*Refer to the funds’ Offering Memorandum for investment objectives and strategies.

1Source: Capital IQ, as at February 2023.

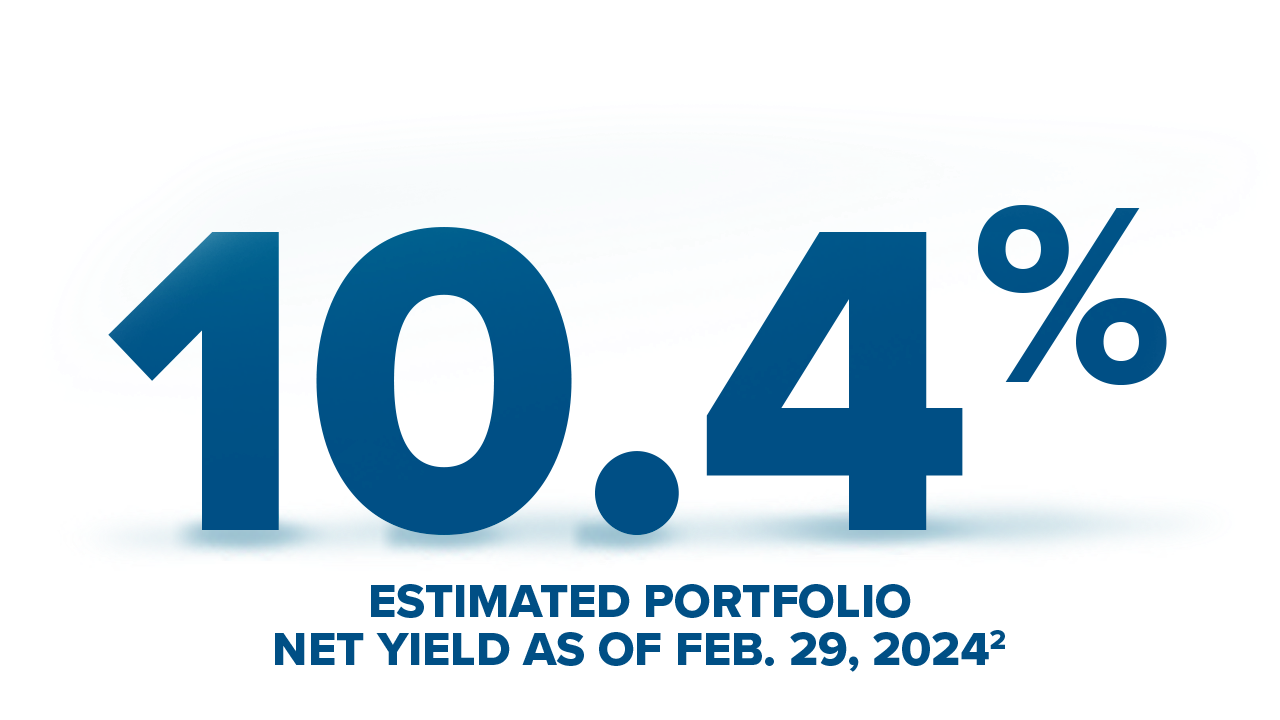

2Estimated portfolio net yield is as at February 29, 2024. Calculated by subtracting applicable fees and expenses (Series F) from the gross yield of the portfolio. Information regarding distributions paid from Fund (which are related to but different from the portfolio yield) is available on www.mackenzieinvestments.com

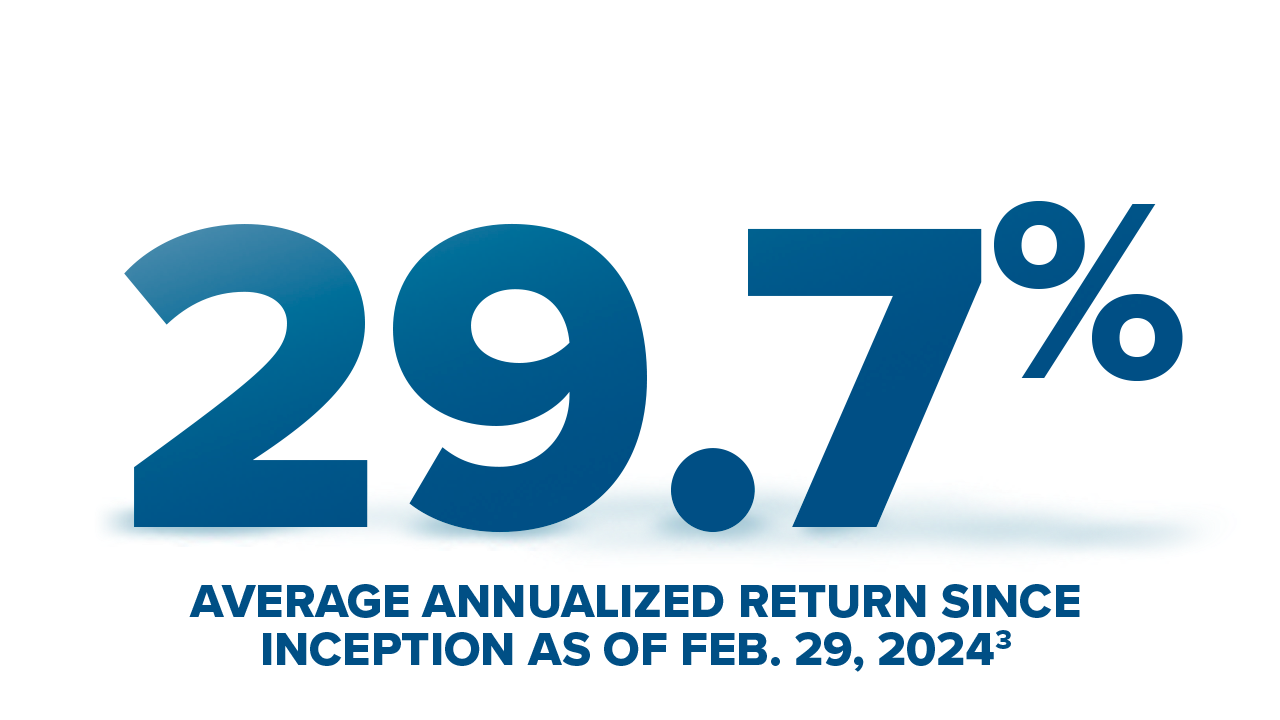

3Inception date: April 19, 2022.

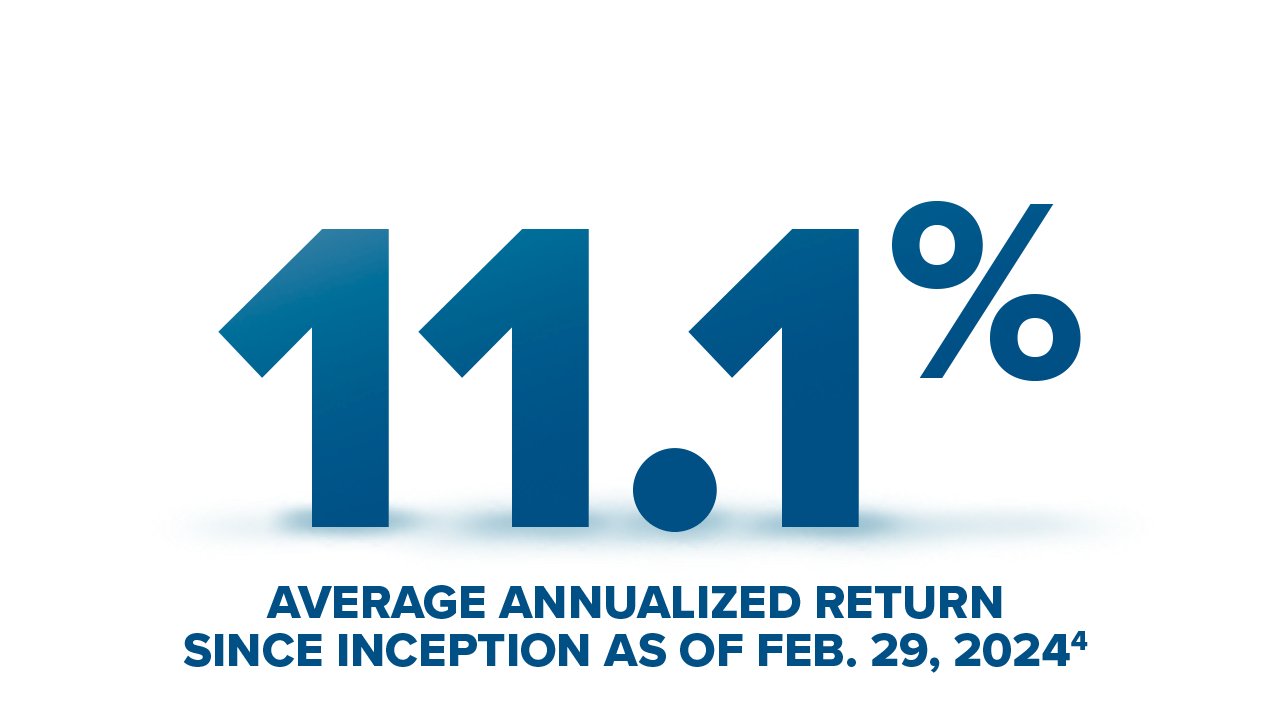

4Inception date: September 30, 2021.

5Source: As at December 31, 2023.

For accredited investors only (as defined in NI 45-106). Past performance is not necessarily indicative of any future results.

The content of this web page (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This material is not intended to constitute an offer of units of Mackenzie Northleaf Private Credit Fund, Mackenzie Northleaf Private Infrastructure Fund, Mackenzie Northleaf Private Credit Interval Fund or Mackenzie Northleaf Global Private Equity Fund (the “Funds”). The information herein is qualified in its entirety by reference to the applicable Offering Memorandum of each Fund. Each OM contains information about the investment objectives and terms and conditions of an investment in the respective Fund (including fees) and also contains tax information and risk disclosures that are important to any investment decision regarding such Fund.

The Mackenzie Northleaf Private Credit Interval Fund is available to all retail investors under a simplified prospectus.

For Mackenzie Northleaf Private Credit Interval Fund, commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.