margins – or they can be well known with incredible scale. It’s also important to evaluate the industry in which a moat company operates and whether, in this era of disruption and economic transformation, the industry is benefiting from thematic tailwinds.

For example, the reason we have always had exposure to financial exchanges is fairly straight forward: They enjoy at least two protective moats (network effects and regulatory barriers) and arguably a third (high switching costs). We consider exchange operators as high-quality “royalties” on the growth of the particular capital markets in which they participate, as they effectively act as essential utilities that enable the trading, settlement and custody of financial instruments ranging from cash equities to interest rate futures. They are natural monopolies approved by the regulators that benefit from network effects, market volatility, and increased demand for data and analytics.

Owing to the critical nature of the services they provide to the markets in which they operate, exchanges must not carry any balance sheet risk. And their economics are remarkably similar: very high returns on invested capital, operating margins greater than 50 per cent, and generally high dividend payout ratios. Mackenzie’s Global Equity & Income Team works to identify those companies with compounder characteristics in order to curate its own “dream team” of dividend stocks.

No matter what the market doing, moats are an important part of stock selection and can help deliver investors the risk-adjusted returns they need.

To discuss ways that dividend investments can complement your clients’ portfolios, talk to your Mackenzie sales representative.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated. The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. This article may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward looking information. The forward looking information contained herein is current only as of Jan. 20, 2023. There should be no expectation that such information will in all circumstances be updated, supplemented or revised, whether as a result of new information, changing circumstances, future events or otherwise.